Gold has long played a role within utility maximising portfolios – given its ability to diversify and reduce volatility.

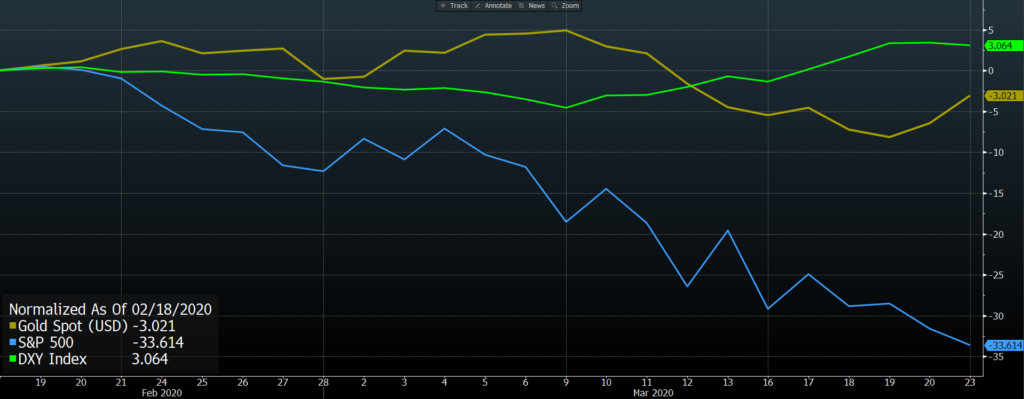

During times of market distress, it has acted as a reliable safe haven asset, displayed in March of last year when the S&P500 experienced the fastest 30% correction in its history – only taking 22 trading days to reach this figure.

During this period, gold was able to outperform the S&P 500 by 30.59%, with the US Dollar also outperforming by 36.68%

Source: Bloomberg

However, outside of its qualities as a safe haven asset, the question must be asked – what value does gold add to a portfolio?

After all, market pullbacks of such magnitude are few and far between.

The 2nd, 3rd and 4th fastest 30% corrections all occurred during the Great Depression era, so for such an event to occur in the near feature would be a statistical anomaly.

We all know that statistical anomalies should not act as a point of a justification within the investment decision-making process – after all, when was the last time a great investor consistently made returns off improbable events.

In order to answer this question, we will steal Jesse’s robust investment decision making process which he outlined earlier this month, looking at the 5 key factors which should be addressed before making any investment:

- Fundamentals

- Technical

- Sentiment

- Correlation

- Catalyst

Fundamentals

On a fundamental basis, gold scores fairly poorly.

Unlike equities, fixed income, and cash, it delivers no income and effectively has a negative carry through its holding costs (storage and insurance).

In assessing its intrinsic value, it carries little use, only being utilised within jewellery and in minor industrial applications.

As famously stated by Warren Buffet:

“Gold has no utility… “(Gold) gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head”

- Warren Buffet, 1998

It should also be noted that whilst Buffet did recently invest into a gold miner in Barrick Gold, this investment was made on the basis of cash flows and was not a result of a change in his view of the underlying asset.

When compared to another non-income bearing asset in Bitcoin, it also scores poorly.

Bitcoin is able to add value through enabling global remittances in a cheaper and faster manner relative to existing counterparties like Western Union, and acts as the base layer of a growing cryptocurrency ecosystem.

Bitcoin is also more divisible (good luck breaking your gold bar in half), portable (good luck transporting heavy gold with you as a store of wealth) and secure.

When it comes to gold’s role within portfolios, it reduces volatility (as previously mentioned), but in markets trending sideways or upwards, such a role is less important, and can be better achieved through other safe haven alternatives, like cash.

Technical

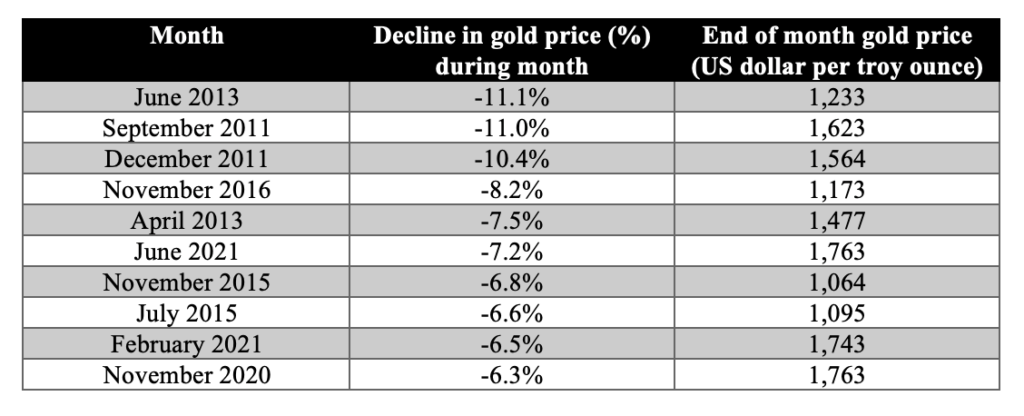

June was the 6th worst monthly return for gold in its history, with other top 10 months including February 2021 and November 2020.

