On the 6th of July, the RBA remained dovish in their monetary policy stance, relative to other developed market central banks, such as the US Federal Reserve or the Bank of Canada.

As we wrote in our missive on 7 July, even the small tapering of the RBA’s asset purchase program was semantic, as they ere merely aligning their stated policy with the actual transactions occurring within financial market.

So, while many could look at the statement and think “wow the RBA is tapering”, in practice they weren’t making any real-world changes to their policy, other than the discontinuation of their yield curve control.

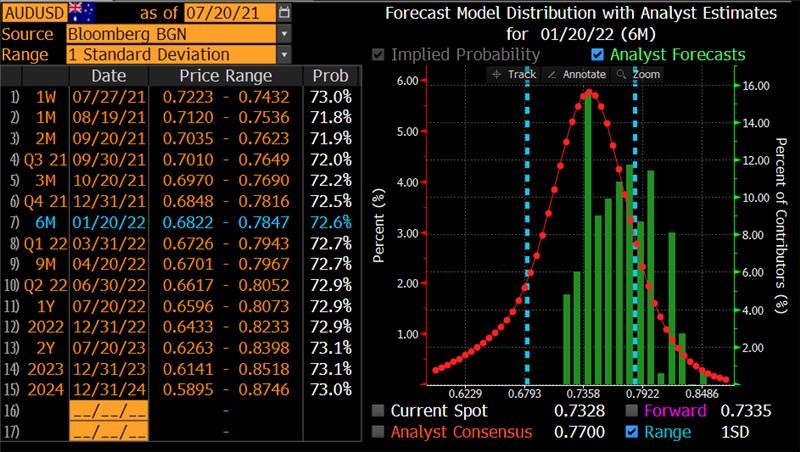

These small tweaks and overall dovish bias started the Australian dollar (AUD) to begin a downward descent, where it’s currently trading around 0.7345 against the USD (as at 20-July, 1030am).

It’s been some time since we commented on the AUD and it’s likely trading path going forward, something we didn’t touch upon in our Mid-Year Asset Allocation update last week.

The last time we wrote about AUD/USD was in May, in a note titled “Why the AUD isn’t Higher”, a note where we discussed the fundamental long-term drivers of the AUD/USD exchange rate:

- Interest rate differentials

- Terms of Trade (exports – imports)

A recent adaptation of these fundamentals has been the RBA’s yield curve control and relative monetary policy compared to other central banks, which has broken the flow-on effect of higher commodity exports leading to higher Australian inflation, leading to higher Australian government bond yields, leading to AUD appreciation as foreign investors buy AUD bonds.

Because of this, today we look at the short-term drivers of the AUD/USD exchange rate, and why POLICY is trumping FUNDAMENTALS.

Relative Central Bank Policy

A large portion of the shorter-term price action for AUD/USD has been sentiment driven, and the relative hawkishness/dovishness of central bank policies.

To start, I’ll share a favourite form of charting that I use to scrutinise trading patterns of assets, this time breaking down AUD/USD daily price levels by time zone.

What we learn from this is that AUD/USD has been broadly weak across APAC, UK/EU and North American time zones, not centralised in one specific area.

This means that sentiment is broadly negative, and not solely due to Australian news – which the majority is published during APAC hours.

Source: Bloomberg

In the RBA’s recent policy statement, they espoused views perceived to be relatively dovish compared to foreign central banks such as the US Fed and Bank of Canada, similar to that of the European Central Bank too.

Because of this, Australian government bond yields have moved lower, which has seen less relative attraction when compared to foreign sovereign bonds.

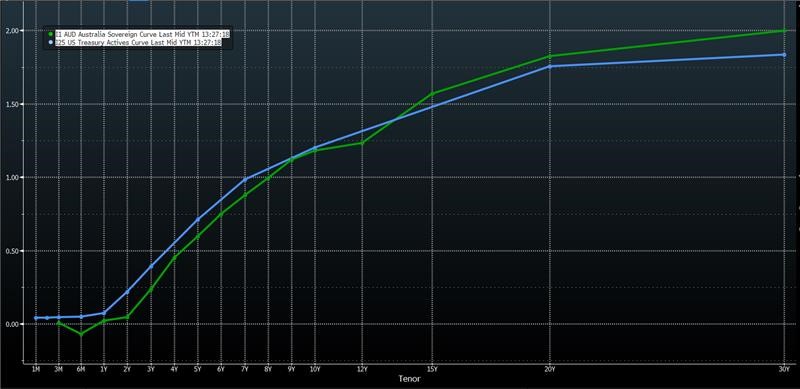

In the below chart, we compare Australia’s yield curve (green) with the USA’s (blue).

Under normal circumstances, Australia would have higher bond yields than the USA, as compensation for investing in a smaller economy more subject to commodity prices and inflationary pressures.

