It makes sense that our fixed income views are related to our currency outlook if the prevailing factors affecting both are:

- Government policy; both fiscal and monetary policy

- Inflation and inflation expectations

- COVID-19 variants and the influence infection rates have on both of the above

In this way, CY2022 may be similar to CY2021 in that variants of the coronavirus will cause fragility and uncertainty in financial markets and may elicit government policy response through continued fiscal deficit spending and support, and monetary policy accommodation with mobility restrictions reimplemented.

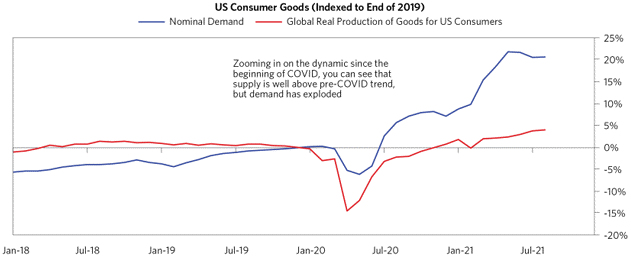

This has the circular effect that supply bottlenecks likely continue, sustaining higher inflation expectations as aggregate demand quickly rebounds, and aggregate supply takes longer to come back online.

Chart 1: US Demand versus Supply

Source: Bridgewater Associates

Inflation Expectations

Both inflation readings and measures of expected (future) inflation have spiked this year, as the market has moved passed the “transitory” (non-permanent) inflation rhetoric to price more sustained inflation pressure where some developed countries such as the US have not seen the quick rebound in employment that other countries – such as Australia – have seen.

While in the past two weeks inflation expectations have taken a back seat to the looming influence of risk-off investing, seeking safer havens in bond exposure (relative to riskier asset classes), we can’t dismiss that inflation will likely be the key influence on bond yields for CY2022, unless new COVID variants prove worse than expected and become the overwhelming influence on markets.

Government Policy

Though federal governments are not expected to continue such large deficit spending next year, they are still continuing with deficits which is a form of expansionary fiscal policy.

On top of which, most central banks are not yet tightening policy (contractionary policy), no, they’re slowly tapering the amount of easing they’re providing.

My favourite expression for this is that these banks are accelerating the car (economy) less and are yet to start pressing on the car’s brakes (tightening).

COVID-19

The coronavirus is continuing to impact our lives and financial markets, and likely to continue to do so to a varying degree as new variants emerge, especially if they prove to be more resilient against current vaccines.

Base Case for Fixed Income

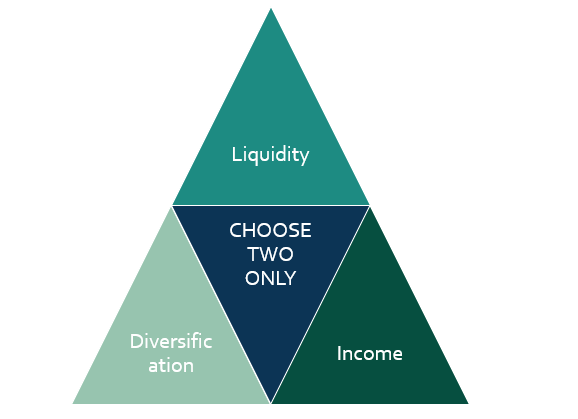

Fixed Income is still an asset class that seeks to provide three value-adds to portfolios:

- Liquidity

- Income

- Diversification benefits compared to equity risk premia

However, as we postulated in July, the “lower for longer” interest rate environment has brought about a trade-off where all three can’t be attained at the same levels seen in pre-GFC portfolios.

Nay, there is now a trade-off where the most liquid bonds (government bonds) tend to have lower income (sub 2% p.a.), where corporate bonds have higher income but relatively less liquidity and less diversification benefits.

Chart 2: Liquidity vs Diversification vs Income: Choose Two Only

Source: Mason Stevens

Also, where we can see that inflation and inflation expectations will stay elevated or sustained over the short to medium term, it’s likely that bonds ensue less diversification benefits overall, where they may sell-off (yields up) at the same time that equity markets lose their upwards momentum.

