Adam Smith was widely regarded as the father of modern economics, with his work forming many of the key tenets of our global economy.

Smith believed that specialisation and the division of labour were the most important factors driving economic progression.

These two directives also referred to as comparative advantage, drove how our global economy was formed – where each country is now able to contribute a limited amount of exports, in return for a considerably larger variety of imports.

For us Australians, this means we are able to largely provide the world with commodities, education, and various financial and professional services, in return for everything one would require to maintain a comfortable lifestyle and functioning economy.

Specialisation and centralisation have also formed a key role in global capital markets, where only regulated exchanges and counterparties are able to facilitate the purchase and sale of assets.

These global capital markets have played a significant role in economic development around the world, through enabling trusted counterparties to efficiently transfer capital between those who possess it, and those who demand it.

However, in the process it has also engendered inequitable outcomes, where individual investors must constantly be at the liberty of the profit-seeking intentions of financial institutions – there is simply no other way.

Government bail outs, the sale of retail order flow, and high transaction costs are all things which we accept and justify, but are they really things which contribute to the betterment of society?

Until this point, parties within capital markets have been required to provide a combination of the following services:

- Custody

- Settlement/Clearing

- Trading

However, as blockchain technology has developed and gained more mainstream acceptance, the possibility of a more decentralised capital market has emerged – a model which is more efficient – governed by code, logic, and the simplistic forces of supply and demand.

Enter Decentralised Exchanges (DEX’s).

DEX’s offer a completely novel way in which we can buy and sell securitised assets. They act as a peer-to-peer marketplace, connecting buyers and sellers directly, reducing costs and increasing efficiencies through the removal of intermediaries.

As a follow up to our earlier note on the concept of DeFi, and Max’s piece earlier this week on centralised cryptocurrency exchanges, today we will discuss Decentralised Exchanges (DEX’s), and how they could revolutionise the way we buy and sell securities.

What Are Decentralised Exchanges?

DEX’s act as a platform where individuals can buy and sell assets from one another.

Unlike Centralised Exchanges (CEX’s), they don’t provide custody or settlement services, nor do they require account opening or AML/KYC processes.

This is due to the user themselves providing all of the ancillary services provided by capital markets – beyond simply matching and execution.

The user themselves never relinquishes control of their assets to a separate entity, until the point at which they transact, taking away counterparty risk and making DEX’s trustless (where one does not have to place trust in an intermediary, but only in the smart contract which facilitates execution).

Trades are matched and executed using smart contracts, which ensure that securities are always exchanged at their agreed upon price.

They are completely transparent, but also anonymous, in that one can see the addresses of all executed transactions, without revealing the identity of the person/s behind this address.

They are owned and operated entirely by the user, where control over updates to the respective protocols can be proposed by anyone, and are voted on by governance token holders.

These governance token holders have limited control over what changes can be made to the protocol, however given there is no counterparty risk (no custody), any impact from a detrimental change in code is confined to the governance token holders (given the value of the exchange would fall). Switching costs are next to 0, so users could simply pack up shop and move on should the change be disadvantageous to themselves.

There is no requirement for expensive management, development, or administration teams, given the pure simplicity of their function – providing a platform where users can buy/sell assets to one another, nothing more and nothing less.

Given the decentralised ownership structure, regulators have had a hard time on figuring out who to target – there is no single owner/operator to fine, and given the underlying code is open source, front end platforms can appear anywhere on the internet.

Comparing the function of DEX’s to centralised exchanges from earlier in the week:

| Function | Stock Market | Centralised Crytpo Exchange | Decentralised Crypto Exchange |

| Account Opening | Broker or Bank | Exchange | N/A |

| AML/KYC | Broker or Bank | Exchange | N/A |

| CUSTODY | Broker or Bank | Exchange | User |

| MARGIN | Broker or Bank | Exchange | Some Exchanges |

| ORDERING/TRADING | Broker | Exchange | User |

| MATCHING/EXECUTION | Exchange | Exchange | Exchange |

| CLEARING/SETTLEMENT | Intermediary | Exchange | User |

Source: Mason Stevens

The minor changes which are made to DEX’s are done solely with the intention of optimising customer experience, as opposed to the profit seeking activities their centralised counterparts must conduct in order to satisfy external shareholders and stakeholders.

They are more secure, in the removal of a central point of failure (an intermediary).

DEX’s are also permissionless – they are open to anyone, anywhere, and at any time, where your access is only determined by your possession of an internet connection.

How Do They Operate?

Decentralised exchanges can be split broadly into two categories:

- Order Book

- Automated Market Makers (AMM’s)

Order Book DEX’s are most akin to models we currently see in CEX’s and in stock markets.

Participants place in their orders at their relevant prices and are matched off when an opposing order comes in at the same price.

However, Order Book DEX platforms are not as popular as AMM’s. This is due to the fact that DEX’s have to operate directly with blockchains – a typical market maker in stock markets and CEX’s may place orders and remove these before they are filled. However, if operating directly with blockchains, each time one places an order (regardless of whether it is executed or not), they must pay a fee.

As a result, developers sought to create a new model better suited to the decentralised world – Automated Market Makers.

