Yesterday on 6 July 2021, the monthly RBA Monetary Policy meeting took place where the Board presided over the current monetary policy calibration within Australia.

If you would like to read the full Statement, you can do so here.

The meeting was flagged in advance as being important, where several RBA Board members indicated that this would be the meeting where they decided whether to extend some or all of the ultra-accommodative policies of March 2020 – whether they were still commensurate with creating the financial environment to achieve their three goals.

#1 the stability of the currency of Australia

#2 the maintenance of full employment in Australia

#3 the economic prosperity and welfare of the people of Australia.

Where the RBA has maintained an inflation targeting framework – seeking annualised increases in the prices of goods and services within Australia at 2-3% p.a., over the medium term.

Policy Changes Made

In yesterday’s meeting, the RBA made several changes which have specific flow-on effects to financial markets and the broader economy.

1/ Retained the April 2024 Commonwealth government bond’s yield target (“peg”) at 0.10% and did not seek to extend the yield target to the November 2024 bond.

2/ Will continue purchasing government issued bonds at a rate of $4 billion AUD per week until at least mid-November. This being a change from the previous six-monthly cycles of buying $100 billion of securities in a 6-month period.

3/ Maintained the Overnight Cash rate (OCR) at 0.10%, which was not expected to have changed.

Yield Curve Control

In our analysis of the Monetary Policy Decision, we should start with the nuanced change with regard to the RBA’s “Yield Curve Control” (YCC) policy.

This was brought in during March 2020, as a form of forward guidance, whereby pegging bond yields (interest rates) at the same level as the OCR, the Bank was signalling to the market that the cash rate would not be changing for at least three years, while the peg was in place.

Now that the RBA has elected not to extend the YCC from April 2024 to November 2024, they’re signalling that economic conditions may be correct between April to November 2024 (or thereafter) to change the OCR from 0.10%.

The market is interpreting that this may see interest rate hikes, increasing the OCR from 0.10% back to 0.25%, and then again to 0.50% in 2024 calendar year.

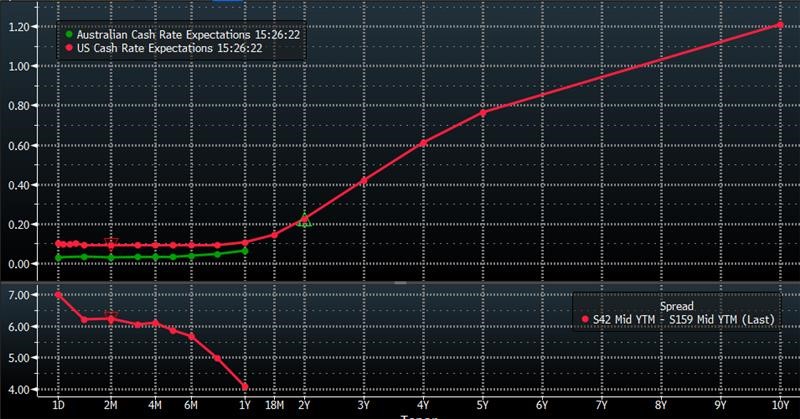

The below chart depicts market cash rate projections – using cash derivative called Overnight Index Swaps (OIS) as our proxy – comparing Australian cash rate forecasts (green line) with US cash rate projections (red line), where they are both intricately linked.

Looking at the market pricing, “lift off” should occur ~2-3 years from now.

Source: Bloomberg

Also, this reverts the RBA from calendar-based guidance – targeting a specific period of time through the April 2024 interest rate peg – to data-based guidance, where they will manipulate the OCR inline with the market data, such as inflation, unemployment and economic growth.

Quantitative Easing

In regard to point 2/, the RBA has also adopted a more flexible approach to their asset purchase program, also called “quantitative easing” (QE).

Also a remnant of March 2020, the RBA’s QE program was established to buy government issued bonds within secondary bond markets.

In H2 2020, they decided to formalise the program by targeting purchase of $100 billion AUD of government issued bonds, to be bought over a six month period, where this program was then extended in March for another 6 months to September this year.

Hence, the RBA is not continuing these 6 monthly programs at this point in time, where they’re more simply buying $4 billion AUD of government issued bonds per week, to continue until mid November (2.5 months after the completion of the latest 6 month program).

We interpret this in two ways:

Firstly, the RBA is continuing the same amount of support for financial markets and will be doing so for at least another 4 months. This means they believe the Australian economy still requires the recession level of stimulus that was required last year, during a period of extreme uncertainty.

Secondly, they will likely review the amount of QE in September or October Policy meetings, and revise whether the amount if still appropriate, and taper it to a lower level if suitable.

This seems to coincidently align with other central bank timetables for tapering their QE programs – probably not coincidence at all! – such as the US Federal Reserve, European Central Bank (ECB) and Bank of England (BoE).

Path of interest Rates

The RBA’s adaptation of domestic monetary policy is certainly not a tightening of policy.

To use a car as our metaphor:

It’s the RBA taking their foot off the accelerator slightly, reducing their forward momentum and growing policy support, rather than them applying the brakes and reducing speed (tightening policy).

As such, RBA policy is still very accommodative during 2021 and likely most of 2022, and it won’t be until at least 2024 where they potentially see conditions are being correct to increase the OCR from 0.10%, where QE has been suitably tapered already.

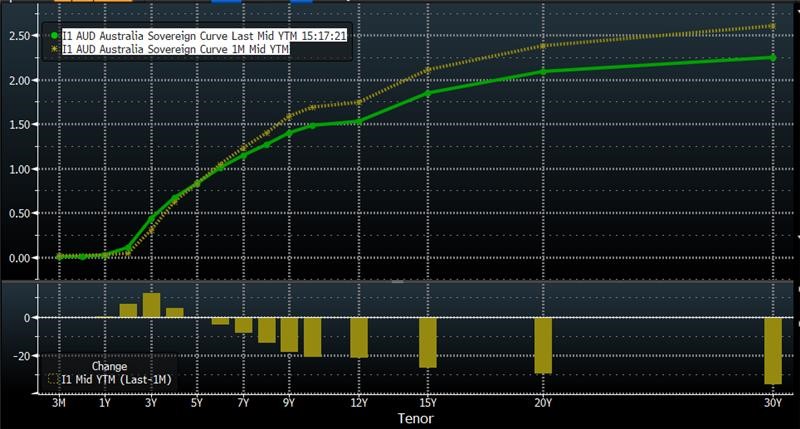

In the below chart:

- Green line is our current government bond yield curve;

- Yellow line was the yield curve one months ago, where longer-term yields were higher, but short to medium term yields slightly lower after the RBA announcement

Source: Bloomberg

Therefore, the RBA is maintaining the current “lower for longer” interest rate policy that is supportive of economic growth, corporate earnings and low borrowing costs, which they see as vital for seeing employment rise and a tight labour market, and inflationary pressures build.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.