If this is the case, then long-only, duration laden fixed income exposures may not provide the levels of expected utility and diversification that investors hoped.

Focusing on Absolute Returns

As a fixed income manager ourselves, we must view ourselves as absolute return managers, where it quickly becomes obvious we should build portfolios that are largely driven by:

- carry (income),

- rolldown (selling shorter dated bonds to invest in a ladder of longer maturity bonds); and

- minimising drawdown risk.

This makes intuitive sense where government bond yields are in a bi-modular market, ebbing and flowing based on views of central bank tightening schedules, net supply of new bonds and inflation expectations.

Simply stated, 10y US or AU government bonds yielding either 1.50% or 2.25% could be justifiable today, depending on which of these regimes drives markets.

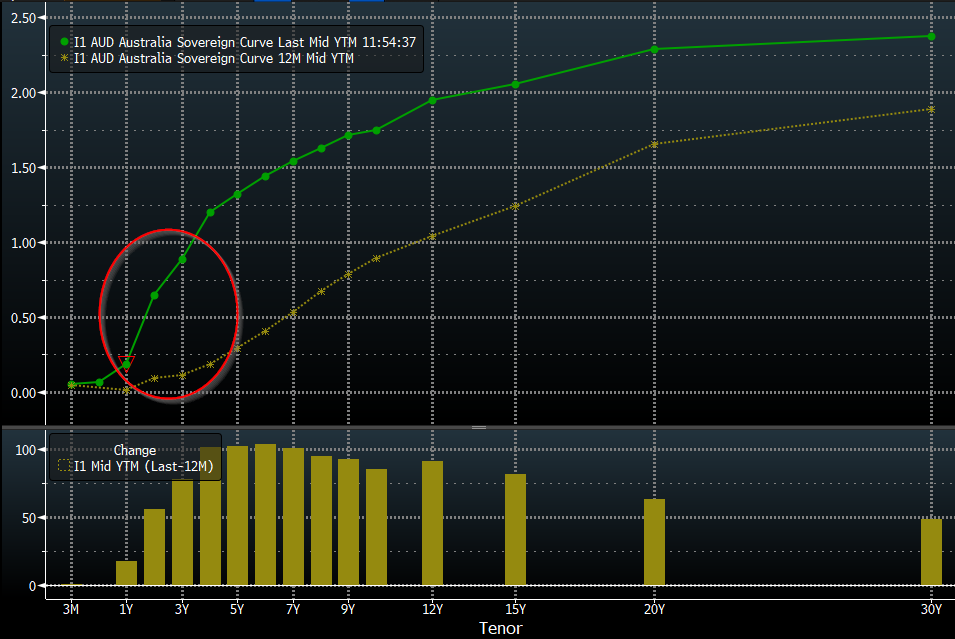

Based on the knowledge we possess, the expectation is that yields should slowly grind higher over the coming years based on the net supply element, which is why we seek to minimising losses by positioning with less than ~3 years of interest rate duration.

Moreover, we also get the upside from higher bond yields if/when they do rise.

Below is the year-on-year change in AU government bond yields from the yellow line up to the green line.

We note that the 1-2-3y part of the curve has seen a material change, though the impact on the capital price of bonds within this maturity profile has been far less impactful than compared to 5y+.

Chart 3: Australian Sovereign Yield Curve: 12 months ago (yellow) versus present (green)

