In our fourth instalment of our Risk Off Series, today we speak about how to potentially gain in managing currency and cash exposure, in a risk adverse market scenario.

For context, we have written the following notes prior to today:

The genesis for this series of missives was that several of our platform investors queried specific strategies they can use to protect, hedge, navigate and even profit from potential drawdowns due to market selloffs.

There are many options available, depending on the underlying portfolio composition, and therefore a specific strategy may be more relevant to you or your client’s capital.

In terms of currency and cash exposure, Mason Stevens has a unique offering in that clients can have multiple cash accounts on our investment platform, and specific to today’s note, they can hold non-AUD exposure in owning US dollars (USD) or Japanese yen (JPY).

As for the below content, I can speak personally for the strategy as I employed the below mentioned techniques to manage my investment portfolio’s FX risk, trading billions of AUD/JPY actively for a previous employer during the 2016 US Presidential election, and also again proposing the strategy for Mason Stevens clients last year.

Non-AUD Exposure

It’s important to note from the beginning that foreign currency cross-rates are all relative, where every currency’s worth is derived from the value of another currency.

For example, one of our AUD is approximately worth 0.75 of a US dollar, at time of writing.

By convention, we compare most currencies against the USD because the USD is the world reserve currency, for example AUD/USD, EUR/USD, GBP/USD, USD/JPY etc, but we can also compare currency values via less conventional currency pairing such as EUR/CHF, AUD/JPY or AUD/NZD which are also used by non-US domiciled investors to bypass using the USD.

The inference from this is that if you are not investing in international markets, meaning you aren’t buying assets in foreign currencies, then the value of your investment portfolio is not relative to foreign currency valuations.

If you’re an AUD based investor investing only in AUD denominated assets, you are not subject to the ever-changing value of your portfolio in foreign currencies, BUT, if you wish to ever deploy your cash or capital into foreign markets, then the strength of our AUD is of paramount importance.

Safe Haven Currencies

Globally there are three main “go to” safe haven currencies, the USD, JPY and the Swiss Franc (CHF).

Of the three, USD and JPY are in our view more suitable as a safe haven play, where the CHF trades with less volume, and mostly during European hours.

Also, the Swiss National Bank (SNB) burned many global (particularly European) investors in 2015 by unexpectedly removing their currency peg against the euro (EUR), where the CHF rallied 30% in one day – in fact, it was in a matter of seconds – where there hasn’t been any recent, sudden or as decidedly negative market impacts from US and Japanese central bank activities.

In both cases, they were originally structurally strong currencies which became a self-fulfilling prophecy, when it became common knowledge these currencies would rally in risk off environments, where traders will now quickly buy both currencies in seconds (or less), to potentially avoid risk and by being quicker than the crowd, and even profit from risk-off.

Also, both currencies are among the most actively traded currencies in the world too, with deeply liquid markets with very small bid/offer spreads.

This is very important as it means there’s always sufficient market volume to facilitate a quick risk-off trade decision.

Deep, Deep & Liquid Markets

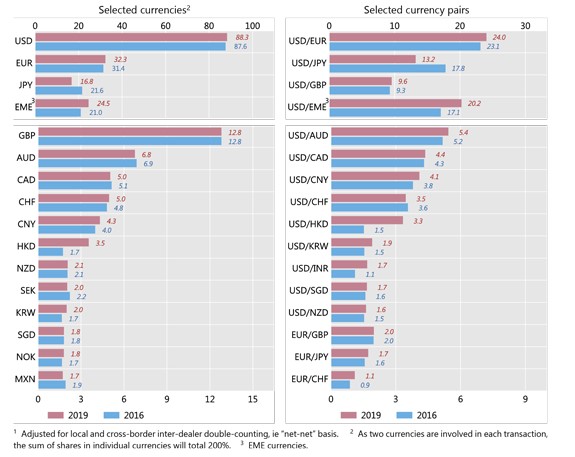

The Bank of International Settlements produces a triennial FX survey to canvas traded volumes of currencies, which our RBA summarises and publishes.

