In Monday’s missive regarding the RBA’s (potential) impending rate cut and alteration of current monetary policy settings, the key sentence for me and a lot of other market participants was

“Given the outlook for inflation and employment is not consistent with the Bank’s objectives over the period ahead, the Board continues to assess other policy options.”

To me, this was a clear statement and shift in rhetoric that the RBA is going to take action to address not achieving their policy objectives, even though the objectives are largely out of their control right now due to COVID.

Remembering the RBA’s three policy objectives

#1 Currency stability (often interpreted as price stability)

#2 Full employment

#3 Economic prosperity and welfare of the Australian people

The RBA seeks to manage all three objectives via inflation rate targeting, to keep inflation in a 2-3% average range, over the medium term.

In reality, our currency has had a 20% round-trip price swing this year, our total employment is nowhere near “full” and it can be argued that our economic prosperity is worse this year than the last few years.

Hence, the bank is changing policy settings to try and achieve their federally mandated policy objectives.

RBA comments on AUD

Another key statement we explored on Monday was when Deputy Governor Debelle said:

“A lower exchange rate would definitely be beneficial for the Australian economy, so we are continuing to watch developments in the foreign exchange market carefully.”

Typically, the RBA does not intervene in the AUD exchange rates and has not actively since November 2008 during the Global Financial Crisis.

While I don’t believe the RBA will actively seek to address the current AUD exchange rate, as the current level is consistent with fundamental value gleaned through our Trade-Weighted Index (TWI) and terms of trade data, I do believe they will “jawbone” the currency lower from time-to-time.

This poses the risk that AUD may not have as much strength going forward and may underperform other currencies into the end of 2020.

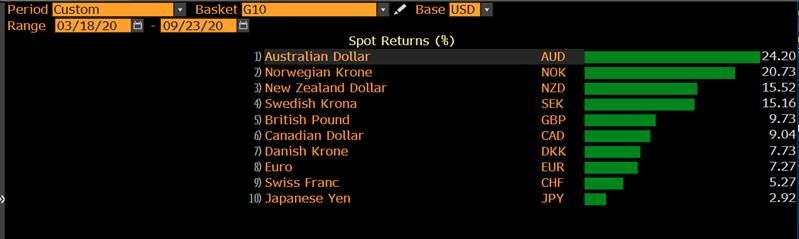

Below depicts certain currency’s performance against the USD since March 2020 – noting AUD leads the group in out-performance.

Source: Bloomberg

AUD Factor #1 – Interest rates

The main take-away from Dr. Debelle’s speech was the subtle shift in language regarding interest rates.

This saw both NAB and Westpac economists change their forecasts and call for a 15bp cut in either of the upcoming RBA Board meetings – taking place on 6 October or 3 November – taking the Overnight Cash Rate from 0.25 to 0.1%.

The problem with the October RBA meeting is that it’s on October 6th, the same day as the Federal budget….so they may wait until November, where they meet on Melbourne Cup day….the same day as the US election!

The news of two major banks forecasting lower cash rates saw our AUD drop 3c last week from 73 to 70c against the US dollar (USD).

The forecast for the cash rate to drop by 15bp isn’t a game changer for our AUD in respect to interest rates, as 1) our yield curve is steeper than other developed markets and 2) our outright level of interest rates are still higher, providing higher “carry.”

Unless we see a meaningful change of our yield curve’s steepness or the outright level of interest rates compared to other nations, likely AUD remains positive due to investment flows into Aussie bond markets.