Source: Bloomberg, as at 12:00pm AEDST, 30-Nov-2021

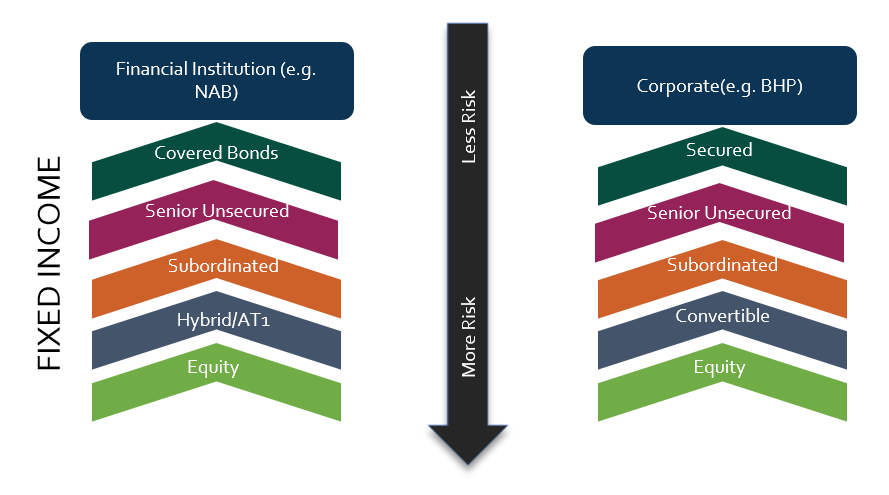

Opportunities in Credit Markets

While we are wary of the risks inherent in the current market structure, there are several areas of opportunity that we’ve identified:

- non-financial corporate bond issuance

- hybrid/AT1/convertible bonds

- subordinated bonds

- foreign currency bonds

Chart 4: Corporate Capital Structure

Source: Mason Stevens

Non-Financial Corporate Bonds

As our domestic banks have received large inflows of deposits, they haven’t needed to issue as many or as much corporate bonds.

This has seen non-financial corporate issuance become a larger portion of overall market activity, where new corporates enter the fixed income market for financing, often providing “new deal premiums” given they’re relatively new to the OTC bond market.

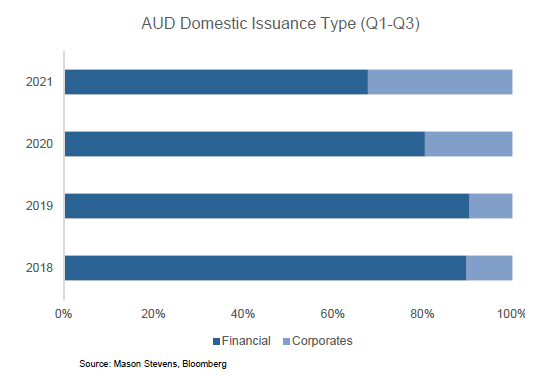

Chart 5: AUD Domestic Bond Issuance

The backdrop to this has been less corporate bond issues this year, at a time where more and more investors are allocating money to defensive assets such as fixed income and credit.

This underpinned a continued resilience of corporate credit spreads, where there was little to any widening of spreads despite higher government bond yields.

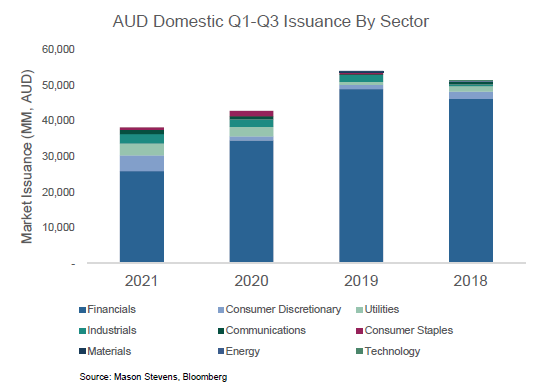

Chart 6: AUD Bond Issuance by Sector

This dynamic is likely to continue for the short to medium term and should see more corporates issue bonds to the OTC market, also assisting portfolio managers to diversify by industry.

