It has become an ever-increasing topic of discussion in how to avoid potential market drawdowns this year or next, yet still be invested.

In fact, for many balanced and growth mandates, they are required to maintain allocations to equities in a range – for example, hold between 30-70% in equities at any point in time.

As an asset allocator, you may share the notion that markets may well “correct” by 5%, 10% or 20% (or more) this year, but are either unsure of the timing, or are required by mandate to maintain equity exposure.

Then you may be looking for financial markets with less volatility or less exposure to global macro factors.

Japan is a country that keeps popping up that may articulate this investment idea, something I’m going to explore today.

Background on Japan

Japan is the world’s third-largest economy by GDP and fifth in global business competitiveness, according to the World Economic Forum.

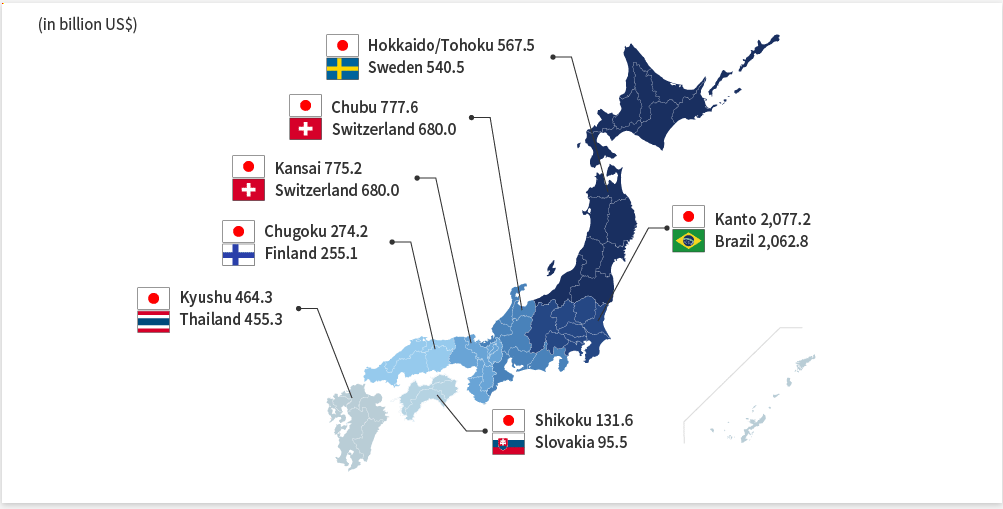

Japan’s economy is so large, that many of their regions have larger local economies than entire countries.

The nation has a stable government, highly ranked “liveable” cities, high standards of living, the second best business conditions in the world and has the world’s most efficient public transport service too.

Japanese Savings

Since WWII, Japan has been the world’s predominant source of savings and investment – a creditor – followed by Germany and China. This is in stark contrast to the USA, which is the world’s largest global debtor.

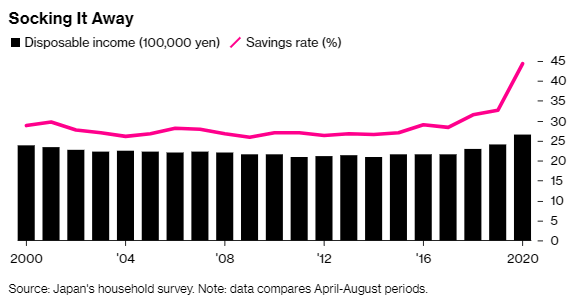

As of Q4 2020, Japanese savings rose to a 20-year high, as anxiety over the pandemic and economic outlook appeared to encourage people to pocket cash handouts from the government instead of spending it.

On average, Japanese workers save 44% of their income, up from the long run average of 33% per annum.

Higher savings rates mean less spending, which is detrimental to a country’s economic growth trajectory, but in Japan’s case, is beneficial to the value of their currency.

On face value, this limits the amount of growth that Japanese equities will exhibit, but coming back to our thesis, it also may limit the volatility due to less sensitive revenue profiles.

JPY – Safe-haven Currency

Japan’s currency, the Japanese Yen (JPY) is considered a safe-haven because of the high Japanese savings rate.

