The renewable energy revolution is a topic we have covered in great length – and justifiably so.

These notes can be found below:

The need to transition to more renewable energy sources is a challenge which is paramount to the survival of the human race.

However, the transition requires more than just the diversion of investor fund flows from non-renewable energy producers.

It requires the development and acceptance of technologies able to efficiently supplant both existing energy needs, and also the growing energy needs of the world as we continually seek to improve our standards of living.

Whilst we might seek to ensure that the lights of our home are turned off when not in use, or to walk instead of driving when possible, it is inevitable that the world will continue to increase its energy usage – particularly within emerging market economies.

Investors have sought to attempt to provide a remedy to this solution through a greater focus on ESG investing, nevertheless it is possible that no amount of capital flows can ensure that wind and solar provide the baseload energy we require, given their relatively low energy density, and the extreme difficulty in storing large swathes of energy.

Moreover, societal rejection of nuclear power and its confusing exclusion on an ESG basis largely strikes out the only current viable efficient energy source to replace oil and gas.

As such, it is extremely likely that the oil and gas sector will continue to play a dominant role in our global economy, and potentially much more than what is currently being priced in.

In today’s note, we will cover the oil and gas sector, the factors which may drive a short-medium term bull market, and the ways in which you can gain exposure.

Supply Shortage in the Short Term

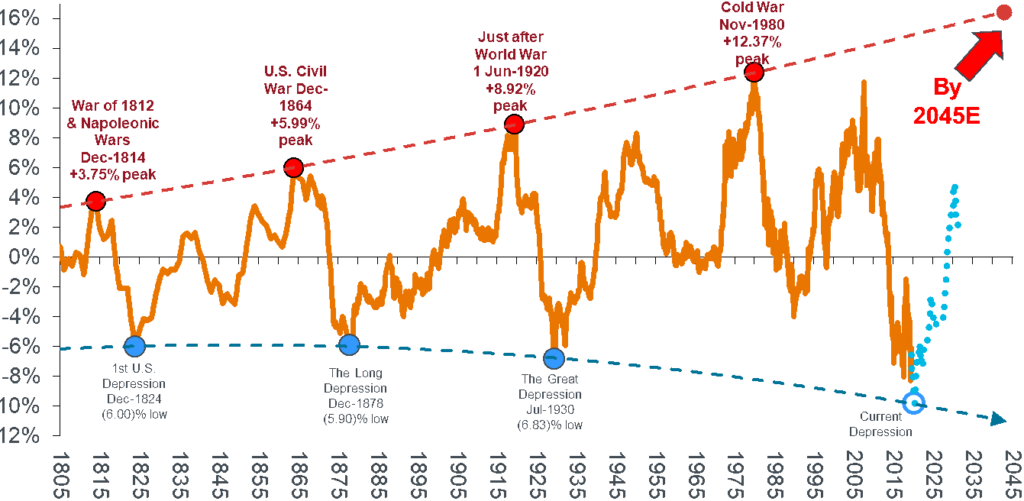

Commodities tend to operate in boom and bust cycles.

When prices are low, investors commit less capital to the industry, and the least efficient producers are taken offline.

Supply falls, but eventually, demand outpaces supply and prices begin to increase again.

As prices increase, producers are incentivised to explore new projects, and previously unprofitable mining becomes once again, profitable. Supply increases, and eventually outpaces demand, starting the cycle anew.

In the chart below of US commodity prices, we can see clear cycles of boom and bust, and we are potentially at the start of a new cycle.

US Commodity Prices

Source: Janus Henderson

For the oil and gas sector, this cycle of boom and bust has held true for many years, however as investors seek to attach greater weight to ESG, producers are unable to attain the same relative levels of funding as in previous cycles.

As such, they are currently unable to expand supply to take full advantage of recent moves higher in oil prices.

This will act as a structural boon for oil prices in the short term, given the inability of supply to keep pace with the increasing demand associated with economic re-opening.

Not As Easy As It Looks

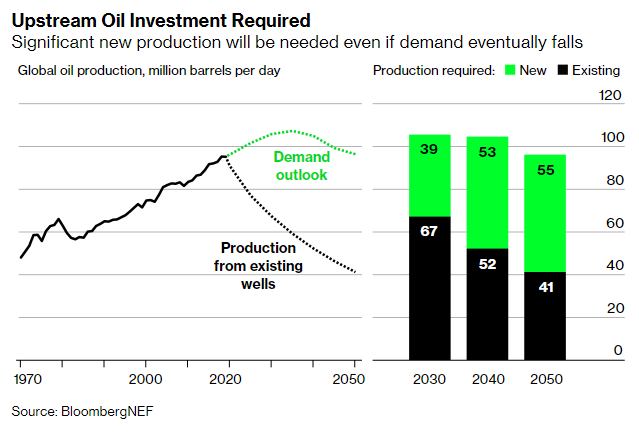

As much as some of us would like to phase out oil and gas in the coming decade, it will be almost impossible to do so given the lack of reliable and efficient alternatives.

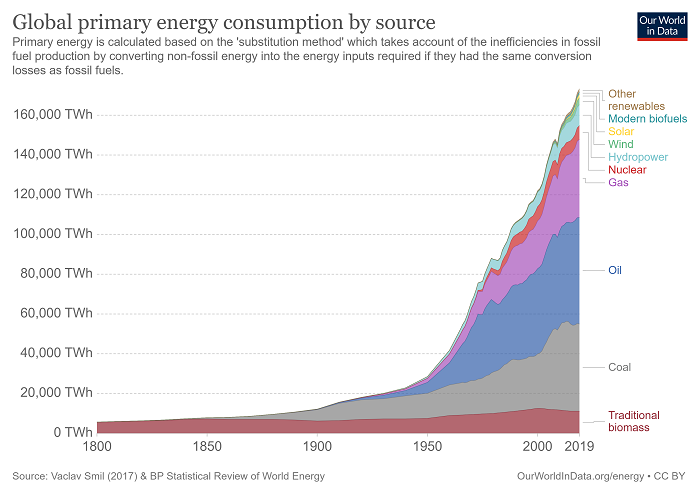

We like to think that as we phase out previous energy sources (like wood and coal), total usage levels should have fallen, but the reality is that they haven’t.