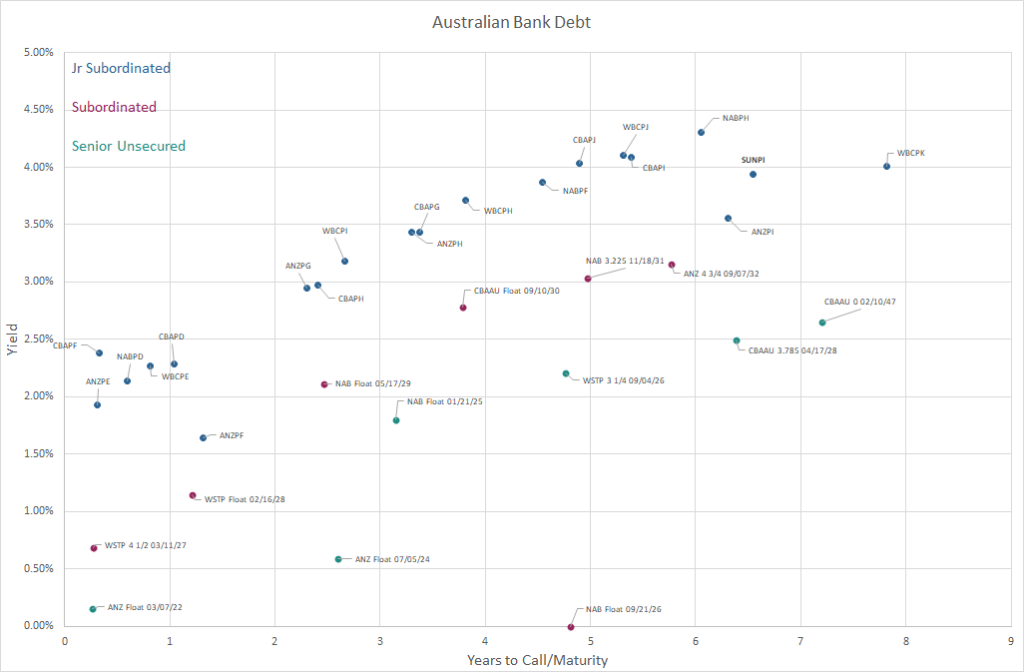

Hybrids, AT1s and Convertible Bonds

Additional Tier 1 Capital (AT1), more commonly known in the Australian fixed income landscape as “hybrids” have been and are likely to remain a staple investment for domestic investors for some time to come.

The higher distributions compared to senior or subordinated bond coupons are still greatly sought after by investment portfolios across the nation.

While the credit spreads (trading margins) of these bonds have compressed over the past two years, because of the increased expectation of central bank rate hikes, the forward-looking return expectation (Yield to Call) of these bonds has risen, where a YTC >4% p.a. can now be projected.

Chart 7: AU Senior unsecured (green) vs Subordinated (maroon) vs Hybrids (blue)

Source: Mason Stevens, Bloomberg, as at 30-Nov-2021

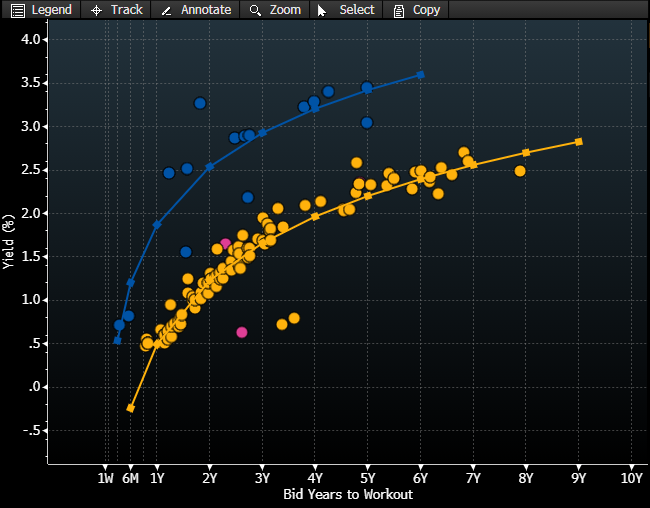

Subordinated Bonds

In a similar way, subordinated bond issuance is likely to remain a boon for bond investors as banks issue Tier-2 regulatory capital as a cheaper instrument compared to hybrids, fulfilling a particular niche of investment where bonds are generally much more liquid than hybrids and higher yielding than senior unsecured bonds of the same issuer, for less yield than hybrids but with higher credit ratings.

In the below chart, we compare AUD subordinated bank-issued bonds (blue) versus AUD senior unsecured bank-issued bonds (yellow and pink).

