It’s that time of the year again when we start to aggregate our views to provide tactical positioning for CY 2022.

As an investor with a fixed income background, I spend an inordinate amount of time managing foreign currency risk, as currency exchange rates tend to gyrate more than bond prices.

For example, it doesn’t make sense to buy a USD bond with a projected 4% return if we expect the exchange rate to deteriorate more than 4%.

Likewise, foreign bonds or equities can be suitable investments if we perceive the foreign currency is going to outperform.

I.e. buying USD bonds if we forecast USD to outperform AUD, adding an extra element to the return.

Furthermore, as a model manager, we’re spoilt for choice in the ETF and international managed fund market, where we often have the choice between hedged and unhedged vehicles, which creates an opportunity cost for choosing the wrong structure.

In addition, we can construct a “hedge ratio”, where based on our scorecard, we can determine what amount of our foreign currency exposure we want to hedge, and even which currencies to hedge.

Looking Back at 2021

Looking back at our FX outlook published a year ago, I can’t help but notice that while we gauged a lot of the important elements supporting our currency views at the time, the speed of which things transpired was faster than forecast.

Where we predicted an AUD/USD exchange rate of ~80c, we got that in the first month of the year, as AUD/USD surged 5c higher or +9.15%.

Chart 1: AUD/USD Spot Exchange Rate

Source: Bloomberg

Because of the speed of the market, the need arose to provide more regular updates to our FX views.

- 24-May: Why the AUD Isn’t Higher, having bounced off 79-80c and trending back downwards due to the slower domestic vaccine rollout

- 21-Jul: Our mAUDlin AUD and the dour effect of lockdowns and the impending national recession led by NSW, VIC and ACT restrictions

- 13-Sep: AUD Currency Outlook, where commodity exports and carry from our higher bond yields were likely to see AUD bounce off 72c and back to 75c

- 18-Oct: AUD Currency Outlook (#2), projecting that AUD continues to move higher over the longer term towards 75-78c, after some nearer term negativity

Risk-on vs Risk-off (RORO) sentiment also persisted, as markets fixated on vaccination rates and lockdown measures as a binary outcome for markets, establishing winners and losers.

Relative monetary policy was also key, as the relative easing between the Fed, ECB, BoJ, BoC, PBoC, RBA, RBNZ etc was important for carry trades, where the more dovish a central bank the less attractive the corresponding currency as a store of value.

One thing that didn’t play as important a factor as we projected was fiscal policy, where the large and growing US fiscal deficits were mostly ignored, and the relative safety of Australia, South Korea, Sweden, New Zealand, Indonesia etc was not an important factor for currency valuations.

Lastly, while several nations’ GDP figures started to rebound from a low base, like fiscal policy, relative economic growth of 2021 was largely discounted as markets were more focused on the outlook for 2022-2024.

Looking Forward to 2022

As we finish up 2021, central bank speeches have quickly and incrementally become more hawkish, where dovish sentiment is starting to erode and central bankers come around to the notion that “transitory” inflation can be “persistently transitory” and thus considered “sustained” if it becomes embedded into an economy’s psyche.

This has already seen central banks start to hike (i.e. RBNZ) or quickly taper their QE programs (BoC) or muse that they should taper sooner than expected (Fed and BoE).

Thus, expectations for monetary policy is geared towards tightening in 2022, establishing a likelihood for relative dovish vs hawkish central bank policy to be expressed in currency markets as carry trades are re-established based on these forecasts and how they shape yield curves.

With this comes the likelihood of increased FX volatility as well, where repositioning events will occur in quicker fashion.

