Most federal elections influence financial markets, owing to the sweeping changes often made to fiscal and sometimes monetary policy by newly elected political parties and their leaders.

Following the election of President Biden and the subsequent “Blue Wave” which buoyed US stock markets to all-time highs, investors would be well placed to keep up to date with upcoming federal elections in countries with large capital markets.

This fact is especially pertinent for elections over the next year, where economies are still facing the ill effects (pun intended) of COVID-19, giving governments a greater license to deploy more expansionary fiscal policy in the pursuit of economic recovery.

Out of the major developed market economies, the next cab off the rank is Japan, and as the only employee of Japanese heritage here at Mason Stevens, today I will take you through the upcoming election – the likely winner, the policies they will look to enact and the investment implications this may have on Japanese equities.

A Long but Strange History

Before taking a look at the election, we need to first take a step back and understand the recent history of Japanese politics.

Unlike most countries, federal elections in Japan have been relatively uncontested since the end of World War 2, with 1 party, the Liberal Democratic Party (LDP) holding power for an astonishing 59 of the past 66 years since its establishment.

During those 66 years, an offshoot of the LDP, the Democratic Party of Japan, also held office for 3 years, with the political positioning of this party being relatively similar, with almost all of its leaders having previously been a part of the LDP.

So, when it comes to election time, the focus has historically been on who will be elected the leader of the LDP, as opposed to the parties which they run against.

But why is it that 1 party can maintain dominance for such a long period of time?

The main reason behind the LDP’s dominance can be boiled down to political culture.

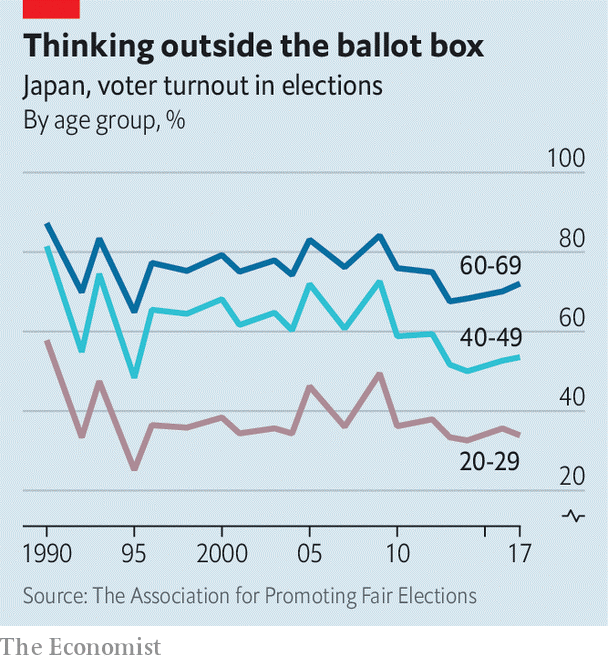

Japan is relatively uninterested in politics and subsequently has low voter turnout rates, averaging around 50-60% across all age brackets and scoring significantly lower in younger generations.

The LDP’s policies also cater towards the older generations, who are both greater in number (due to Japan’s ageing demographic profile) and have higher voter turnout rates.

So, if we know the LDP will likely win, why do we care?

The current leader and Prime Minister of Japan, Yoshihide Suga, who took over from Shinzo Abe after his retirement, was not given the opportunity to run again due to dwindling public support from his handling of the COVID-19 pandemic.

As a result, the LDP must elect its new leader (and likely Prime Minister), an internal process which will take place on the 29th of September, well before the general election on the 28th of November.

Who Will Lead the LDP?

The race for leadership of the LDP is effectively a 3-horse race between Taro Kono, Fumio Kishida, and Takaichi Sanae.

Kono has been endorsed by the outgoing Prime Minister Suga and will likely win with a survey conducted amongst economists giving him a 75% chance.

As the current Minister of Administrative Reform and Regulatory Reform, Kono has been riding a wave of popularity, having been in charge of Japan’s extensive and rapid COVID-19 vaccine rollout.

His primary policies include the succession and development of Abenomics, the continuation of large-scale fiscal spending, and accommodative monetary policy.

