Over the past two years, the focus on inflationary rhetoric has been primarily centred around the disruption of supply chains, and injections of fiscal and monetary stimulus.

What has received less attention is the role of wages in the inflationary mix, whose effects are more structural in nature, and have a greater impact on medium-long term inflation outlooks.

For the RBA, wages have been as important as CPI readings over the last few years, where Governor Lowe has continued to state that wage growth must be above 3%, for the Australian economy to achieve its inflation target of an average of 2-3%, even going so far last year to suggest that the RBA wouldn’t hike until this was accomplished.

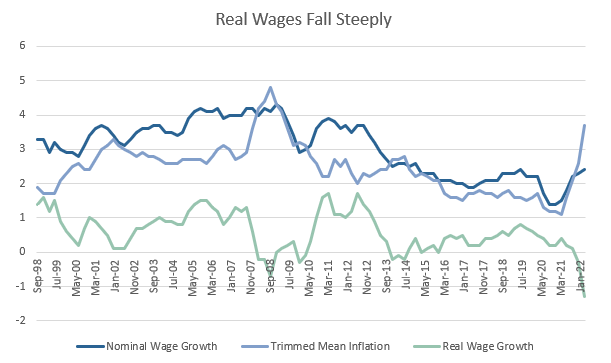

This is due to the simple fact that if nominal wages are increasing at a rate slower than inflation, consumers will have to choose to either deplete savings, or reduce levels of consumption – making any inflationary impulse in this environment, unlikely to remain over the long term.

On the other hand, if nominal wages increase at a rate greater than inflation, economies can enter into an inflationary spiral, where the forces of reflexivity can create a cycle of continuously higher wages and goods/services prices.

Source: Goldalliance

Given its importance in determining the RBA’s rate hike trajectory, today we will focus on wages – how they’ve trended historically, Wednesday’s WPI release, and the implications going forward.

The Australian Wage Story

Over the last 20 years, there has been little to no real wage growth in Australia, which can be in part attributed to structural factors of slowing labour productivity, excess capacity in labour markets (reflected through underemployment) and declines in terms of trade since the mining boom.

Source: ABS, Mason Stevens

As we flagged earlier, this level of wage growth is not conducive to generating sustained inflation, where Australia has consistently undershot its inflation targets on the back of this structural dis-inflationary force.

Wednesday’s WPI Release Disappoints Again

Wednesday’s Wage Price Index (WPI) release was followed closely by many market participants, due to the importance which the RBA had attached to it in determining the pace and magnitude of upcoming rate hikes.

The RBA has viewed WPI in tandem with CPI over the last few years – given their acknowledgement of the importance of wage growth in the context of inflation over medium-long term time frames.

As has been the case for many years, the data surprised to the downside, coming in at 0.7% QoQ (against an estimated 0.8%), taking the YoY figure to 2.4%.

This was in spite of Australia recording its lowest unemployment rate in 47 years of 3.9% – though economists forecast that WPI growth will eventually occur, at a gradual rate.

In the most recent minutes from the May meeting, the RBA justified its rate lift-off before receiving this WPI data, citing business surveys and internal data which had indicated broad increases in wages.

Interestingly, this indicates a potential reversion to the RBA’s previous CPI focus, where the speed and intensity of upward moves in CPI have carried much greater significance than WPI and put the RBA into “inflation fighting mode”, where WPI will become less of ongoing concern in the immediate term.

