Over the past few months, it has seemed that there have only been three things in life which have been certain: birth, death and taxes in the form of inflation that erodes purchasing power.

With this in mind, we’ve begun to revisit the real asset space, where in recent weeks, we’ve explored several potential exposures, as well as the role of gold within investor portfolios.

Central to our missives has been our view that we are in the midst of a paradigm shift within the investment landscape – where the typical 60/40 portfolio which has enjoyed success over the past decade is unlikely to be able to continue to generate strong, real returns.

The deflationary economic conditions and expansionary monetary policy which promoted multiple expansion and long duration exposures over the past decade are set to be replaced by less accommodative monetary policy, and untethered inflation – drying up the prospects of positive real returns for certain sectors of the market over the coming years.

As the sands shift beneath our feet, we need to be cognisant of how investment strategies must evolve, and the elevated importance of diversified portfolios and uncorrelated assets within volatile markets.

One of the simplest and potentially one of the best ways to gain exposure within the real asset space is through soft commodities – which are defined as those commodities which are grown, and not mined or extracted.

They offer a rare combination of having low correlations to other industries/asset classes, and relatively inelastic demand curves – a perfect exposure which has intrinsic immunities to volatility and inflation.

The Value of Soft Commodities

One of the only things which bands together the majority of living organisms on earth is the need for food.

For humans, we can’t live without it.

It serves as a vital source of sustenance, acting as one of first needs within Maslow’s Hierarchy of Needs, but also acts as an immense source of joy for many, being a foundational element within many cultures around the world.

Source: Maslow, A.H. (1943). “A Theory of Human Motivation”.

Given these facts, soft commodity demand curves are relatively inelastic – meaning that buyers of soft commodities are relatively price insensitive (a very important concept within current inflationary environments for producers).

Disrupted Supply Chains

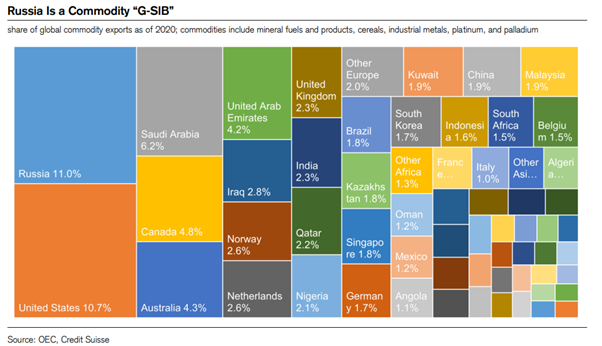

A few weeks ago we wrote about the potential of an impending global hunger crisis, borne from Russia’s crucial role in global agricultural supply chains from end to end, through its provision of energy, fertilisers and agricultural commodities.

Since that note on 4/April, not much has changed – fertiliser prices still remain extremely elevated, commodity prices have continued to rise, and there still seems to be no end in sight for both the Russia-Ukraine conflict, and its related global economic sanctions.

Whilst we can be constructive on agriculture over the short-medium term as the supply chain attempts to make up lost ground, what this saga has demonstrated is the lack of any alternative to make up the calorific deficit left by Russia’s economic sanctions.

In other consumer markets, there may be similar products which satisfy temporary shortfalls in supply, though when it comes to soft commodities – alternatives are few and far between, where a reduction in overall demand may simply just reflect a humanitarian crisis.

Scalable, and more environmentally friendly means of harvesting soft commodities are decades away – though they hold great potential for future generations, with technologies such as starch synthesisers having the ability to create starch through the conversion of carbon dioxide at rates faster than conventional farming methods, and “cultivated” (lab grown) meats showing promise through their ability to replicate and even improve upon the taste and nutritional properties of their living counterparts, without the environmental damage.

Correlation Correlation Correlation

So far, we’ve established some crucial characteristics of soft commodities – their relatively inelastic demand and the lack of any alternative in the coming decades.

As an investment which has some degree of intrinsic protection against inflation, we can give soft commodities a tick.

But how does it trade against broader market indices? Does it provide an element of diversification?

