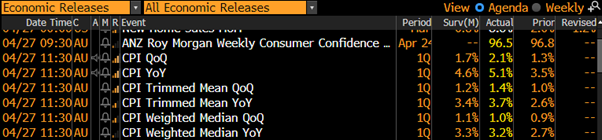

The ABS published our domestic CPI data for Q1 2022 yesterday at 11:30am AEST and the result was an upside surprise, where inflation pressures surged above consensus expectations in Q1.

The result was strong, where headline CPI rose 2.1% for the quarter, taking the y/y rate to 5.1%.

Trimmed mean, the RBA’s preferred measure because it removes more volatile items that tend to be less effected by monetary policy, rose 1.4% q/q and hence, 3.7% y/y.

Source: Bloomberg

Most importantly for the market reaction, trimmed mean at 1.4% q/q is well above the RBA’s forecast of 0.8% q/q, published in their February Statement of Monetary Policy.

This result shows that inflation is not only materially above their forecast, but also accelerating higher, where the market is looking for action through tighter policy to remove the current emergency levels of stimulus.

Details of the Inflation Print

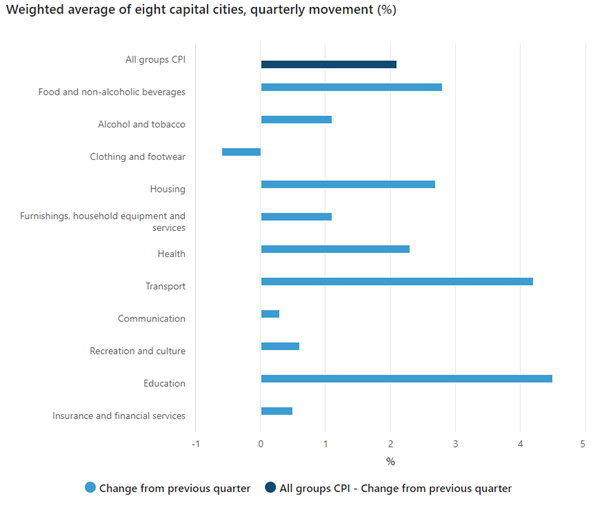

Inflationary pressure was broad across the board, where only clothing/footwear saw price decreases – every other component rose during the quarter.

Also, the components that represent the largest part of the consumer price index saw some of the largest increases.

For example, healthcare +2.3%, transport +4.2%, education +4.5%, housing +2.7%, food and beverages +2.8% [all figures q/q].

So not only were these the largest increases, they have the highest weighting to the index and contributed the most to the result.

Source: Australian Bureau of Statistics

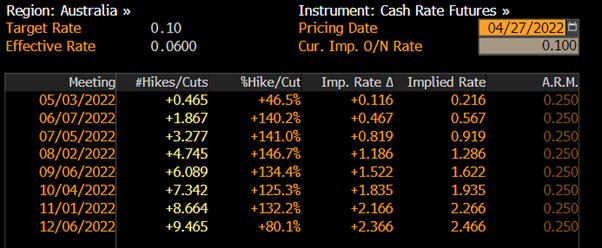

RBA Cash Rate Pricing

Market pricing for the RBA has moved higher, implying a 2.47% cash rate by year end (2nd column from the right, below).

Source: Bloomberg, 27 April 2022

While we wrote this note, the pricing was moving around as within ten minutes, that year-end cash rate was showing 2.89%, an over-reaction to the result, and hence, there’s potential that pricing is changed by tomorrow morning when this note is published.

However, the market has been consistent in that the year-end cash rate is now forecast to be >2.0% by year end, with >1.9% of rate hikes between then and now, where lift-off is either in May or June.

The nuance here is that the current RBA cash rate is 0.1% p.a., where there’s a general assumption that the RBA will seek to get back to 0.25% increments at some point.

Some forecasters are proposing the RBA raises the cash rate 0.15% in May to 0.25%, whereas we’re of the view they may raise 0.4% in June to get to a 0.5% cash rate.

The impact is a technicality, but worth being aware of.

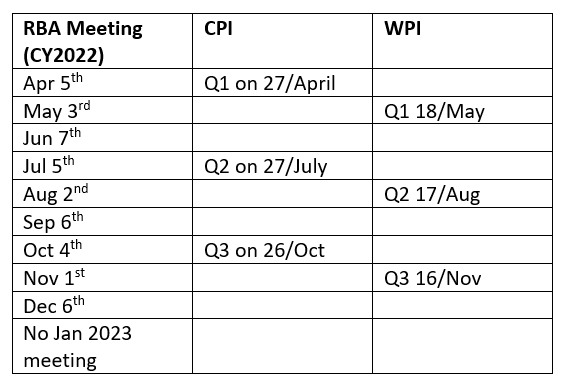

Relative Level of Hawkishness

Re-publishing a table we last produced on 8/April when last updating the path of the Australian Overnight Cash Rate, there are some significant data publications we’re looking to in the coming months to shape the direction of RBA policy – future CPI updates and quarterly Wage Price Index data.

We next look to Q1 Wage Price Index, as another dataset that may confirm that inflationary pressure is sustainable, where an acceleration in wage growth will support this view.

A disappointing WPI print, below current forecasts will create an interesting situation where inflation could still be viewed as ephemeral (trying our best to not use the word “transitory”), if not supported by wage growth, and that demand will abate as savings decline back to pre-pandemic levels.

This event seems less and less likely as inflation expectations become more and more entrenched, and wage growth is a topic of conversation for collective bargaining agreements as well as individual workplace contracts across public and private sectors.

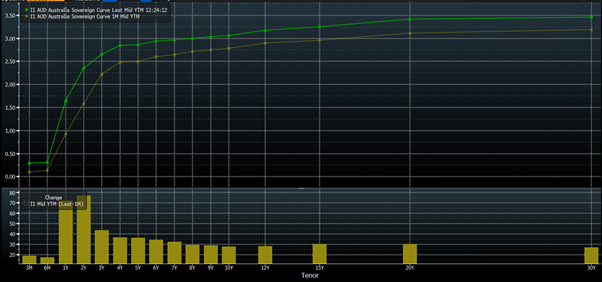

Yield Curve

The Australian Commonwealth government yield has shifted higher after the result, where the green line denotes the current yield curve relative to the yellow line, one month ago.

The majority of movement has been in 2023-2024 maturities, with yields surging 10-20bp higher in the ten minutes after the publication, where longer maturity bonds have not risen as much.

The sell-off in bonds is an extension of the last year’s trend, where 2023-2024 maturing bond yields are +70-80bp, where 10-20bp of that was yesterday.

This is a flattening move, where the differential between 2y and 10y bond yields has decreased to 71bp (2y 2.35%, 10y 3.05%).

Source: Bloomberg, 27/04/2022

Closing Remarks

This CPI result was stronger than expected and broad-based as well, highlighting that the RBA is behind the curve with their forecasts, and that inflation pressure is accelerating as well, creating the impetus for the RBA to play catch-up.

This has cumulated into markets pricing for the cash rate to be aggressively increased at every RBA meeting to year end, where there’s increasing likelihood (as per market pricing) the RBA tightens by 0.50% at one or more meetings before year end.

All-in-all, the news added an extra 25bp to cash rate expectations, where the terminal cash rate is forecast to be 3% in ~2024-2025, according to swap market pricing.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.