In the last review period in 2019, foreign exchange turnover was $119 billion USD per day, which was an increase in 6% p.a. from the previous survey.

On average, AUD/USD traded 14.75 billion USD worth of volume per day, and AUD/JPY traded 3.3 billion USD per day.

Source: Bank of International Settlements Triennial Central Bank Survey

Japan (JPY) as a Safe Haven

Japan is the world’s third largest economy by GDP, and the JPY is one of the three most traded currencies in the world alongside the USD and EUR.

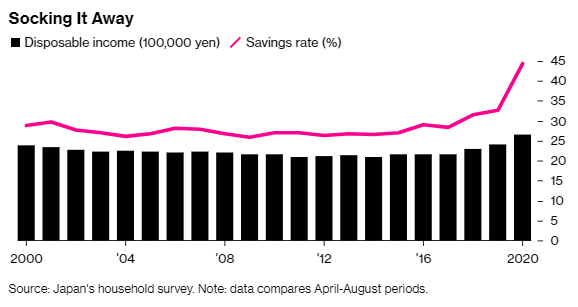

Since WWII, Japan has been the world’s predominant source of savings and investment – a creditor – followed by Germany and China.

Source: Bloomberg, Japan’s household survey

Because of this high savings rate, Japan has a positive net foreign asset position, meaning they export capital in the form of investment around the globe.

Following this thought, it is commonly believed that Japanese investors will sell their foreign assets in a time of crisis, and repatriate their funds back into JPY, where JPY would likely rally due to the inflows from increased buying.

United States (USD) as a Safe Haven

The elements that make the USD a perceived safe haven are different to the JPY, where the US is not a net creditor nation, but instead are the largest debtor nation in the world.

The difference is that the USD is the world’s reserve currency and is the default currency for most international trade, and the settlement currency for the majority of commodity dealing and international business transactions.

This perception yet again creates the self-fulfilling prophecy when risk aversion strikes markets in its various forms, the USD quickly rallies.

We saw this happen in real time last week, when on Thursday morning (our time zone), the US Federal Reserve Bank released their monetary policy statement at 4am AEST and the USD popped higher soon after, as equity markets sold-off. While this was due to an unexpected monetary policy development, we would categorise it partly as a shifting fundamental landscape, but also a knee-jerk reaction of traders to buy a safe haven asset.

In the below graph, AUD/USD clearly sells off on 17-June (Thursday morning) from 0.7708 to 0.7610, meaning the AUD depreciated relative to the USD (rallied), at the same time the S&P 500 (green line), declined 1.5%.

Source: Bloomberg

Short AUD/USD, AUD/JPY

For these reasons, selling AUD and buying USD or JPY can be a suitable pre-cached strategy to hold ready to potentially avoid portfolio losses, to sell AUD cash (or assets) and raise USD or JPY cash.

As a case study, if you had sold AUD and bought JPY in Q1 2020, it was a profitable trade where the AUD sold off relative to the JPY.

In fact, AUD sold off against most developed market currencies (such as EUR, GBP, CHF) whereas the JPY also rallied relative to most other world currencies.

If you had put on this trade prior to the COVID March/April washout, you could’ve made ~17.5% gross in that 6-week period.

Source: Bloomberg

Likewise, if you had sold AUD and bought USD for that same period, you could’ve seen a ~13.5% gross return.

Source: Bloomberg

Closing Remarks

It’s remarkable that purchasing foreign currencies such as the USD and JPY as a safe haven play is not as mainstream as purchasing precious metals such as gold, despite a much stronger safe haven relationship.

Part of that is likely system infrastructure, as until recent years, retail investors did not have the ability to hold foreign denominated cash, unless they did so via a private banking arrangements or commercial business facilities.

Now that investment platforms – such as Mason Stevens – provide this level of access, I would presume that the investment strategy becomes more commonplace in Australia, as it is overseas or amongst Australian institutional investors.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.