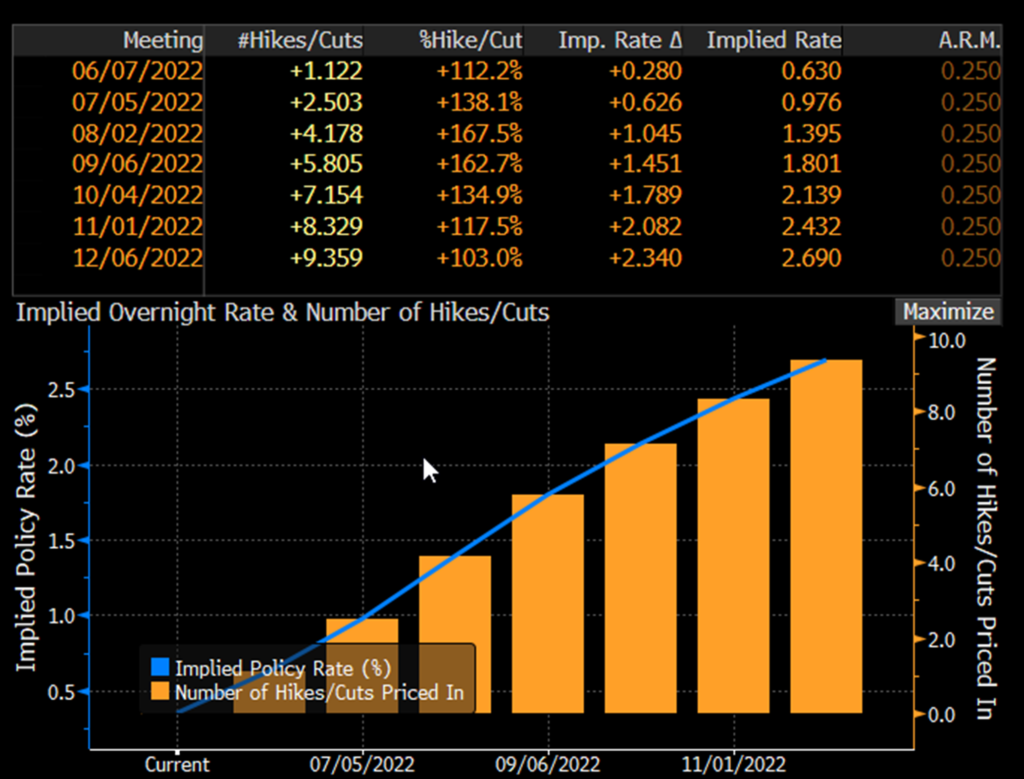

What will likely therefore transpire in spite of weak WPI data, is the RBA choosing to continue hiking 25bps in their June, July and August meetings, before re-evaluating after the next WPI release scheduled for the 17th of August. 40bp or 50bp rate hikes in upcoming meetings are likely also off the table, unless there is a material shift in global markets and inflationary outlooks.

Should there be another weak reading in the next release, we could be set for another retracement in rate hike timelines, all but ruling out the prospect that we would reach the 2.74% cash rate forecasted by the market by year end (equating to 9.36, 25bp rate hikes in the next 7 meetings).

Source: Bloomberg, as at 19/5/22

What If Australian Wages Finally Lift-off?

Wages around the world have begun to accelerate at a rate greater than that of Australia on the back of the tight labour markets, where most developed market nations are dealing with the same issues, being:

- Record high job vacancies

- Record low unemployment

- Falling labour force participation

These issues have been propagated by the “Great Resignation”, where employers in specific industries have had to increase salaries in an effort to retain and attract staff.

In the UK, average annual pay rose by 7% YoY in March, while in the US, average hourly earnings rose by 5.5% YoY in April. Both readings may reflect negative real wages growth, though there is a materially higher throughput of labour market tightness into wage growth data than that of Australia.

However, this could soon change in Australia, where upcoming award negotiations could see higher wages across the board, with the Australian Council of Trade Unions (ACTU) calling for a 5.5% increase to minimum wage, in line with predicted headline CPI figures.

Should this be successful, it would see a structural uplift in wages across the board and have flow on effects through the repricing of many private/public sector awards.

Wages Narrative Will Grow in Importance

As the inflation debate evolves and grows, it is likely that we continue to see greater attention placed towards wage levels as the implications of tight labour markets (or the lack thereof) becomes apparent.

Within Australia, the labour cost in the national accounts (which will be released June 1), and August’s WPI release will act as the key indicators of wage pressures, where the ACTU’s bid to increase minimum wages by 5.5% will also play a role through shifting forecasted wage levels.

Markets will look to how DM economies deal with tight employment markets, and whether this translates into higher wages, and subsequently, higher and more permanent levels of inflation.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.