Chart 8: AUD Senior Unsecured (yellow and pink) compared with AUD Subordinated Bond Yields (blue)

Source: Bloomberg, as at 30-Nov-2021

We’re also seeing non-financial corporates enter the subordinated debt market with increasing consistency.

Most notably, Ampol Limited recently issued a subordinated and convertible bond in 60 non-call 5.33y format.

This means that the bond had a 60y term to maturity in 2081 but would be callable (redeemable) in 5.33 years in March 2027.

This type of structure was assessed by credit rating agency Moodys to provide 50% equity credit, which while is a debt issuance, the long tenor of the bond would only increase leverage by 50% of the bond’s value – hence, equity-like characteristics.

While Ampol and Scentre are recent Australian corporates to utilise this form of financing, insurers such as IAG and QBE have been issuing bonds like this for years already.

Foreign Currency Bonds

The gyrations of global government bonds create cross-market opportunities for those with access to global fixed income markets.

For example, issuers such as CBA and Westpac issue bonds in multiple currencies such as AUD, USD, GBP, EUR, where their credit risk is virtually the same for each bond.

Hypothetically if the USD or EUR bond was to trade at a credit spread above and beyond the AUD equivalent bonds plus any hedging costs, we would buy the foreign currency bond as a form of cross-market arbitrage.

Hypothetical example:

CBA AUD 5y trading at 2.0% p.a.

CBA USD 5y trading at 2.25% p.a.

AUD/USD hedging cost of 0.05%

>> we would execute the transaction to buy the CBA USD 5y bond with the currency hedge, and be compensated by a 0.20% positive yield differential

This will likely occur with more regularity in CY2022, where different central banks are on different trajectories to taper their QE programs or hike interest rates.

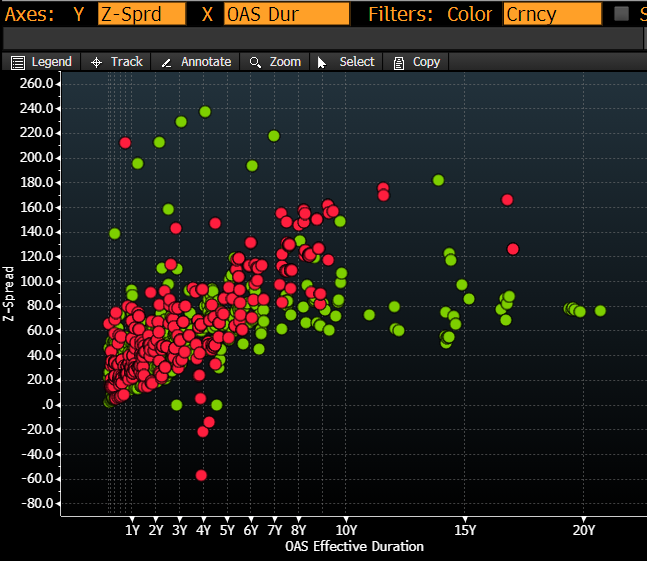

In fact, we’re already seeing this, where AUD (green) and USD (red) bonds are of similar yields, though the US corporate bonds are starting to move above AU comparables.

Chart 9: AUD (green) versus (USD) Corporate Bond Yields

Source: Bloomberg, as at 30-Nov-2021

In this regard, the US Fed, RBNZ, BoE and BoC are well ahead of our RBA and likely sees their bonds trade at higher yields than our own, more consistently.

Closing Remarks

Where our base case is for government bond yields to slowly grind higher based on increased net supply of bonds and more sustained inflation and inflation expectations, we seek relative defence by positioning ourselves in the short end of the yield curve.

This should provide less directionality based on the gyrations of these bond yields and the vying forces of safe-haven reactions (yields lower) versus net supply and tighter central bank policy (yields higher).

Moreover, we should focus on income generation, rolldown and minimising drawdown risk, whilst finding opportunities in the markets as they present themselves.

Lastly, we’ll remain open to taking on fixed-rate exposure, if/when bond yields move materially higher and if we expect them to resume the “lower for longer” long-term structural trend.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.