Much of the Australian Federal Budget for 2023-24 had been leaked in the build up to last night’s formal release which resulted in a muted response to last night’s actual announcement. Below we have endeavoured to provide a summary of the budget and then we delve into wider economic and market implications.

Overview

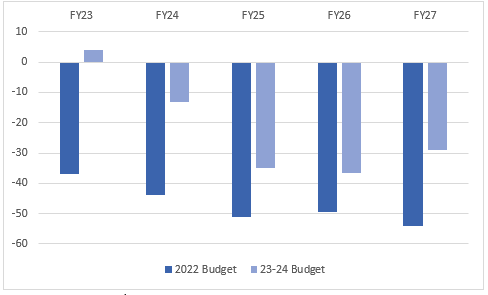

The 2023-24 budget delivered a surplus of $4.2b for FY23 in the first budget surplus in 15 years. This surplus is thanks to a combination of the strength in the labour market as well as higher commodity prices which drove a turnaround of nearly $37b from October 2022 (in tax receipts and royalties). The budget surplus is expected to be short lived, however the budget forecasts a return to deficit from FY24 and onwards as shown by the below chart.

Fig 1: 23-24 Budget vs October 2022 Budget

Source: 2023-24 Budget Papers, Mason Stevens

There was a focus on a few key areas like health, climate & energy, housing, defence, and cost of living summarised below:

- Healthcare: For health, there will be $3.5b spent over 5 years in increasing the money paid to doctors who bulk bill as well as $1.2b spent on pharmacies to make medicine cheaper – touted to halve the cost of medication for the consumer.

- Housing: For housing the government will increase rental assistance by 15% for more than 1 million Australians while also spending $2b on social and affordable housing and making some slight tweaks to the First Home Guarantee to expand eligible applicants.

- Climate & Energy: From a climate & energy perspective the government will be spending $2b to support large-scale hydrogen production, while also investing in household energy upgrades to make homes more energy efficient.

- Defence: There will be $20b spent on defence strategic review, which will be split amongst AUKUS nuclear-powered submarine program, long-strike capabilities, and defence bases.

- Cost of living: The $14.6b package offers comfort to some consumers through rebates on energy bills, increased rates on jobseeker payments and the expansion of single-parent welfare.

Inflationary or not?

Having seen the impacts of what can happen when fiscal and monetary policy don’t work together over in the UK, many market participants were rightly concerned that the $14.6b cost of living relief package within the budget, may in fact be inflationary and make the RBA’s job harder.

Some parts of the budget will no doubt help reduce headline inflation i.e. the subsidies child care, rental assistance, and on energy bills (which is expected to shave 0.75% off headline inflation). However, this becomes a double-edged sword with these subsidies resulting in more disposable household income which has the potential to be inflationary dependent on what the consumer does with the increased disposable income. Given the nature of both sides, Treasury along with many brokers, believe the net effect of the budget is expected to not materially impact inflation. While this is how treasury and the street view it, time will tell on how the RBA itself views the budget.

Sectors to benefit

The expected beneficiaries of the budget from an equity perspective? Citi has noted that they believe some names in retail and real estate could be beneficiaries. They believe retail will benefit from the increase in disposable income in lower-income households as they are more inclined to spend out of an uptick in income.

From a real estate perspective, Citi believes land lease-exposed companies will benefit the most from the 15% increase to rental assistance as a significant portion of renters in land lease communities generally receive rent assistance.

Citi doesn’t believe the changes in the health space will have any material effect on the sector, with perhaps only some marginal benefits on the pathology side because of the changes to bulk billing incentives.

Impact to Fixed Income

Typically, budgets are not known to move fixed-income markets, however, a few market commentators such as Nomura and Moody’s felt that this budget did have a little in it.

Treasury’s plans to run smaller fiscal deficits and issue less bonds over the course of the remainder of the budget. Barrenjoey noting that government debt was previously forecast to rise to $1,091 billion by FY25 but is now only projected to rise to $960 billion.

Nomura estimates that AGCB issuance will fall from around A$80b in 2022-23, down to around A$72b in 2023-24. Nomura believe that is much stricter than required and reflects their expectations that the AOFM will elect to prefund some of its requirements for 2024-25 in 2023-24. Nomura believes this budget has been positive for the long end of ACGBs and AUD with Moody’s also saying that the move to fiscal repair is “credit positive”.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.