Innovation is critical and as a generation in the 21st century, we are lucky to witness the start of a new era of digital financial innovation. Over the past few years, we have seen a rapid evolution of different FinTech like cryptocurrency, digital lending and peer-to-peer lending. As we inevitably move to a financial digital existence, many traditional activities have transformed into the digital realm.

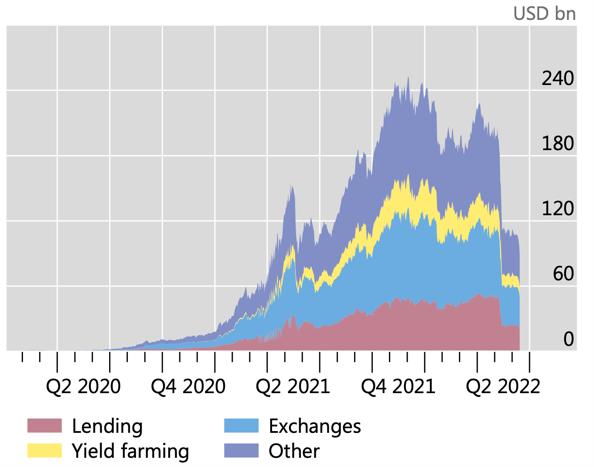

One particular example is the evolution of how we earn interest using a deposit account held at a bank or other financial institution. This method of maintaining and generating wealth is popular among depositors due to its simplicity and safety. However, the interest income earned from term deposit savings recently is significantly low due to the current low-interest rate environment. As a result of this and the evolution of FinTech, some investors have been seeking an alternative method of generating more wealth through cryptocurrency lending platforms. Consequently, the total value deposited in Defi lending platforms increased from nearly zero at the end of 2020 to $50 billion in early 2022 (Figure 1). Nevertheless, the collapse of Celsius – one of the world’s largest cryptocurrency lenders, has doubted investors about the future outlook of this type of decentralised platform.

Figure 1: Total value locked by category (Aramonte et al. 2022)

From this, the question has been raised about whether a decentralised cryptocurrency lending platform has opened a new era in FinTech or if it is simply a failed innovation. To seek a solution to this question, we need to understand its functionality, advantages and disadvantages when using this platform and what promise it possesses.

Crypto Lending 101

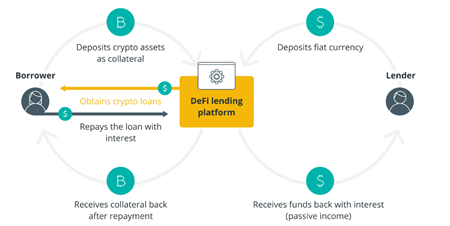

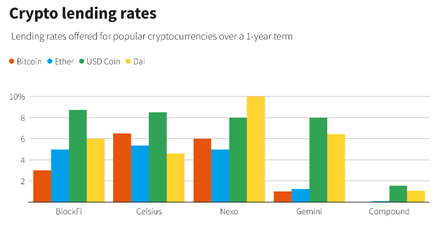

Cryptocurrency lending is a decentralised financial (DeFi) service that acts as an intermediary to connect borrowers and lenders. Lenders deposit their crypto into interest lending accounts, and borrowers can access loans by entering a collateralised contract using fiat or digital assets (Figure 2). The lending products that borrowers can access are not limited to one type of asset but rather more diverse, like fiat currencies, cryptocurrencies and stablecoins. Therefore, the interest rate for lending and borrowing varies depending on which platform users access and what type of cryptocurrency they use (Figure 3).

Figure 2: Crypto Lending Platform (Source: cointelegraph)

Figure 3: Lending rate on crypto lending platform as at June 2022 (Source: Mattackal & Singh 2022)

Compared to a centralised platform, a decentralised cryptocurrency lending platform is powered by blockchain and regulated by a smart contract. A smart contract is a computer-coded blockchain application that works on pre-programmed terms and conditions that govern a transaction between two parties. When these pre-specified rules are met, the transaction will be automatically executed. In comparison to a centralised platform, a decentralised platform is more transparent as investors can search for the platform’s TVL (total value locked) to measure the total liquidity and health of the cryptocurrency lending protocol.