This is due to the fact that our absolute energy demands have continued to increase as populations grow and standards of living increase.

The reality is that new, and more efficient energy sources simply serve as an addition to our overall energy mix, and this trend will likely be the same story for oil and gas.

Moreover, the main issue with phasing out oil and gas is energy density.

We expect solar and wind energy to take up a large proportion of the energy produced by oil and gas, but they require much more land to produce the same amount of energy.

Both wind and solar are also not suitable to act as a base load power, given their reliance on suitable weather conditions, and the inability of current battery technology to store substantial amounts of energy over long periods of time.

The costs to produce wind and solar energy are also often ignored.

The turbines required to generate wind power need to be replaced often (adding to landfill), are currently produced using fossil fuels as a power source, and are made out of petrochemicals.

In Europe, 3,800 turbine blades will be sent to landfill each year until 2022, and in the US, 8,000 will be removed in the next four years (Bloomberg).

Solar power also has the same problems, having a long payback period and relying on weather.

In recent years, costs have come down significantly, making its use more feasible.

However, the reason costs have been able to come down is due to greater production out of China, where coal is used as a primary energy source.

They also carry the same problem as wind – where significant amounts of waste are generated once panels have reached the end of their productive lifetime.

Other energy sources like geothermal, hydro and nuclear offer greater energy density, but they are either constrained to certain geographical regions, or are not widely accepted by society as a suitable energy source.

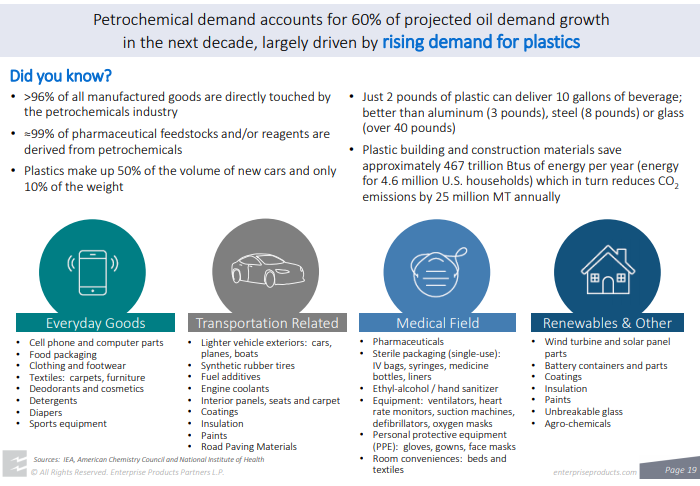

Petrochemicals have also become increasingly more important in society (despite our greatest efforts), given their unparalleled efficiency in manufacturing.

It is unlikely that we will be able to find an alternative in the short-medium term that can match their strength and durability.

As such, we are likely set up for oil and gas demand to continue to grow (instead of declining) over in the short-medium term, given the alternative is to stunt the growth of developing nations, and decline the standards of living of those in developed countries.

To ESG, Or to Not ESG

Investing into the oil and gas sector will remain unavailable to those investors with an active ESG filter, however for those who are less restricted with their universe, there are multiple options to gain exposure.

For a more diversified option, investors can select the Energy Select Sector SPDR ETF (NYSEARCA: XLE), which invests primarily into oil, gas, consumable fuels, and energy equipment /services.

Domestically, Oil Search (ASX: OSH) and Santos (ASX: STO) have agreed upon an AUD$21bn merger, making them the largest oil company on the ASX. The benefits for both parties are clear given the diversification in assets, with both stocks underperforming relative to benchmark oil prices in recent months due to a growing focus on ESG.

We haven’t touched on the impact of OPEC+ in this note, yet it likely serves as the single biggest impact on oil prices in the short-medium term and would subsequently impact upon the profitability of the aforementioned exposures.

In the past weeks, OPEC+ finally reached a deal to increase production by a total of 400,000 barrels a month, which will likely place some downward pressure on oil prices.

This outcome took a series of discussions, with issues primarily arising through the UAE voicing their grievances regarding the disproportionate impact they incurred during previous production cuts.

Whilst it is in the best interests of all OPEC+ members to maintain their control of the market, the threat of a disbandment of OPEC+ has become increasingly more likely.

For a more ESG friendly option, investors can gain exposure to the carbon capture space through Denbury (NYSE: DEN).

Carbon capture involves the collection and storage of CO2 before it is released into the atmosphere, following the burning of fossil fuels.

Given its reduction of the environmental impact of fossil fuels, it has been widely touted to play a key role in the worldwide journey towards zero emissions, with both the EU and the US investing heavily into the roll out of carbon capture solutions.

The Oil and Gas Dilemma

Whilst most would like the world to reach a point where we reduce, or remove fossil fuel use entirely, this is nothing more than a dream for the time being.

Existing technology simply can’t enable renewable energy sources to act as a base load source for most nations, with the only other real alternative of nuclear energy being rejected by most governments.

For investors, the growth of ESG investing offers an opportunity, where current share prices of oil companies are trading below their intrinsic value.

If ESG continues to grow in its influence, oil and gas companies could continue to be undervalued into perpetuity.

However, once you strip out all the noise, a share price should primarily be based off its discounted cash flows – something which isn’t likely to drop for oil and gas producers.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.