AUD Factor #2 – Commodity prices

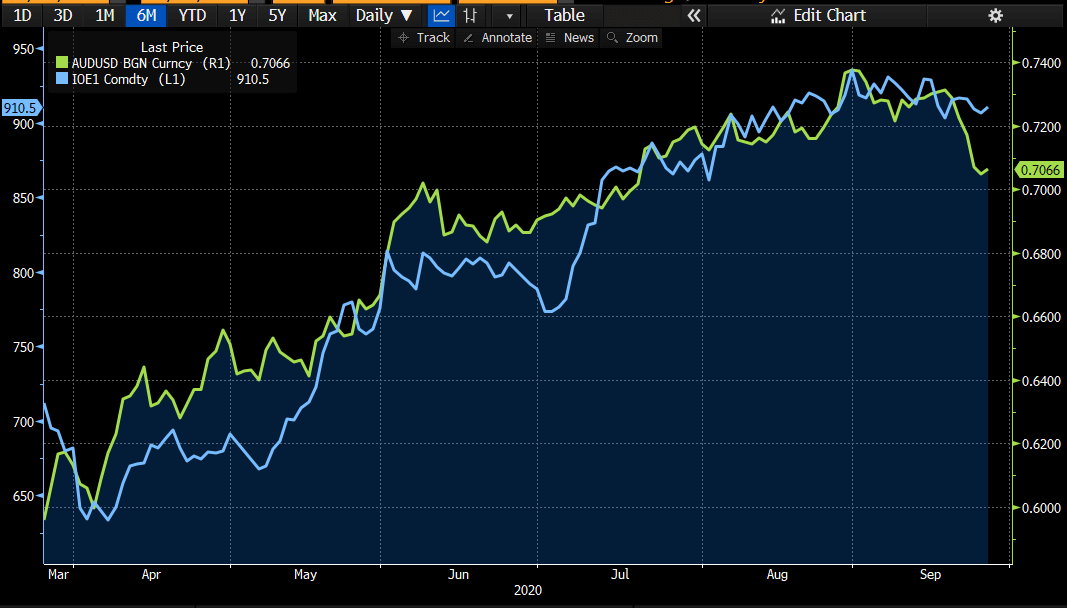

AUD versus iron ore (AUD/Fe) has a long-standing historical relationship where if iron ore price rises, our largest bulk export, then AUD generally rises with it.

Below, I show the AUD/USD (green) has a very high correlation with Iron ore prices (blue), with the increase in iron ore prices being the driving force behind AUD’s meteoric rise since March.

Please note that AUD has broken-away in the last week, which may signal the relationship is not holding, or that AUD is set to rebound to a higher rate in the future.

Source: Bloomberg

AUD Factor #3 – Bank equities

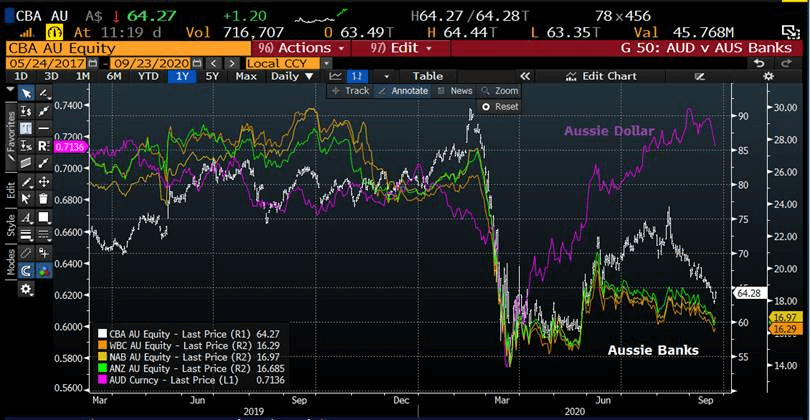

This metric is a new one to me, courtesy of BNP, comparing the change in our major bank prices against AUD/USD.

i.e. AUD/USD (purple) tracked quite closely with CBA (white), NAB (yellow) etc until March and then has rallied while the banks have not rallied with the same strength.

Source: Bloomberg, BNP

AUD Factor #4 – Positioning

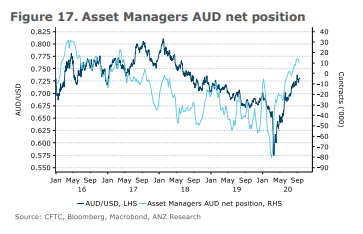

We don’t talk about this much, but there are ways to track the implied positioning of traders/asset managers in foreign currency markets.

In this case, ANZ Research uses Commodity Futures Trading Commission (CFTC) data as a proxy for bullish/bearish positioning.

The graphic (light blue line) shows that fund managers are net long (bullish) AUD against USD.

AUD Factor #5 – S&P 500

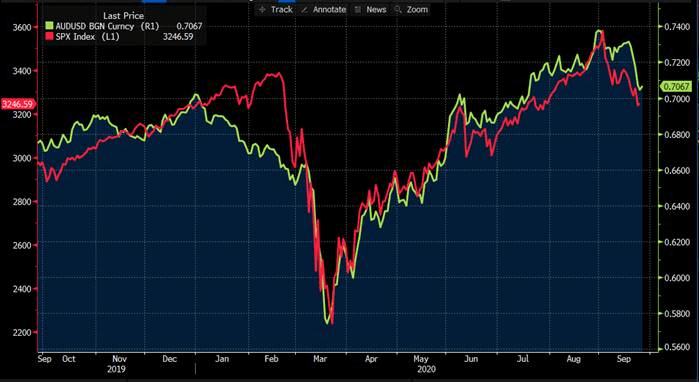

The final correlation I wish to share with you is the AUD/USD exchange rate (green) versus the S&P 500 stock index (red).

