Over the past two years, cryptocurrencies have emerged from the fringes of capital markets to become regular talking points within asset allocation discussions.

Whilst many remain sceptics, making comparisons of the asset class to Tulip Mania and the great excesses of the Dotcom Bubble, other notable individuals and institutions have all voiced their support for the industry.

Legendary value investor and former Chairman of Legg Mason, Bill Miller, has recently stated that Bitcoin and other cryptocurrency-related investments make up 50% of his personal assets, while other well-known investors like Paul Tudor Jones, Ray Dalio and Stanley Druckenmiller, and numerous pension and sovereign wealth funds have all allocated to the industry.

However, whilst the seemingly exponential growth of valuations over the past few years has been attractive enough to justify allocations for most, it is imperative that investors are aware of the role which cryptocurrencies play within portfolios.

Within this, investors must understand how the cryptocurrencies will react to various scenarios, including macroeconomic events, interest rates, and equity markets; and the extent of correlations between other portfolio holdings.

To arrive at these conclusions, the following questions should be asked:

- Are cryptocurrencies a point of diversification within portfolios?

- Is Bitcoin an effective store of value?

- Do different types of cryptocurrencies offer diversification?

Do Cryptocurrencies Offer Diversification?

For some, investments into cryptocurrencies have been justified by its supposed point of differentiation to other asset classes.

Over the long run, this makes sense – as cryptocurrencies purport to reshape global financial systems – and therefore will be beholden to different narratives.

However, it has become increasingly more obvious over the last two years that cryptocurrencies are still very much affected by the incumbent financial system – particularly over the last few months as cryptocurrencies have fallen lockstep with equity markets.

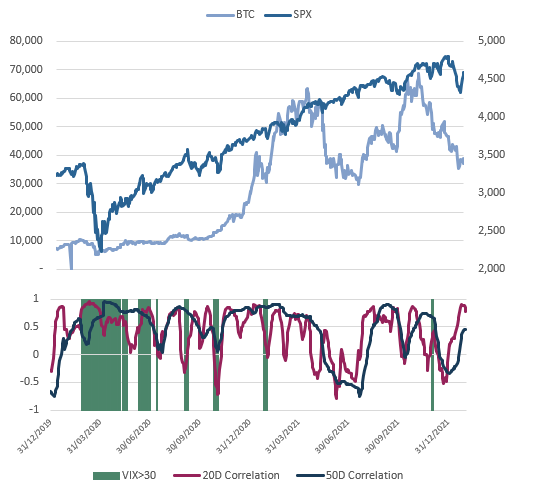

However, as evidenced in the chart below, this correlation only reveals itself in times of greater than normal volatility – with this being defined as when the VIX is over 30 (which has occurred unsurprisingly for 89 out of the 526 days taken in the sample, due to elevated market volatility from the COVID-19 pandemic).

Now whilst the chart below only shows the correlations between Bitcoin and US equities, it is representative of the market as a whole, due to the closely bound correlations between all cryptocurrencies – but we will get to that later.

Chart 1: Top Chart – BTC (light blue) vs S&P 500 (dark blue), Bottom Chart – VIX>30 (green), 20D correlation between BTC and S&P 500 (red), 50D correlation between BTC and S&P 500 (dark blue), from 31/12/19 to 2/2/22

Source: Bloomberg, Mason Stevens

This correlation has played out as a result of Bitcoin being viewed as a risk asset – similar in its nature to long duration technology stocks, due to the longer time investment horizon and greater degree of speculation.

Increased institutionalisation has also enhanced the correlative relationship, as investment managers direct flows to and from Bitcoin, in the context of a broader investment portfolio.

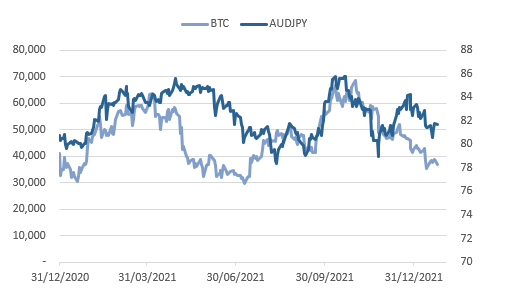

Further reinforcement of Bitcoin’s position as a risk asset in broader financial markets is evidenced through its relationship with AUDJPY, which is regarded as one of the most accurate indicators of risk sentiment, owing to the currency pair being a preferred method of fund managers to express their positioning.

