Today marks the 34th day since Russia’s invasion of Ukraine, where both sides have entered into a protracted stage of conflict where neither side has shown signs of being able to definitively secure victory in the short term.

In the month since our last update on the Russia-Ukraine conflict, little has changed militarily, where Russia has still been unable to seize control of Ukraine’s two largest cities – Kyiv and Kharkiv.

Whilst both cities have been bombed heavily, incurring significant civilian casualties, Russian forces underestimated the staunch resistance which they’ve faced from Ukrainian forces.

As expected, Russia has seen success in the Donbas region, as well as within much of southern Ukraine, where the majority of the coastline with the Black Sea is now under Russian control.

Over this period, Russia has been crippled by economic sanctions imposed by Western nations, including a partial removal from the SWIFT payments system, seizure of the foreign currency reserves of the Russian central bank, and a myriad of restrictions on Russian exports and the assets of Russian oligarchs and notable political figures.

Such moves have forced Russia into finding more creative means of financing its economy outside of the vacuum of economic sanctions, floating the idea that oil and gas trades can be facilitated through Russian rubles, the local currencies of ‘friendly’ nations, and even potentially in Bitcoin.

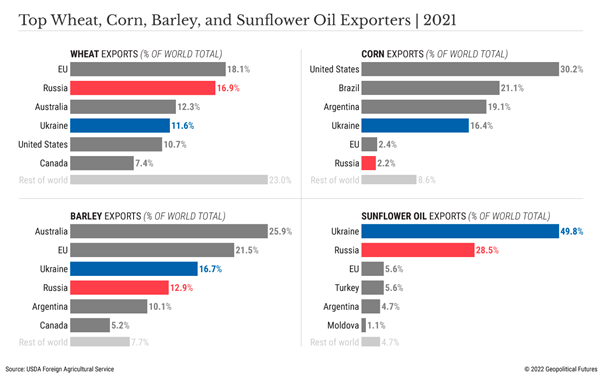

The conflict has also begun to stir up the beginnings of a global food crisis, given the weight which Russia and Ukraine hold in global grain and fertiliser exports.

Source: USDA Foreign Agricultural Service, Geopolitical Futures

Russia and Ukraine are currently in the midst of the ever-important spring planting seasons, where conflict and fear of an inability to export grains has resulted in little planting activity within both nations.

The implications of these proceedings within the global food supply chain are far reaching, complex and befitting of its own note, so we won’t delve into this issue any further today.

Global Markets Continue to Be Driven by Geopolitical Tensions

Global financial markets have continued to be influenced by updates regarding the Russia-Ukraine conflict, however, the narrative has shown signs of exhaustion in recent days as volatility has begun to decline.

Chart 1: 1-Month Performance of the VIX Index

Source: Bloomberg, as at 29/3/22

Markets have attempted to price in the economic impacts of sanctions imposed on Russia, where fears of a recession have been propagated by continually flattening yield curves which have been begun to near levels of inversion.

Fears have been centred around Russia’s importance within energy markets, where restrictions in their supply of oil and natural gas to the global economy could see higher prices and an eventual slowdown in economic activity.

Whilst the narrative has begun to near exhaustion in its current form, it doesn’t necessarily mean that we will start to see appreciations in risk asset valuations.

Markets have been distracted from the detrimental impacts of upcoming Quantitative Tightening (QT) activities from the Fed, which should likely see further moves down in risk assets over the medium term as liquidity is withdrawn from capital markets.

Any further worsening in the conflict, or a breakdown in peace talks will also likely see further moves lower, applying increased pressure to energy and other agricultural markets which Russia and Ukraine play large roles within.

How Will This End?

Whilst the prospect of nuclear war has become a non-zero probability, it is futile to focus on such an event when evaluating portfolio positioning given the devastating impacts it would have.

After all, if worldwide nuclear war begun, your asset allocation would be the last thing you would be concerned about.

Instead, it is likely that we see the conflict proceed in one of four ways.

Peace deals and Ukrainian neutrality

Over the past few days, President Zelenskyy has stated that his government would be prepared to discuss adopting a neutral status as part of a peace deal with Russia (meaning they will not ally themselves with other countries militarily).

This would have to be put to a referendum in Ukraine and would require security guarantees from Russia for it to come into fruition.

Ukrainian officials have been adamant that such a deal would not involve forgoing any territory, although they have also stated that they will not try and retake the Donbas or Crimea by force.

Whilst such a deal might seem in reach, it is likely that neither side will be willing to give up concessions so early in the conflict, especially considering that both sides likely believe that they can achieve their objectives without needing a deal.

Partial Russian victory through taking official control of the Donbas, Crimea and Southern Ukraine

As time has gone on, the probability of a nationwide victory for Russia has continued to decline, where it has become more and more likely that the conflict will end with Russia taking official control of the Donbas and Crimea, and part of southern Ukraine.

This shift in focus has already begun to materialise in Russia’s military strategy, where they have stated that they will focus efforts on taking full control of the Donbas region, enabling them to move one step closer to creating a land bridge between Russia and Crimea.

Prior to the conflict, both the Donbas and Crimea were under the de facto control of Russia, where the Donbas was governed by two puppet separatist governments armed and assisted by the Moscow, and the Crimea having been previously annexed by Russia in 2014.

Whilst such an accomplishment by Russian forces would fall far short of their initial intentions to de-militarise and occupy the entirety of Ukraine, they would still likely be subject to heavy economic sanctions should they pursue this new strategy.

Russian Victory

Whilst Russia has been unable to take control of Kyiv and other major cities, there is still an outside chance that they are able to be successful in their initial goals of occupying and demilitarising Ukraine.

On paper, they boast a stronger military force which was widely expected to be able to capture Kyiv within days.

To date, poor military intelligence and strategy has hindered their ability to make meaningful progress, where a change in approach will likely be required to take control of Ukraine.

Should they change tact and mobilise more forces, they may be able to make more inroads in taking control of major cities and outlast Ukrainian resistance.

At this point, the severity of sanctions imposed on Russia may mean that they believe they are past the point of no return.

Invasion of bordering countries (Georgia, Moldova)

Russia’s overarching intention to ‘get the band back together’ and reunite the USSR has stoked fears that invasion may spill over into Moldova and Georgia.

Both nations possess Russian backed breakaway regions – the Trans-Dniester in Moldova, and the South Ossetia and Abkhazia in Georgia, which opens up the potential for a similar style of invasion as to what has occurred in the Donbas.

Most imminently could be an invasion of Moldova, as Russian forces sweep westward toward the nearby Ukrainian port city of Odessa.

Source: Geopolitical Futures

Both nations are split by pro-EU and pro-Russia factions, and are also heavily dependent on Russia as a trade partner, and as their primary energy provider.

As a result, they will have to tread the fine line of maintaining sovereignty, without upsetting the overall health of their economies.

Difficult to Predict

Given the lack of accurate information and the gamesmanship of modern warfare, it is incredibly difficult to accurately forecast how this conflict will eventuate.

On one hand, the conflict could have detrimental impacts on global economic and inflationary outlooks over the coming years, given the disruptions caused within energy and agricultural markets.

On the other hand, the conflict could end in the coming weeks, and global supply chains could soon return to a level of relative normality.

For many investors, a lack of insight and “edge” in predicting geopolitical outcomes will mean that this conflict should not be a primary reason for investing into certain securities/asset classes (outside of for hedging purposes).

What should and will likely take up more attention of investors in the coming months will be the timing and scale of QT activities, which should be revealed by the Fed in their next meeting, and by other global central banks in forthcoming meetings.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.