Source: The Perth Mint, World Gold Council

One could follow the old adage to “buy when there’s blood in the streets”, however it is more prudent to look at the reason why valuations have slid.

Gold has continued to slide from its record high in August of last year of USD$2,065oz.

This record high was reached not only because of the pandemic and the subsequent risk off sentiment, but also due to unprecedented monetary stimulus and fiscal deficits (CARES Act).

Source: Bloomberg

Gold prices also surged higher in the first few months of 2021, driven by the election of President Joe Biden, and the forecasted increased levels of budget deficit spending.

Both of these catalysts were a result of increased inflationary expectations, and unprecedented levels of monetary and fiscal stimulus causing concern for the stability of the US dollar, which will be unlikely to occur again at the same magnitude, given the increasing difficulty to justify such a decision with economic recovery underway and no impending US election.

Sentiment

As global inoculation rates continue to increase, it seems as if the end is in sight.

Whilst many countries are undergoing the re-introduction of restrictions and lockdowns, most developed countries will soon approach herd immunity, where enough of their respective populations will either be vaccinated or possess the required anti-bodies to protect against COVID-19.

As such, gold is likely to continue facing a decline in demand for its safe haven properties.

Moreover, gold’s position as a safe haven asset has been called into question over the past year, with existing investors losing faith, and young investors preferring alternatives like Bitcoin.

After all, an asset’s safe haven status is predicated by a self-fulfilling cycle – if enough people stop perceiving gold as a safe haven, it will lose some, or all of its volatility reducing features it has historically enjoyed.

If younger generations continue to favour other safe haven assets, this could become a very real possibility in the coming decades as we undergo one of the largest generational wealth transfers in history from Baby Boomers to Millennials and Gen Z.

Correlation

Gold has always enjoyed a strong correlation with real yields, and as such, an outlook on interest rates and inflation will impact your investment decision making process when it comes to gold.

This correlation is due to the fact that gold is a non-income bearing asset – when real interest rates are higher, it becomes relatively more expensive to hold gold (given the opportunity cost of holding cash).

Similarly, if real interest rates are lower, it becomes relatively cheaper to hold gold, given the alternative is to earn a lower, or even a negative real return on your cash.

This is seen in the chart below, where the blue line (US 10-year inflation adjusted treasury yields (TIPS)) is negatively correlated to gold prices – as real rates decline, gold prices increase.

Source: Bloomberg

Given this correlation, the billion-dollar question for gold investors will be – where do real rates go from here?

With all major central banks adopting inflation targeting regimes, an increase in inflation (or projected inflation) will likely see a commensurate rise in interest rates (if allowed by central banks).

This effectively puts in a soft floor on further moves down for real rates, weakening the bull case for gold investors.

Moreover, markets expect current inflationary spikes to be transitory, with US break-even inflation rates currently implying an average inflation rate of 2.32% over the next 10 years.

Similarly, in Australia, the Australian Office of Financial Management (AOFM) priced A$7.5bn of Treasury Inflation Linked bonds maturing in 2032 on Tuesday at a real yield of -0.67%, implying an average inflation rate of 1.83% over the next 11 years.

Given the market expects no long-term increases in inflation, and the highly unlikely event of further rate cuts, it is more likely that we see an increase in real interest rates (which will be negative for gold valuations).

Such an event aligns with current expectations of inflation to be transitory, and for the Federal Reserve and other major central banks to begin tapering asset purchasing (QE) programs in the coming months, and to increase interest rates in the next 1-2 years.

Catalyst

Every rationalised investment thesis should have a catalyst – after all, why invest into a certain security/asset class if there is no reason why prices should increase.

Simply saying that gold is “cheap” and undervalued isn’t a strong enough thesis – there are likely fundamental, sentiment and technical based reasons why valuations are at their current levels.

For gold, the most likely catalysts for a move up in prices would be an increase in US budget deficits forecasts (which is unlikely), an increase in the US debt (potentially), and a 3rd or 4th wave of COVID through new variants.

These catalysts are yet to play out, but should they occur, gold valuations would likely move higher.

All That Glitters Is Gold?

Admittedly, the overall tone of this piece has been bearish on gold, however it is undeniable that it can have a place in utility maximising portfolios through its volatility reducing features.

However, a long term holding of gold should likely make up no more than 5% of a portfolio, given it has been historically proven that betting against markets in the long term will almost always result in subpar outcomes.

Given gold is non income bearing asset, an investment thesis is solely informed by the belief that someone will be willing to pay more for your gold in the future – otherwise known as the Greater Fools Theory – perfectly summarised by Warren Buffet:

“Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future.”

- Warren Buffet, 2012 Berkshire Hathaway annual letter

Therefore, when considering gold as a long-term investment, we have to consider whether investors will in fact be willing to pay more in the future.

You could make the argument that this demand will grow as budget deficits and monetary bases continue to increase.

However, younger generations will only increase their purchasing power and wealth over the coming years/decades, and if they maintain their positioning in alternative asset classes, who will be left to buy the gold?

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.