Title: The USA’s New Plans for Asia Pacific

While financial markets have been focusing on;

- bond markets sell offs,

- equity market earnings season,

- COVID-19 vaccine rollouts,

- cryptocurrency developments,

the United States has been rolling out a comprehensive strategy against China and has been proposing grand plans for how to enact it.

Haven’t heard anything about this?

I hadn’t either until Geopolitical Futures wrote a detailed update last week.

Ambitious Plans

Thinking back to 2017 and 2018, the US/China tit-for-tat tariffs were the focus of the market, where recession was predicted if a protracted trade war occurred. This narrative went quiet in 2020 as COVID was the more pressing issue affecting the globe, though tensions still simmered under the surface.

Some thought that the election would change this dynamic, with President Biden taking a different tact from former President Trump – not so.

This dynamic is unlikely to alter or pivot any time soon, as the initial concerns around transparency, foreign access to Chinese domestic markets, rule of law and intellectual property theft have not been addressed.

This is why President Biden has been running an ambitious gambit, making the case that stronger deterrence measures are sorely needed beyond the “hard” military measures of bombs, guns and ammunition.

Still, military power is a dominant force in curtailing China’s regional plans and ambitions, as the USA holds the balance of power though there are growing concerns regarding Washington’s ability to sustain it.

More, Faster, Broader

One of the main issues the USA is seeking to address is that its current military force is not positioned nor optimised to deter an adversary with China’s firepower and technological sophistication, in its own littoral waters.

To prepare the US armed forces for this task, it needs to increase the size of its forces (More), be quicker to react (Faster) and increase coverage throughout the Asia Pacific region (Broader).

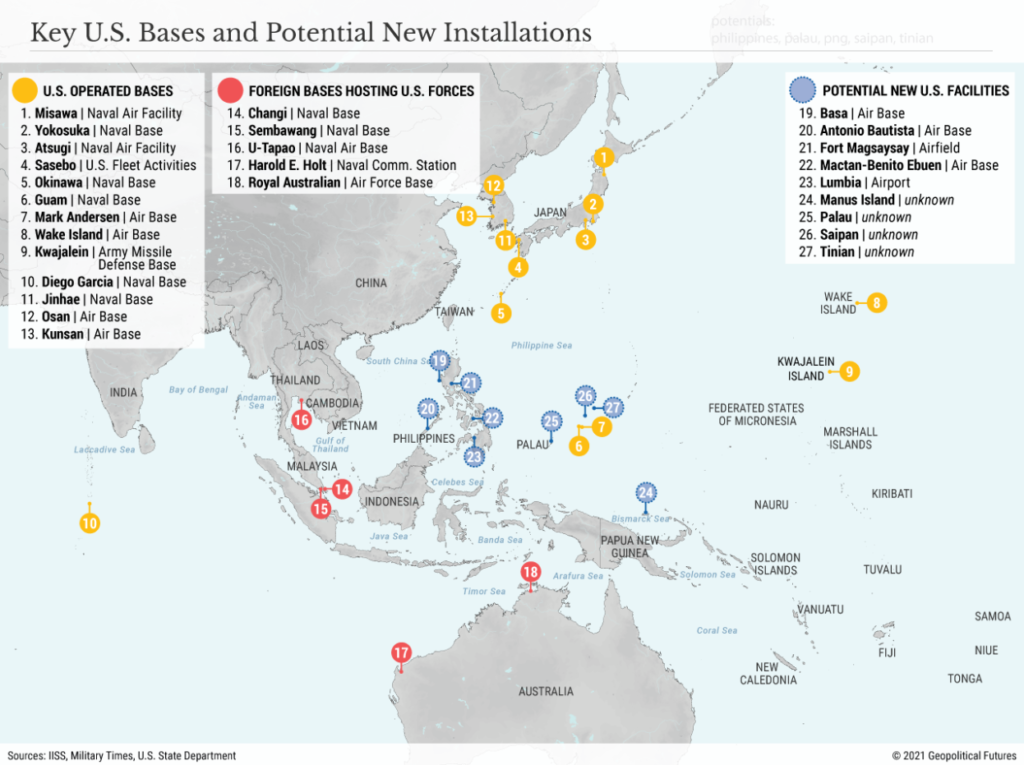

The USA’s regional base network was built up during and after World War II, with a focus on containing Japan through forward deployments of forces that would be within the region to react, if concerns arise.

This was many decades ago, and long gone are the major US naval bases in the Philippines, Taiwan and Thailand that were integral in this containment strategy.

The remaining bases are postured towards the West and South Pacific – such as Japan, Guam, Australia and Hawaii, with less proximity to China.

Hence, this latest proposal is to concentrate US forces and assets – such as ports, airfields, supply depots and so forth – in areas further north (blue dots below).

Therefore, if a military conflict were to break out unexpectedly, the US forces would be able to react more quickly than forces current barracked in Darwin or Japan.

This would allow the US and its allies – namely India, Japan and Australia – to blockade Chinese shipping traffic through chokepoints like the Malacca Strait.

Forward Facilities

While the US is currently unparalleled in its ability to conduct major operations in remote corners of the globe, there’s only so much firepower that it can move quickly and easily.

For example, a typical aircraft carrier strike group – think Top Gun – includes three to six destroyers and cruisers, which can carry 90-120 missiles each, which isn’t really that much to sustain longer term operations.

This is why they require nearby bases to re-fuel and re-load ammunitions, should skirmishes or wars break out.

The Pentagon, therefore, believes it needs a more dispersed, more agile force structure.

It wants more and smaller unmanned ships (sea-borne drones) and nifty unmanned platforms and supply depots, that don’t require a permanent human geographic footprint.

This sounds future-esque because it is. Many of these requirements have not been invented yet – at least to public knowledge.

In the recent Pentagon ask of the US Congress for funding, they’re seeking 9bln USD to redistribute forces “west of the International Date Line”. The big focus here being redeployment of ~2000 Marines operating a new fleet of light amphibious warships – think Rambo (2008) in Myanmar.

Making It Work

The US Treasury is already facing a tall order in funding strategic geopolitical imperatives of the Biden Administration, already at record deficit spending levels, and bond yields rising to compensate for the higher funding demand. This is not to mention the now touted 4 trillion USD “Build Back Better” infrastructure stimulus package.

Therefore, it’s important to note that the USA needs to:

- Be able to afford and budget for these expenses

- Secure the land for these new outposts, in negotiations with various Asia Pacific nations to do so.

This is also difficult as by lending/leasing land to the US for military installations, you also make yourself a target for US adversaries, such as China.

You’re also likely to provoke non-military retaliation, such as China’s freezing of coal imports from Australia at times, despite allowing non-Australian imports to continue.

For example, China pressured South Korea into barring the USA from installing THAAD anti-missile systems into bases in South Korea.

Finally, the US also has the goal of seeing its regional partners – Japan, India and Australia – pitching in substantially more through the Quad alliance, as well as ANZUS treaty. This could create all sorts of mechanisms for expanded US access through joint training and operations.

Closing Remarks

All of this underscores that while the Pentagon is challenging China in the Asia Pacific region through military and technological means, the biggest challenges ahead are diplomatic.

Very few countries are willing to pick a side, and the 2016-2020 ambivalence of the Trump Administration towards the region only deepened the reluctance of many nations to support the US goals and initiatives.

Therefore, the Biden Administration and Pentagon officials will try and gain favour with Asia Pacific nations over the coming months and years, to build a force that is sustainably capable of deterring China.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.