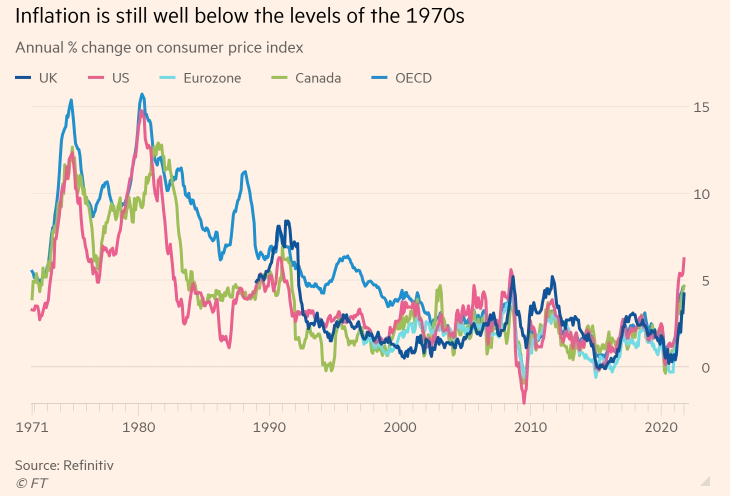

Inflation is also going to continue to be the topic de jour in 2022, as many will see the similarities to the current surge in inflation to the 1970s.

Chart 2: National CPI across UK, US, E-Z, Canada and OECD average

While we doubt we’ve skipped straight to 70s style inflation, it does seem that the Biden Administration as well as other federal governments are emulating LBJ policies that were the genesis of the 70s “Great Inflation”.

Learning from our previous outlook, we can forecast a much quicker and shorter business cycle this time around, with the boom/bust implication of the government spending and monetary policy response.

Personally, I’d go one step further and doubt we’re still in a textbook business or economic cycle, where I’d be closer aligned to what Ray Dalio is calling a “debt cycle”, where we’re in a permanent boom economy percolated by the occasional RORO event where the economy skids to a halt, governments come in to save the day, and economic growth resumes.

2022 Price Targets

As we noted last year, Q4 2020 saw less and less strategists and economists publishing FX forecast, given currencies had oscillated far more than historical averages.

This is proving to be the case this year as well, where price targets are being scored as bands (i.e. AUDUSD at 72-74c) or in thematic terms (i.e. strong bullish, mildly bullish, neutral etc).

However, the theme that is coming across is the importance of carry trades reasserting themselves, as relatively hawkish central banks have more rate hikes priced in, and generally higher yielding bonds.

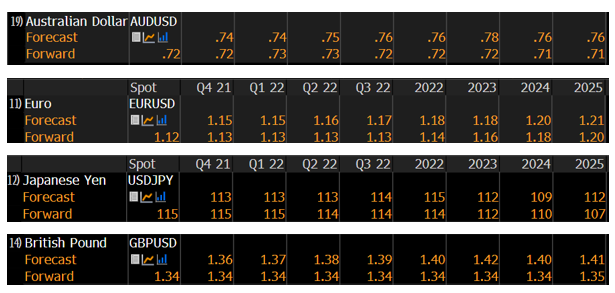

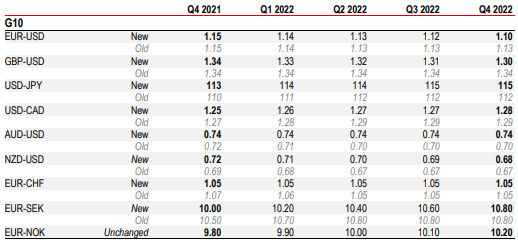

Below are the Bloomberg consensus forecasts, where the “forward” levels are based on market prices of derivative contracts, rather than forecasts.

It’s interesting to see how different the market prices are compared to economist projections.