Japan has a positive net foreign asset position, meaning as net savers, they export capital in the form of investment around the globe.

Following this thought, it is commonly believed that Japanese investors will sell their foreign assets in a time of crisis, and repatriate their funds, back into JPY.

This perception creates the reality where under signs of equity market stress, traders and fund managers will buy JPY, knowing that Japanese investors may eventually return their money home from abroad.

This creates a self-fulfilling prophecy, where JPY rallies in times of market turbulence or uncertainty.

Demographics

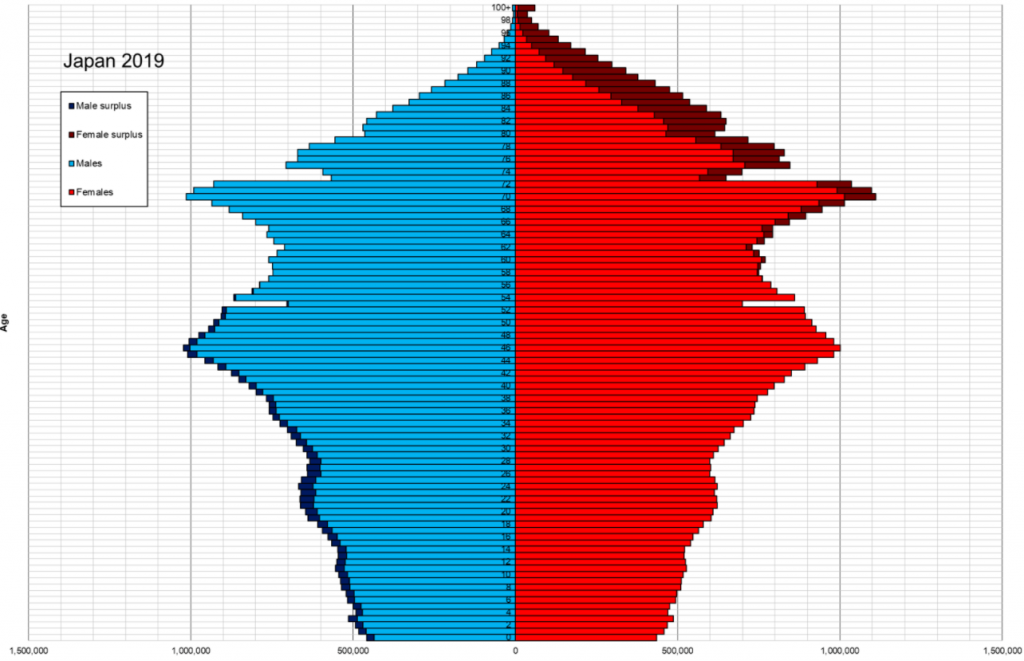

Japan’s population is growing slower than all other nations, with their population of persons 65 years and older doubling in the next 25 years from 7.1% of the overall population to 14.1%. This same increase took 61 years in Italy, 85 years in Sweden and 115 years in France.

Again, this isn’t a bullish growth narrative, but it reinforces the JPY safe-haven currency narrative, as there is a large cohort of elderly Japanese that are retiring and returning their investments from international to domestic currency.

Japanese Domestic Market Participation

Another reason for Japanese market stability is their strong domestic market bias.

It’s been a long-term component of Japanese markets where foreign participation has been low, something former Prime Minster Shinzo Abe sought to change over the last 7 years, in 2014 removing many of the foreign investor taxes that stymied foreign capital flows.

Because of the higher domestic participation, Japanese equities and bonds are less sensitive to global risk appetite and more influenced by domestic factors over exogenous factors.

This is contrary to Australia, where our AUD, bonds and equities are heavily influenced by foreign markets such as USA, China, Europe, UK.

AUD/JPY

There is a definite dispersion between the structure of the Australian and Japanese economies.

Australia is smaller (in population) and more open, with English being both our national language and the “universal” language spoken around the globe.

On the other hand, Japan is insular with significant language barriers for foreign investment, both in bond and equity markets, and also in on-the-ground businesses.

