Over the last decade, our Australian dollar (AUD) exchange rate has been closely correlated to the relative change in iron ore prices. As iron ore was more highly demanded and bought, our AUD would rally against foreign currencies – all else remaining equal.

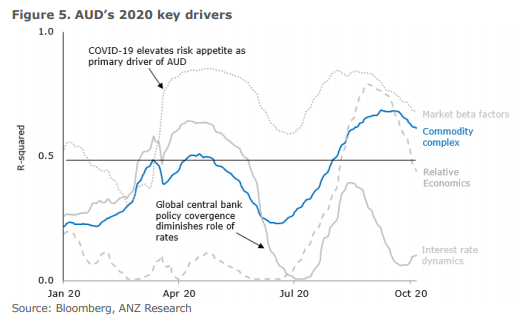

This relationship broke down in part this year as trade related forces became a secondary concern behind liquidity and risk appetite.

As AUD is a historical risk barometer for global fund managers based upon our open economy, heavily dependent on imports and exports, whilst also being one of the top 5 traded currency pairs in the world (AUD/USD) – AUD was a liquid way to sell “risk” assets in March/April, but also raise cash for investors with global asset allocations.

This strengthened correlation between AUD and risk appetite saw a higher correlation to the S&P 500 stock index, another global barometer for risk appetite.

However, this epitome of risk on/risk off has waned as markets have become placated to virus concerns, seeing AUD more influenced by iron ore yet again.

Iron ore returns as a signal

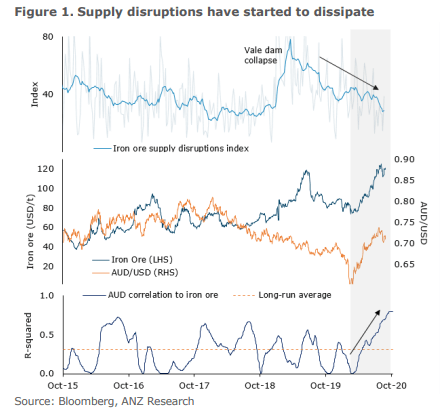

As supply constraints dissipate from industrial metals markets – mainly Brazil – market prices of these commodities better reflect underlying demand economics which has improved iron ore price changes as a signal for AUD’s value.

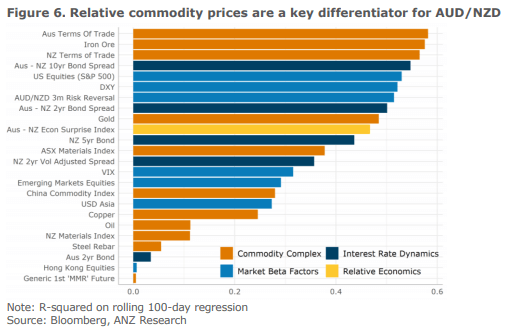

This should continue as economies normalise operations, and relative terms of trade become – once again – the driving force for commodity currency differentials – AUD, CAD, NOK, NZD etc.

This should be a net positive for AUD as China-centric industrial growth output continues to buoy hard commodity prices, such as iron ore and coal. Whilst Chinese news publications have recently reported stories of the government seeking to reduce their dependence on Australian coal, this goal will be hard to achieve and is in competition with their annual economic growth and nation building targets.

Iron ore’s supply story

As we mentioned, the link between AUD and iron ore has faded in recent months, but it was also fading in recent years due to supply chain disruptions.

These disruptions artificially inflated prices which disguised the waning of underlying demand.

As most of these supply issues have been resolved and weather-related disruptions in Australia have ameliorated, exports have been increasing, so much so that we saw record export growth in Q2 2020.

The upshot from this is that iron ore prices are truly reflecting changes in demand, suggesting a strong signal for a rising AUD against USD for the rest of 2020.

Interest rate differentials

If the COVID-19 crisis has elevated risk seeking behaviour as a driver for AUD and equity markets, then a shift away from COVID fears will see a regime shift towards fundamental drivers of currency valuation.

The second most important driver of AUD in recent years has been interest rate differentials.

However, the convergence in global central bank policy rates to zero% interest rates has eroded this dynamic as a meaningful indicator of AUD performance.

The Australian market is still at a positive interest rate differential to other developed markets, albeit much reduced, but does continue to see foreign investment in AUD-based assets, assisting our AUD’s elevation in Q2 and Q3 this year.

Back to fundamentals – this means that the largest important factor emerging is relative terms of foreign trade.

Furthermore, manufacturing – rather than services sectors – has been the centre of the current economic recovery. Goods trade and construction have rebounded much faster than household facing service industries. As such, industrial commodity prices have rallied more strongly than soft commodity counterparts. This dynamic favours AUD as one of the largest exporters of industrial metals and ores, as opposed to nations such as New Zealand and their NZD, which favours “soft” agricultural products.

Closing remarks

All in all, my outlook for our AUD remains unchanged as the fundamental factors underpinning our valuation point to AUD appreciating relative to other currencies, specifically USD.

The interest rate differential piece will play an increasingly smaller role in the AUD’s fundamental value, certainly if the RBA eases monetary policy further in their November 3rd meeting.

As terms of trade lead the charge in economic stimulatory efforts and industrial output, this likely sees more marginal buying of AUD – also due to remaining “risk on” sentiment from waning pandemic fears, global economies reopening as well as monetary and fiscal ”reflation” policies.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.