Most importantly, he has been critical of the BoJ’s 2% price target, which would likely mean that Japan remains within its ultra-low inflation environment in the coming years.

Moreover, Kono is pro-business, focusing on deregulating the economy which should see corporate profits rise.

However, when looking at what impact Kono could have on policy, it must be noted that Japan has one of the highest turnover rates for Prime Ministers in the world.

Since 1998, Japan has had 11 different Prime Ministers, each serving an average term of 2.1 years. However, when you take out Shinzo Abe’s term of 8 years, which was the longest in Japanese history, the average drops down to 1.5 years per Prime Minister.

This is a product of internal conflict between the many factions within the LDP, as well as the difficulty in maintaining the support of the public given the monumental task of emerging from the economic doldrums which Japan has been in for the past 30 years.

Therefore, given Kono’s term may be cut short, one of the more important decisions which may occur during his term will be his selection of a new BoJ governor – with Governor Kuroda’s term ending in April 2023.

Kono’s intentions to continue on with Abenomic’s should see a governor appointed who is supportive of maintaining the monetary policy accommodation which has boosted equity markets over the past years.

However, should he change tact in this policy area, his new appointment could have considerable ramifications for financial markets given the scale and importance of monetary policy operations in Japanese markets.

How Will This Sit with Markets?

The Nikkei has recently reached a 31-year high – surging since the start of September when it was announced that Suga would not be running as leader of the LDP in November’s general election.

Source: Bloomberg

This was a positive, as with Suga gone, the LDP has a greater chance of winning the election and gaining more seats in the lower house.

Kono’s likely appointment has been viewed as a positive for Japanese equity markets, given the benefits which will be seen in corporate profits through his pro-business agenda, with a survey conducted by Nomura finding that 33% of investors expect a movement of 2% or more upon election, 28% expecting a move between 0.5%-2.0%, and 36% expecting the index to trade within its current range.

However, in the improbable event that Kono is not elected leader of the LDP, the other 3 candidates all have similar focuses on economic normalisation in the near term, as Japan continues to recover from the COVID-19 pandemic.

Much like Australia, Japan initially lagged the world in its vaccination rollout and still maintains restrictions in Tokyo, with the removal of these restrictions likely set to spawn another “re-opening trade”.

Japanese equities also offer a valuable source of diversification in investor portfolios, both through the lower correlations to US equities, and the safe-haven status of the Yen.

Therefore, an investment into Japanese equities at this time can be justified by three factors:

- Economic tailwinds with the election of Kono, both in the continuation of economic normalisation policies, and pro-business reform

- Economic re-opening as vaccination rates increase, and restrictions ease

- Unique point of diversification in investor portfolios, through lower correlations to US markets, and the safe haven status of the Yen

To gain broad exposure, there are two currency hedged ETF options on the ASX – the Betashares Japan ETF (ASX: HJPN) and the iShares MSCI Japan ETF (ASX: IJP).

To gain the correlative currency benefits of the Yen and gain more direct exposures, investors could select one or more of the 5 securities which Berkshire Hathaway acquired 5% holdings of in Q3 2020:

- Itochu (JP: 8001)

- Mitsubishi (JP: 8058)

- Mitsui (JP: 8031)

- Sumitmo (JP: 8053)

- Marubeni (JP: 8002)

The Land of the Rising Economy?

Despite the upcoming election and its associated changes in policy, Japan will likely remain in its current economic state of low growth and low inflation for the coming years.

This is due to the scale of the issues which plague Japan – being an ageing demographic profile and low consumption rates.

The one-party dominance of the LDP, and the weakness in political culture has restricted the brave decisions required to return Japan to its former glory – after all, why make potentially controversial decisions when your re-election is almost assured.

In order to see an improvement in political culture and subsequently overall voter turnout rates, we would first have to see a shift in Japanese culture as a whole – where conformity is currently encouraged, stifling any chance of thinking out of the box.

Radical policy change will have to wait until Japanese culture is more accepting of differing views, a change made increasingly more likely as younger generations continue to be exposed to more western influences.

However, in the short-medium term, this doesn’t make Japanese equities an unattractive investment proposition – where ultra-low interest rate settings have set up an environment conducive to increased corporate profits, in addition to the diversifying benefits it carries.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.