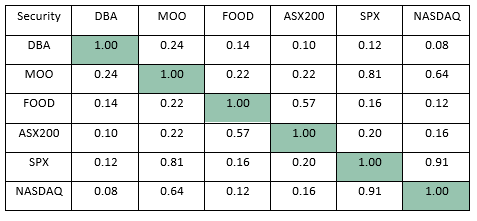

For the purposes of this correlation analysis, we used the below ETFs which represent the main soft commodity ETFs:

- Invesco DB Agriculture Fund (DBA: NYSEARCA) – invests directly into a range of commodity futures, including sugar, coffee, corn, wheat, live cattle, cocoa

- VanEck Agribusiness ETF (MOO: NYSEARCA) – invests into ~50 global companies across; chemicals and fertilisers, animal health, seeds, irrigation equipment, machinery, aquaculture and fishing, livestock and cultivation

- BetaShares Global Agriculture Companies ETF (Hedged) (FOOD: ASX) – invests into ~70 global companies across similar sectors as MOO, though with a higher weighting to packaged foods and meats.

Table 1: 2-Year Daily Correlation of Soft Commodity ETF’s Against Market Indices

Source: Bloomberg, as at 28/4/22

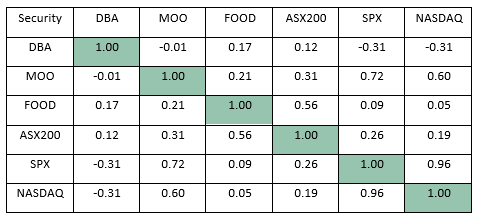

Table 2: 3-Month Daily Correlation of Soft Commodity ETF’s Against Market Indices

Source: Bloomberg, as at 28/4/22

As evidenced in the tables above, all three soft commodity ETF’s display low-medium levels of correlation to their respective indices, where a trend towards declining correlations is evidenced through lower correlations in the 3-month table.

This decline in correlation can be attributed to the impact of rising bond yields, and higher than expected inflation, which has driven a bifurcation in outcomes between these securities and their respective market indices.

On a performance basis, all three ETFs have outperformed over the past 6 months, highlighted in the chart below (soft commodity ETFs as the yellow, green and red dotted lines).

Chart 1: 6-Month Performance of Soft Commodity ETFs vs Major Stock Indices

Source: Bloomberg, as at 28/4/22

While these securities will always deliver some degree of correlation given their liquidity status (being purchased and sold in line with other liquid assets), unlisted alternatives such as the AAM Diversified Agriculture Fund can offer more uncorrelated return profiles.

The Fund, available only to wholesale investors on the Mason Stevens platform, invests into geographic and sector diverse, agricultural real estate assets, as well as having significant exposure to Australian poultry assets.

For further details, please reach out to your Mason Stevens representative.

Soft Commodity Exposures

We’ve touched briefly on the performance and composition of the main soft commodity ETFs, though there are certain nuances to each exposure which must be noted.

As shown in the previous correlation table, FOOD and MOO display medium – high levels of correlation to their indexes – a product of the diversified nature of their holdings.

This is something which is unlikely to ever go away, where both ETF’s would be dragged down with the rest of the market in a “delta 1” (or “correlation 1”) market selloff.

Moreover, the negative effects of inflation will likely have greater flow through to both FOOD and MOO, compared to direct commodity exposures, given the inability of some producers to pass on increased costs in full.

When looking through the lens of performance and correlation, DBA may seem to be the most appropriate exposure, though caution must be given to the underlying structure of the ETF.

Like all futures based ETFs, DBA serves as a relatively inefficient way to gain direct exposure to commodity prices – where the cost of rolling futures contracts, inefficiencies of futures markets, and the forces of contango and backwardation leave a situation where investors will almost always underperform the underlying commodity price.

Given the complexity of such an instrument, one should take extra caution in understanding the structure of the ETF and clearly defining their objectives before choosing to invest.

Dinner Time

Despite their integral nature to our day to day lives, soft commodity exposures have rarely played more than a bit-part role in investor portfolios.

It is our view that their role in investor portfolios will continue to grow, as the global investment landscape evolves and favours assets which are able to generate real returns.

As an area of the market which offers uncorrelated returns, they can act as a valuable source of diversification, and avoid the concentration risk which has decimated the portfolios of many over the past few months.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.