Source: Bloomberg

The biggest driver within this has been worries that the global economic rebound will be slower than previously forecast, or that our economies will grow at a flatter pace, prompting a “risk off” response from markets.

This has seen the USD outperform, rallying against most other currencies – especially our AUD.

Risk-off and State Lockdowns

Compounding upon the USD outperformance of late has been our local economy’s state lockdowns and COVID outbreak, amid a backdrop of slower vaccination rates.

Where a large portion of our nation’s industries are under lockdown, it’s no wonder this factors into economic forecasts and a slower domestic economic growth rate.

The current lockdown policies will be felt in Q3 economic figures, most of which won’t be released until after quarter end, in October.

In the meantime, FX cross-rates, equity and bond markets are factoring the Australian growth rate into their pricing.

The largest influence of this has been the NSW lockdown, a state that accounts for 32% of national economic output, where NSW Treasury estimates the current lockdown will cost 850 million AUD per week or reducing our annual national GDP by 0.043% per week.

Hence, three weeks of lockdown so far has reduced 2021 national GDP by 0.13% already.

If NSW lockdowns are anything alike to VIC’s 16 weeks of lockdowns, the effect would slash 0.7% off annual GDP growth.

While this sounds dire, the relativities involved in international financial markets mean we need to compare the similar situations present in the US, UK, Canada, EU etc.

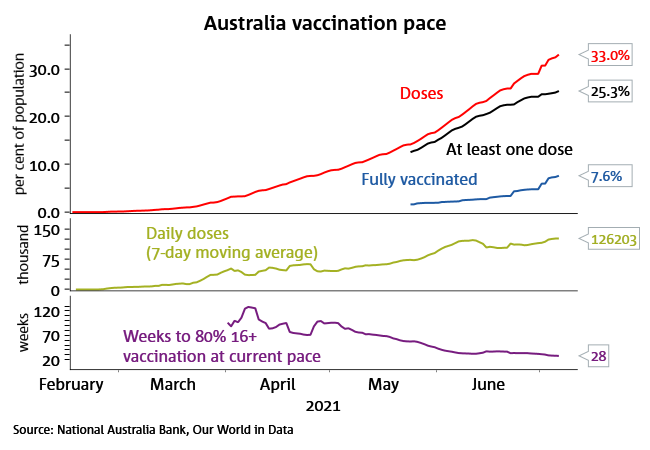

At present, we’ve only double vaccinated about 11% of our population, well below the likes of the USA (48%), UK (54%) and Canada (50%).

Also, our vaccination rates have not increased as did other nations as vaccine supply became more readily available, which is why our current pace sees us achieving herd immunity ~25 weeks from now, in Q1 next year.

Long-Term Drivers

Despite the fall in the AUD/USD exchange rate from 0.80c in February to the current ~0.74c area, we do not believe that the long-term appreciation of the AUD has ended, no, though we do believe in the short-term that these influences will continue to see AUD underperform other nation’s currencies.

These reasons being:

- Slower Australian vaccination rates

- Other nations vaccinating quicker, allowing them to reopen their economies more quickly

- Australian states and territories locking down parts or all of their areas on rising case numbers

- Australia having relatively slower economic growth because of the lockdowns and lack of reopening to tourism

- Foreign central banks being relatively more hawkish than the RBA, because of these reasons

In our 2021 FX Outlook, we saw an 80c price target for the end of 2021 as achievable, a target we reached in early February. We still see the AUD having long-term upside from here, where we’d be more inclined to a ~78c level than an 80c level for 2021, and an 80-82c area for 2022 CY.

Looking at other analysts & economists’ projections (the green columns), the bulk of predictions have the AUD/USD exchange rate between 77-79c by year end, as well.

Source: Bloomberg

Forecasting the Future

While the short-term impulse is a lower AUD because of these factors, these are likely to reverse over the next 6-9 months which will see detractors of growth transitioning to supporters of growth.

In particular, vaccination complacency and a lack of supply will reverse after the current lockdowns and as more Pfizer and Moderna vaccine supply arrives in the coming weeks and months.

This has highlighted to many Australians that vaccines are the only way to end the cycle of lockdowns, while being infected is more likely with the delta strain, so Australia will quickly catch up to other nations so that these two factors are no longer subtractive from our relative FX valuation.

In turn, this will see a higher “reopening” forecast for Australia as other nations start to come down off their high points and see Australia subject to higher inflationary pressure due to the consistent demand for our commodity exports from nations now looking at infrastructure packages.

Together, these factors will see AUD/USD regain its shine and trend higher, back towards 80c.

Closing Remarks

While we are expecting this longer-term uplift in the AUD/USD exchange rate, we do recognise the current malaise from lockdowns and low vaccination rates that will weigh on Australian growth forecasts into the near future.

This will keep the RBA relatively more dovish than other central banks, keeping our government bond yields anchored at low levels, flattening our domestic yield curve.

These short-term factors should abate over the coming 6-9 months, and AUD/USD trend higher.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.