Chart 3: AUD/USD, EUR/USD, USD/JPY and GBP/USD Forecasts and Forward Rates

Source: Bloomberg, as at 23-Nov-2021

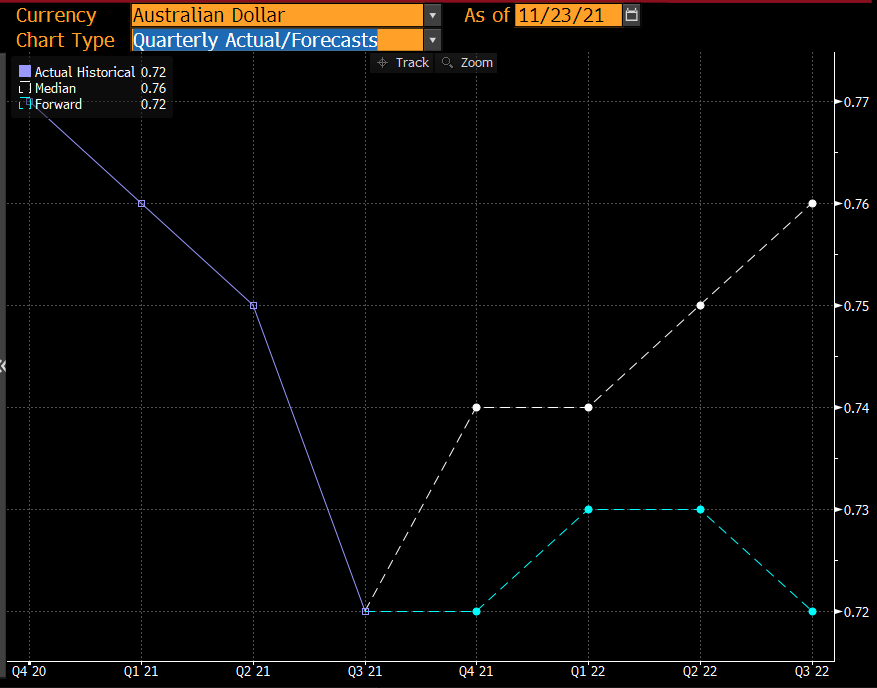

Going into more detail on AUD/USD, both the market and economists believe that AUD/USD’s trajectory is an appreciation of AUD relative to the USD but differ in the magnitude and the tenor of the move.

Economist projections have the AUD moving sustainably higher, back to 76c in Q4 2022, whereas market prices have it never regaining above 73c for long and ending next year more or less where it currently resides.

Chart 4: AUD/USD Spot FX, Path of Price

Source: Bloomberg, as at 23-Nov-2021, rounded to the nearest cent increment

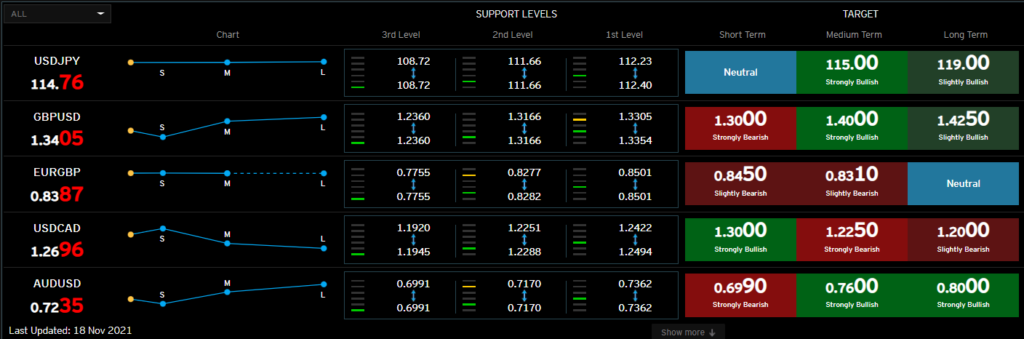

Looking at some house views of investment banks to also get a gauge on sentiment and positioning, Citi still view AUD/USD bullishness in the medium term, though short term bearish below 70c.

As we would expect as well, their longer-term target is lower from 85c down to 80c.

Chart 5: Citi FX Technical Outlook

Source: Citi Velocity, as at 18-Nov-2021

Compare this to HSBC, who have a more conservative view, with a lower price target for AUD/USD, but generally a weaker USD compare to Citi.