Chart 2: BTC (light blue) vs AUDJPY (dark blue), from 31/12/20 to 2/2/22

Source: Bloomberg, Mason Stevens

Therefore, when we consider the role of Bitcoin (and cryptocurrencies more broadly) in a portfolio, we must take note that valuations will be shaped by overall risk sentiment in the short-medium term and will not offer downside protection like gold or fixed income might.

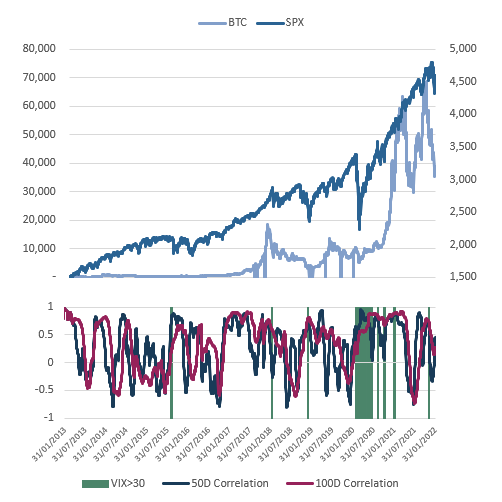

However, over the long term, Bitcoin will likely still exhibit its own unique price action, where idiosyncratic factors will have greater weight in times of average market volatility.

As a result, Bitcoin can serve as an effective point of diversification within investor profiles over longer-term time horizons, where the factors that shape long term valuations differ greatly from traditional markets.

Chart 3: Top Chart – BTC (light blue) vs S&P 500 (dark blue), Bottom Chart – VIX>30 (green), 50D correlation between BTC and S&P 500 (dark blue), 100D correlation between BTC and S&P 500 (red), from 31/01/13 to 2/2/22

Source: Bloomberg, Mason Stevens

Is Bitcoin an Effective Store of Value?

Significant amounts of Bitcoin investment over the past two years have been justified by its role as “digital gold”, where investors have sought to purchase it in reaction to the undertaking of unprecedented monetary expansion by global central banks.

“Store of value” assets are defined by three key features:

- Limited supply

- Durability

- Social agreement

Bitcoin scores strongly on the limited supply front, with a finite supply of 21 million coins – no more, no less.

In terms of durability, it is more divisible, portable, and secure when compared to its closest counterpart – gold – though it’s now taken for granted that we have near-continuous access to power supplies and the internet.

The final point is the most contentious – and takes a little bit more work to understand.

Social agreement is what drives the majority of valuations for store of value assets and is the product of the perspectives of market participants – making it therefore susceptible to change over time.

When looking at Bitcoin in dollar terms, its value is derived by many through its position as an inflation hedge.

It has no physical properties, nor does it generate any income.

Whilst it provides seamless, cheap and borderless transfers 24/7, and has the potential to be a medium of exchange through utilisation of the lightning network – these factors do not justify current valuations.

An investor’s justification to buying Bitcoin is currently informed by the belief that someone will be willing to pay more for that Bitcoin in the future.

Its lack of utility doesn’t make it useless – nor does it take away from its role as a store of value asset.

A similar relationship exists with gold, where the lion’s share of its valuation is derived by the social agreement that gold is a useful inflation hedge, and a safe haven asset.

People can make the argument that gold is also used in in jewellery and electronics, but these use cases are not the reason why people purchase gold, and why it is currently worth ~USD$1800 an ounce – without its store of value properties, its price would plummet.

Therefore, when we evaluate how effective Bitcoin is as a store of value asset, we only need to look at the level of demand – reflected through price.

Chart 4: 5yr performance of BTC, as at 2/2/22

Source: Bloomberg

Chart 5: 6m performance of BTC, as at 2/2/22

Source: Bloomberg

Depending on the time frame you choose – Bitcoin can be evaluated as both a good store of value asset, and a bad store of value asset.

In the first chart, we can see that Bitcoin has clearly maintained its purchasing power against fiat currencies over the past 5 years – far exceeding the effects of inflation.

However, if we look at the second chart, we can see that Bitcoin has almost halved in value in the last 3 months, whilst inflation has continued to increase over that time period.