Why use a Crypto Lending Platform?

The critical difference between the DeFi lending platform and banks is the speed of borrowing funds. Since the DeFi lending platform is an automated process that uses smart contracts, loan disbursement is nearly instantaneous, and associated costs are modest. Hence, it is faster, more convenient, and less complicated for borrowers to access funding than traditional banks.

Additionally, borrowers who are not eligible for loans from a bank due to failed credit checks can quickly secure crypto-backed loans on the DeFi lending platform. This is because borrowers can use their digital assets holdings as collateral to secure a loan at a lower rate than that of a bank loan. For borrowers that need funds instantaneously, this is an excellent opportunity for disqualified borrowers to access funding.

Moreover, the DeFi lending platform has opened a new prospect for investors who hold cryptocurrencies to utilise their capital. When lending their crypto holdings, lenders can generate a passive income at rates far higher than interest rates on saving accounts. According to Forbes, lenders can get up to annual percentage yields (APY) of 15% or more from deposit accounts held on the platform (Dunggan & Powell 2022). For investors that are not actively trading in the cryptocurrency market, this can be seen as a considerable opportunity to earn additional income on their holdings.

And…What are the risks when using a Crypto Lending Platform?

Firstly, the standout of the cryptocurrency ecosystem is the fact that the market is not overseen by financial regulators. The lack of regulation creates enormous uncertainty for users of crypto lending platforms. One distinctive difference between deposit accounts in a bank and a crypto lending platform is the government’s protection in the event of bankruptcy or systematic crisis in the financial system. In the US, FDIC insures up to USD250,000 for each account holder in deposits in a commercial bank or a similar financial institution. Likewise, APRA’s Financial Claim Scheme (FCS) also provide AUD250,000 per account holder per ADI. While in the DeFi ecosystem, there are no guarantees that investors assets are protected if the platform shuts down. In an extreme case, it is possible that depositors could lose all their digital currency in their accounts if the platform collapses. Hence, the lack of regulation has created an inherently unstable market for investors when there is no guarantee or back stop.

Already a prime example is the fallout of Celsius highlighting the risk investors could face when using a crypto lending platform. About two weeks ago, the company filed for Chapter 11 bankruptcy after suspending more than 2 million customer funds in June, making it the most significant collapse in the industry. Based on the filing, it claimed that the combination of bad bets, market conditions (particularly crypto winter) and poor governance to manage its rapid growth led to the failure. What’s worth noting is that the company has $5.5bn in liabilities and $4.3bn in assets, leaving a $1.2bn deficit. The hole on the balance sheet suggests that investors may not fully redeem their funding after the company pays its liabilities to creditors. Through this, it is apparent that the lack of government protection can bring great costs to investors.

Secondly, the level of security of the crypto lending platform is still an unanswered question. As DeFi crypto lending protocols employ smart contracts, there is the possibility that hackers could exploit it to access borrowers’ wallets to their advantage. Hacking in the blockchain system is not surprising news for investors because it has happened frequently. The most vulnerable DeFi lending platform belongs to Cream Finance – which suffered three hacker attacks in 2021. The costs of the attacks were $37 million in February, $29 million in August and $130 million in October. The susceptibility to hacking has created a great threat to the efficiency of FinTech landscape.