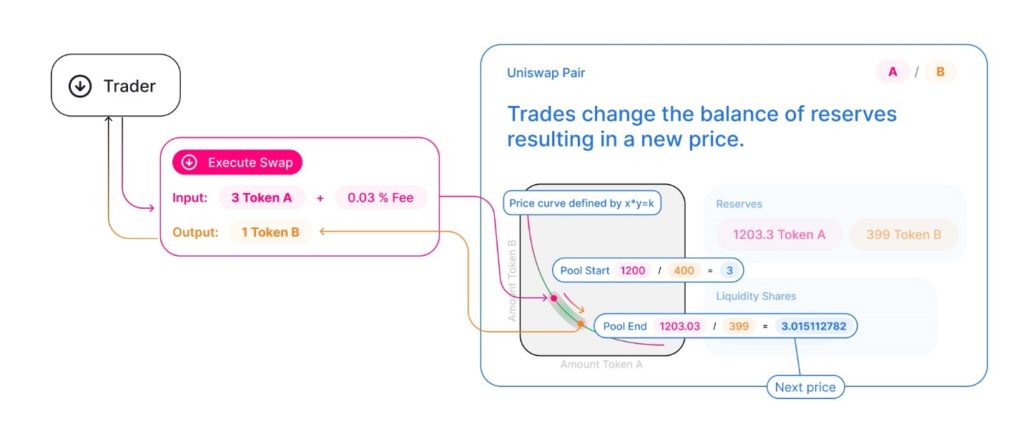

Automated Market Makers replace order books with liquidity pools – where algorithms set token prices based on the ratio of the two relevant tokens for which the pool is for (e.g. 1ETH=1000USDC). They are more efficient, faster and have less price slippage (more liquidity, less slippage).

Source: Uniswap

An example of a common liquidity pool would be USDC/ETH – USDC being a stablecoin pegged to the USD, and ETH being Ethereum. Such a pool could be found on one of the largest DeFi platforms – Uniswap.

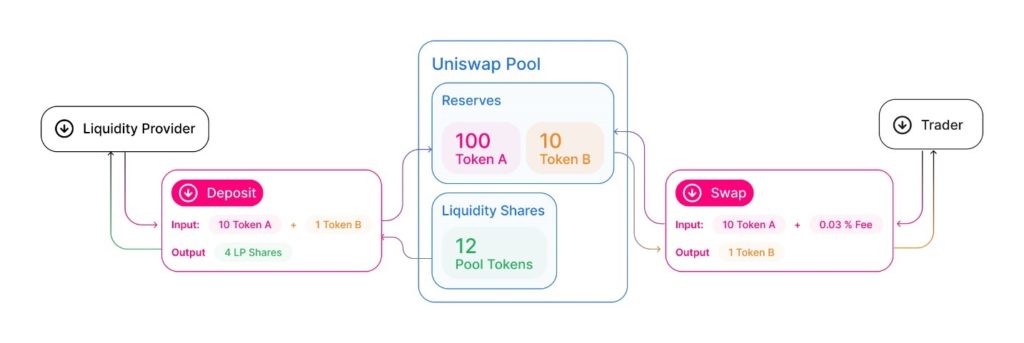

This liquidity pool is funded by liquidity providers (LP’s), whose funds are locked into these pools through smart contracts. These LP’s are incentivised to act as market makers and ensure that the ratio between the two tokens is as close as possible to the real-world price of ETH.

LP’s are rewarded with a Liquidity Provider Tokens (LPT), and the fees investors pay when trading their tokens through the liquidity pool – paid proportionately to the amount of liquidity the LP provides.

Source: Uniswap

If we take a step back to our earlier example, if I were to have $1,000 worth of ETH, I could either hold this ETH, and simply be exposed to the fluctuations in the underlying valuation-

OR, I could stake this amount in a liquidity pool, and earn a portion of its trading fees.

In order to become an LP, I would have to contribute an equal amount of both tokens in the liquidity pool, so if 1 ETH = 1000 USDC, I would have to contribute both 1 ETH and 1000 USDC. If the pool size was 10 ETH/10000 USDC, I would then get 10% of all trading fees.

Uniswap liquidity pools maintain these ratios through using the formula:

x*y=k, where x is asset 1, y is asset 2, and k is the total value.

So in this case the total pool value would be: 10*10,000 = 100,000

If ETH prices rise to 5,000 USDC, then pool would change its ratio to 4ETH/25,000USDC = 100,000

However, providing liquidity it is not without risk. When withdrawing, I am only entitled to my proportion of the pool (10%), which in this case would now be 0.4ETH/2,500USDC.

The total value of this would be $4,500 ($2,000 of ETH, and $2,500 of USDC) – a 250% gain since first investing. On top of this, I would have earnt 10% of all trading fees during my time in the pool.

However, if I simply held the ETH, it would be worth $5,000 (1 ETH = 5,000USDC), and I would also have my 1,000USDC – a 400% gain.

Much like a buy write strategy (selling call options), I want prices to remain stable, given I sacrifice a portion of my capital upside.

As you can see, the market maker model can now be decentralised, where anyone, regardless of their amount of capital or resources, can use their assets to functionally become a market maker and earn a return on their existing holdings.

The concept of liquidity pools can be tough to digest, so if you are interested in reading about the concept further, I would recommend this article.

A Pool Based Future?

We have always operated in capital markets where the presence of an intermediary is necessary – which has served us well over the years.

However, now that we have the technology, we can potentially get rid of some of these intermediaries, whilst simultaneously improving the user experience, increasing efficiency and reducing cost.

The concept of liquidity pools isn’t only confined to cryptocurrencies, with NFT’s also being traded in this manner (where you can own a portion of the NFT).

The same concept can apply to property once property deeds are able to be uploaded into blockchains – no excuses for millennials who complain of housing affordability, just buy 1/8th of an apartment!

As with most parts of the cryptocurrency industry, regulation is a growing concern, but we will cover this in a later note.

However, given their decentralised ownership structures, it is very difficult to ban altogether – it is merely a few lines of code, available for all to see and copy. Governments can alter tax laws, but the only real way to ban DEX’s would be by banning internet access for all, good luck with that…

Much like how stock markets have progressed from brokers yelling in trading pits to purely digital offerings, could decentralised exchanges be the next evolution for capital markets?

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.