Speculation around its valuations is a dynamic no different to gold – though volatility is of a greater magnitude given its vastly shorter history (and the subsequent weakness of correlative relationships), and the retail dominant investor base.

Gold has experienced similar periods of drawdowns (though with lesser velocity), with a peak to trough of just under 50% after economies began to recover from the GFC.

If you held it during this downturn, it would not have been an effective store of value asset – as it was losing its purchasing power, but by looking at it on a longer-term horizon, it eventually returned to its former valuations.

Chart 6: 11yr performance of gold, as at 2/2/22

Source: Bloomberg

Given its volatility, investors can be forgiven for writing off Bitcoin’s potential to be a solid store of value asset, however, these evaluations often fail to consider longer term investment horizons, where Bitcoin has continued to prove its effectiveness as a store of value.

Within younger generations, there is also a psychological shift, where Bitcoin is continuing to be preferred over gold, which will only continue to reinforce its store of value characteristics, especially considering that we are amidst the largest generational wealth transfer, as Baby Boomers bequeath their fortunes.

As the world becomes increasingly digital, the younger generations will likely continue to favour Bitcoin given its greater utility – being able to be used as a form of collateral with DeFi, as well as being more portable, secure and divisible as previously mentioned.

In order for Bitcoin to become a more stable store of value asset, it will require the further development of correlative relationships (much like how gold is currently regarded as a safe haven asset), and the maturity of the industry and its investor base along with further education to level the skill gap inherent in investing in new technology and digital assets.

Do Different Types of Cryptocurrencies Offer Diversification?

Well-constructed portfolios should be diversified – where the securities selected offer exposures to different asset classes, countries, and industries.

Through constructing a portfolio with non-correlated and negatively correlated securities, investors can maximise their risk adjusted returns, and enjoy a smoother return profile.

In an optimal world, a cryptocurrency portfolio should be able to perform in that same manner – offering protection in market downturns and enabling a smoother return profile.

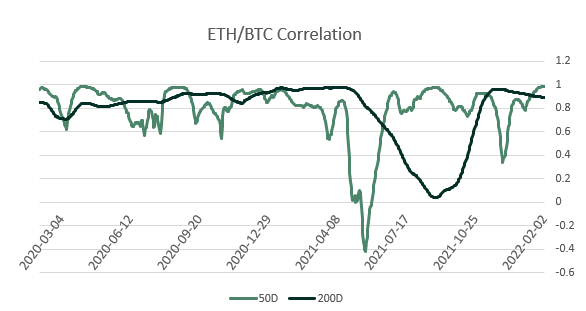

Though the reality is somewhat different – with almost all cryptocurrencies having a degree of correlation to their counterparts despite the disparate use cases of their networks.

The reasons behind their close correlation are due to the market treating them as similar assets – all operating using blockchain technology, attempting to achieve similar goals in building an all-encompassing cryptocurrency ecosystem.

Chart 7: 50 day (green) and 200 day (dark blue) correlation between ETH and BTC, from 4/3/20 to 2/2/22

Source: CoinGecko, Mason Stevens

Therefore, whilst investing in multiple cryptocurrencies will offer exposures to different corners of the market, and their unique value drivers – all will be exposed to the same overall investment narratives, which will involve similar moves (but in different velocities) throughout the market cycle.

What Role Do Cryptocurrencies Play in a Portfolio?

Whilst cryptocurrencies have exhibited strong correlation with equities in times of elevated volatility, they still offer a unique point of differentiation in investor portfolios over the long term.

Bitcoin, as the leading cryptocurrency, offers an alternative as a digital store of value asset, and will continue to perform well over longer term time horizons, should investors continue to view that it is an appropriate store of wealth.

Whilst different cryptocurrencies carry different use cases (where Bitcoin plays a role as “hard money” within the ecosystem, and Ethereum and Solana act as primary proponents within the technology layer), they are all still tightly correlated, and similarly impacted by the same market wide narratives.

Given the volatility of the industry, investors should only seek to invest a small portion of their portfolio in cryptocurrencies – with Ray Dalio recommending an allocation to Bitcoin of up to 2% for all investors.

As with all investments, careful consideration of one’s risk and return profiles must be undertaken, as well as the interaction of cryptocurrencies to other assets held in your portfolio.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.