These structural influences are epitomised in the AUD/JPY exchange rate, which is a well-known go-to for fund managers wishing to express risk-on or risk-off bets.

If risk-on; where one is expecting a higher growth, inflation outcome >> buying AUD and selling JPY (long AUD/JPY).

If risk-off; where one is expecting a lower or negative growth story, lower inflation and generally “doom and gloom” scenario >> selling AUD and buying JPY (short AUD/JPY).

If you had simply executed this trade and held the JPY cash in Jan-Feb 2020, you made 18% as AUD sold-off relative to JPY currency.

Coming full circle, this is why we proposed Japan as a possible way to articulate a bearish economic narrative – where the structural factors support their markets and dampen volatility, but Australian investors with AUD can gain upside if growth and “reflation” are worse than expected, or if COVID third waves force governments to reimpose lockdowns as states in Australia are experiencing.

Trade Ideation

In terms of an investment process, execution shouldn’t be too complex.

Selling AUD and buying JPY currency is a simple way to express a bearish market view, where the JPY can be kept in cash accounts. AUD and JPY are two of the top six traded currencies and are highly liquid with relatively low transaction costs.

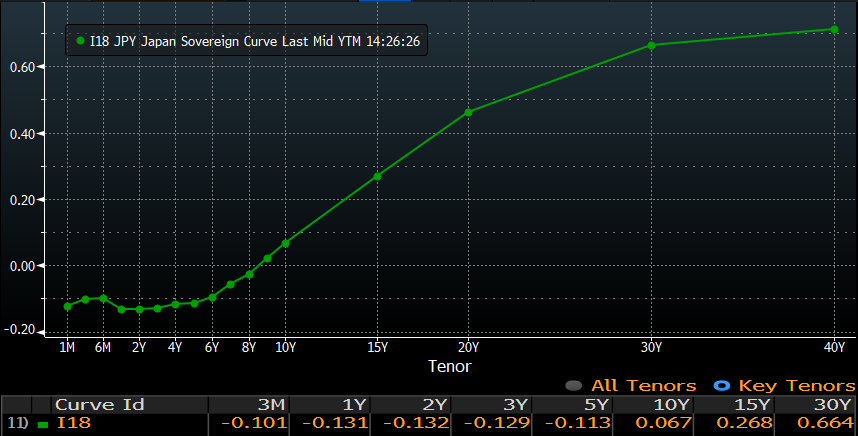

Another way to express this bearish view is to sell AUD/JPY and then buy Japanese government bonds (JGBs) – where it’s becoming consensus the Japanese central bank, the Bank of Japan, may cut their interest rates to more a more negative level from the current -0.10% cash rate. Moreover, buying JGBs can expose portfolios to interest rate sensitivities, where bonds can rally if/when macro-economic factors deteriorate.

The Japanese yield curve is flat, but can certainly flatten more (bonds rally)

Via equities, there’s direct equity exposure into selective names that may be valuable. Warren Buffet and Berkshire Hathaway made a high-profile investment into several Japanese exchanges and other equities in Q3 2020, acquiring 5% of each of the below:

- Itochu (JP: 8001),

- Mitsubishi (JP: 8058),

- Mitsui (JP: 8031),

- Sumitomo (JP: 8053), and

- Marubeni (JP: 8002)

However, if direct securities aren’t for you, then there are two well-known AU-based ETFs that buy Japanese exposure: Betashares Japan ETF (ASX: HJPN) or iShares MSCI ETF (ASX: IJP).

HJPN has been around for ~4 years while IJP was incepted in March 1996.

Closing Remarks

It’s interesting to me that markets that often fly under our radars, can come into vogue under the right conditions.

In Japan’s case, we’re all well aware of the size of the nation, influence on the domestic economy, maybe also visited the country itself and seen how high the quality of living is, yet do not have material exposure to their market.

However, if you’re seeking diversification this year and seeking uncorrelated returns, then Japan may provide such a benefit.

Because of the JPY’s safe-haven status, exposure to Japanese currency may prove to be the hedge sought out by investors should bear market conditions eventuate.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.