Chart 6: HSBC FX Outlook

Source: HSBC, as at 13-Nov-2021

The Likely USD Story

As the new year beckons, it’s likely that USD resiliency continues.

Note this is resiliency rather than ascendency, an important distinction.

In our outlook for this year we talked about USD weakness based upon a resumption in global trade and economic reopening, which hasn’t been the case relative to our forecast.

In reality, we’re seeing a moderation in global growth as COVID-19 variants and 4th waves continue to affect the global economy.

The other factor to consider is that the Fed is shifting towards policy normalisation, quicker than some other central banks such as the RBA, ECB and BoJ.

This seems similar to circumstances in 2018-2019, where the Fed steadily raised interest rates, propelling the USD onto a stronger path compared to GBP, EUR, JPY, SEK, DKK, AUD etc.

We would also nuance this view that while the recent USD strength has been based on market’s ascribing higher US bond yields compared to these other markets and currencies, we’re starting to see some pushback from central banks as they rule out hikes in 2022, in opposition to market pricing for hikes throughout H2 2022.

Wary of Consensus

Our process is to establish our own views, and then evaluate where our views sit within the market’s view and whether we’re consensus, above or below, or contrarian.

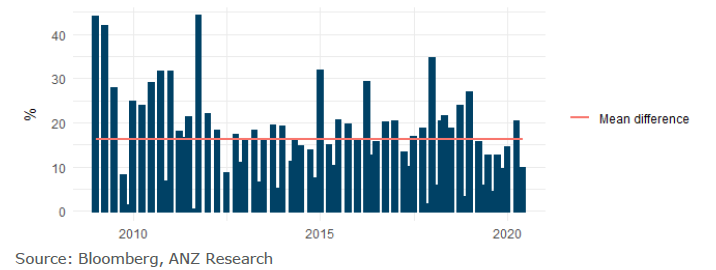

The reason for this is that G10 FX forecasts haven’t been a good approximation for actual FX movements over the past 15 years, where the consensus has only been correct about 50% of the time (ANZ FX Strategy Insight, May 2021).

This is in part due to a large dispersion between forecaster’s views

Chart 7: Spread between highest and lowest forecast for AUD/USD

The market consensus also tends to be too conservative, erring on the side of caution and hesitating to price in higher AUD/USD despite accelerating global trade and booming commodity prices, which has supported AUD/USD for much of the period.

This correlation between our Terms of Trade and AUD/USD broke down in 2020 and for most of 2021, where the second order effect of a steeper AU yield curve was not realised which didn’t see inflows into long AUD/USD carry trades.

As the RBA has moved away from Yield Curve Control, this has become a relevant relationship, yet again.

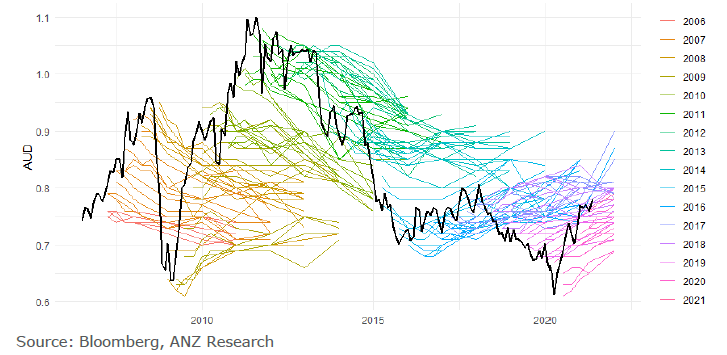

Chart 8: AUD/USD consensus forecasts Vs Reality

I suppose this is why I tend to be out of consensus for AUD/USD forecasts, where only a handful of forecasters were expecting AUD/USD to reach 80c this year, and nearly no one is expecting it back above 75c again any time soon.

However, I find myself near consensus this time around – possibly to my discredit – as the catalyst for a resumption in global trade and economic growth rebound seems more a 2023 story, than a H1 2022 story.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.