This has been the biggest determinant of our AUD’s value versus other major trading pairs in the last 6 months, as interest rates and commodities have had less correlation comparatively.

Source: Bloomberg

This isn’t to undermine that AUD and iron ore still have a strong relationship – they still do – but iron ore prices have been relatively tied to the broader US equity market as the first order relationship.

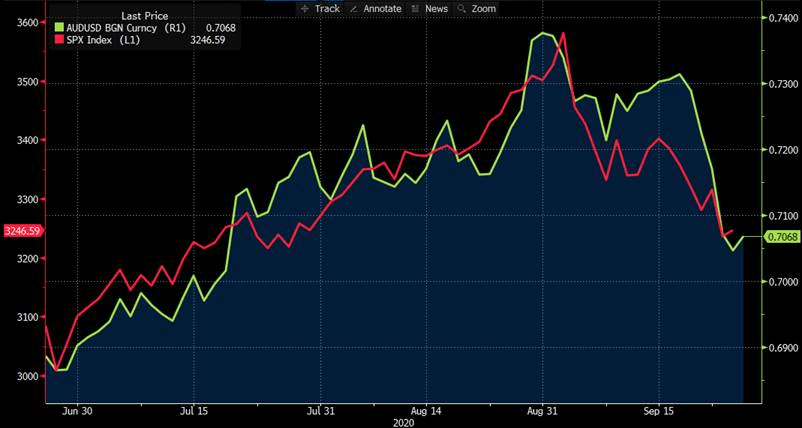

The below chart shows the relationship between AUD/USD and S&P500 over the last 3 months, where AUD/USD was delayed in selling off, with US equities leading the move lower.

Source: Bloomberg

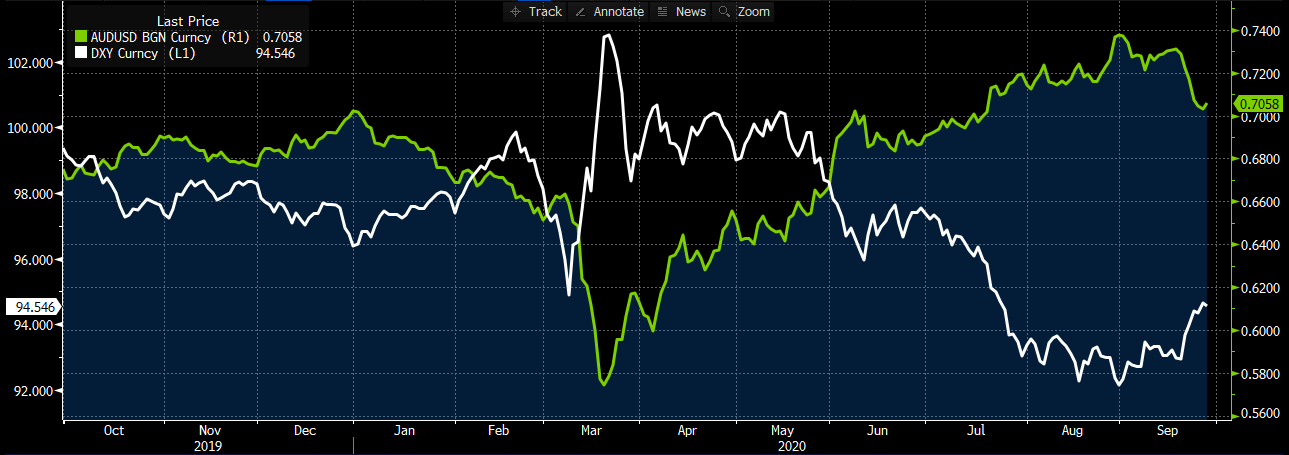

AUD Factor #6 – Trajectory of the USD and the coming months

The final factor worth mentioning about our AUD against the USD (AUD/USD) is that a large amount of the appreciation in the AUD has been a decline in the overall levels of the USD this year.

Below we chart AUD/USD (green) against the USD index (white).

AUD has rallied since April because USD has declined, not because AUD has been strong on its own accord. Likewise, our AUD weakness in March was due to the USD appreciating through safe-haven demand for US Treasury bonds.

Therefore, a forecast for AUD/USD must involve a forecast for the USD – which has underperformed this year.

Source: Bloomberg

As US equities continue to be a global proxy or barometer for global growth and a return to “normal” life post-pandemic, it is likely that a number of financial markets, AUD included, follow the equity market to an extent.

In terms of outlook for AUD, it seems logical that a forecast is highly correlated to this relationship, where an outlook for higher US equities sees a higher AUD/USD, and an outlook for lower US equities sees the reverse.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.