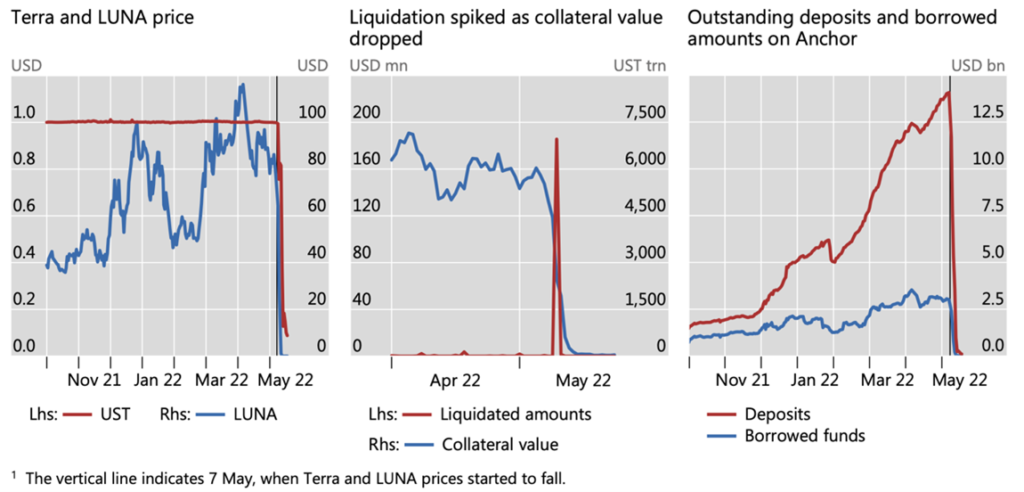

Thirdly, the interconnectedness of various components of cryptocurrency lending can exacerbate procyclicality as it implies that a shock to part of the DeFi ecosystem can affect the whole system as what happened to the TerraUSD (UST). UST was used to keep a one-to-one peg to the USD by being convertible into 1 dollar worth of LUNA. To make sure a sufficient demand for UST, Anchor – one of the largest lending protocols, offered a deposit rate of 20% for these stablecoins. As a result, investors purchased LUNA to mint UST, leading to a strong appreciation in the price of LUNA. When the price of UST dropped to almost zero, investors scrambled to take their UST out of Anchor to mint $1 worth of LUNA (Figure 4). Despite the hope of selling LUNA, the confidence in the whole system was shaken in which investors were hesitant to purchase this newly minted digital currency. Consequently, the value of the LUNA crashed, implying that the value of collateralised assets declined and fell below their liquidation ratios. Hence, the widespread fears among investors led to a large withdrawal of funds. As a result, there was a large increase in the liquidation of DeFi loans, which ultimately led to a collapse in loan volumes. Hence the interconnectedness in cryptocurrency can be a double-edged sword that could either enhance the probability of success or increase the risk of failure of the cryptocurrency lending platform.

Figure 4: Depletion of lending platforms in the Tera ecosystem (Aramonte et al. 2022)

Concluding remarks

Despite the recent failure of Celsius, the cryptocurrency lending platform is likely to continue to grow in popularity given the growth of the digital coin market and the overall FinTech ecosystem. However, the persistent risks due to its system and threats of market volatility require regulatory enforcement. From the collapse of Celsius, the cyber-attack on Cream Finance and the crash of Terra/Luna, it is necessary for regulators to put regulatory enforcement on the DeFi ecosystem to maintain its efficiency and resilience. Precisely, regulators will need to consider how they can ensure lenders return the collateral and borrowers repay their loans promptly. Additionally, regulatory agencies like the Securities Exchange Commission (SEC) focus on market integrity and illegal activities will need to expand their realm to cover DeFi. Thus, enforcement for transparency and security is needed to ensure that the innovative potential of DeFi brings overall benefits to the FinTech industry. But, given that innovation is rapidly evolving and regulation is slowly responding to changes, the crypto lending platform will be expected to operate in a regulatory grey area for some time.

As a concluding remark, cryptocurrency lending platforms have created a new era for investors to earn passive income or access to loans more efficient and profitable than the traditional banking system. Due to the lack of regulation enforcement and the fact that this is a new technology, it’s uncertain whether a crypto lending platform is a failed innovation or not.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.