Monetary policy has become less clear, despite central banks stated desire to promote stability and transparency.

It used to be that looking at the RBA’s cash rate target and charting the yields of ASX-listed bank bill futures would provide a reasonable path for the cash rate’s future trajectory.

In the past, the RBA Board would cut or hike interest rates >> banking institutions would then pass on some/all of the cut/hike >> depositors and borrowers would receive lower or higher interest rates on their accounts/loans.

This was simple.

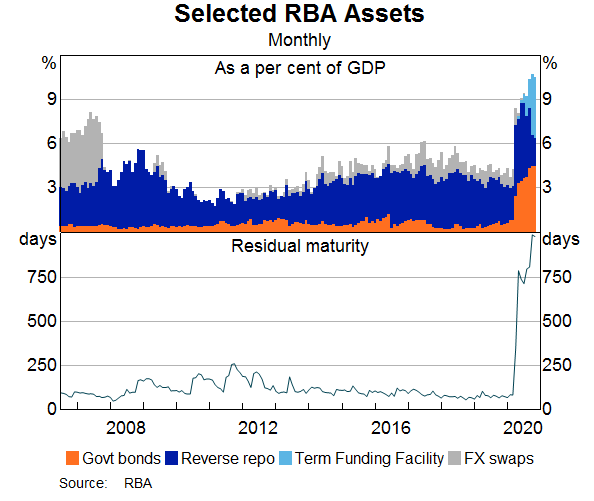

In the new world of unconventional monetary policies, things are more complex as we need to be aware of cash rates, repo eligibility of bonds, quantitative easing, forward guidance, yield curve control (yield targeting), FX intervention and corporate lending facilities such as the RBA’s Term Funding Facility.

All of these affect the overall amount of monetary policy accommodation, as policy is “eased” by providing more accommodation through many or all the above tools.

Time for change

The RBA Board next meets on Tuesday 3rd of November, publishing the outcomes of this meeting at 2:30pm AEDT.

Through recent speeches by RBA Governor Lowe, Deputy Governor Debelle and Assistant Governor Kent – three voting members of the Board – the RBA has given forward guidance that financial markets have taken at their word, that the Board will ease monetary policy further, at this meeting.

By way of pricing; the market is forecasting:

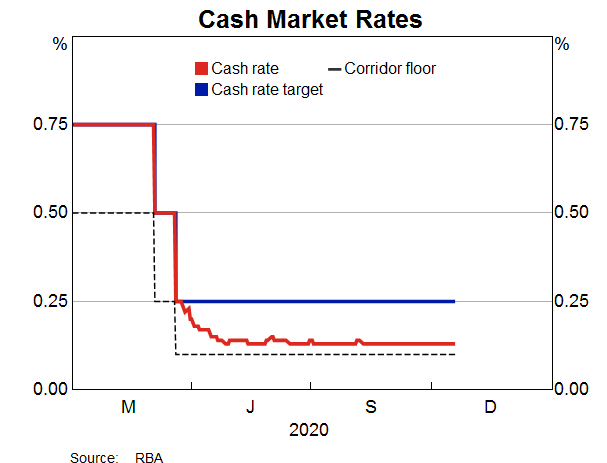

- A cut to the Overnight Cash Rate from 0.25% to 0.10%

- A reduction in the 3-year government bond yield target from 0.25% to 0.10%

- A reduction in the Term Funding Facility lending rate from 0.25% to 0.10%

- A reduction in the interest rates banks receive on their deposits with the RBA from 0.10% to 0.05%

- An increase in the government bond yield curve control from 3-5-year government bonds to also target 6-10-year government bonds (a net increase in quantitative easing)

The question that comes to mind is how much this easing of monetary policy will move the needle for the RBA to achieve their mandated goals of #1 currency stability, #2 full employment and #3 welfare and prosperity for Australians.

Will the rate cuts work?

They will help, but not in the way that you think.

The RBA has been vocal over the last two years (even when the Cash Rate was 1.50%) that the heavy lifting needed to be done by Commonwealth and State budgets, as their balance sheets were and still are in relatively great shape, with capacity for Keynesian style fiscal stimulus.

All this was because monetary policy can only do so much.

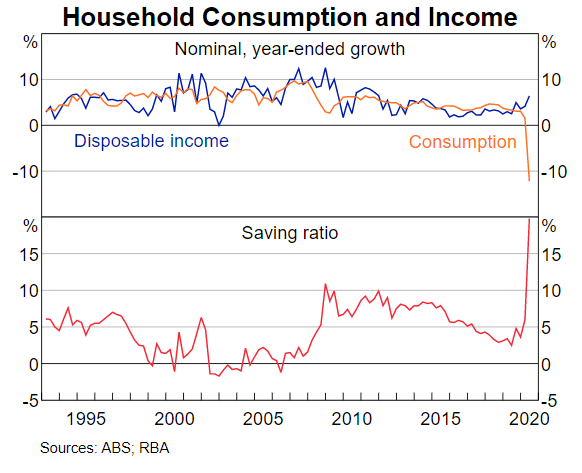

Monetary policy accommodations primarily flow through the mechanisms of reduced borrowing costs leading to greater disposable income (assumes wages stay the same). This policy easing also creates a disincentive to savers by devaluing the future value of their cash flows. Though I should note during the current pandemic, this disincentive to save isn’t working, i.e. we haven’t seen an increase in spending in the face of so much economic uncertainty.

When interest rates are near the zero bound, further effect is muted – certainly during a recession where credit growth is negative and hence the need for unconventional policy, which has unconventional outcomes.

Unconventional policy

Unconventional policy is meant to affect credit market liquidity and availability, and foreign currency exchange rates, rather than outright lending/deposit rates.

What this means is the RBA is seeking to prevent any further credit market disruptions, to allow an economic recovery, where eligible borrowers can readily access credit.

The RBA is managing the international attractiveness of Australian financial assets, by reducing the forward-value of our AUD against other currencies and lowering the future value of our government issued fixed income securities.

This makes non-government debt, equities and other financial assets more competitive to government issued debt, which generally sees asset allocations to private sector initiatives such as corporate debt, infrastructure, property, private equity, listed equity etc.

The increase in central bank participation in financial markets results in lower volatility, larger central bank balance sheets and more certainty of the availability of credit.

The last example of policy effect I’ll mention is that the forward guidance and yield curve control has lowered outright levels of interest rates – which lowers costs of longer-term borrowing, but also makes Australian government bonds of this level of maturity less attractive to foreign equivalents, and reduces the net amount of buying AUD currency.

In my view, the net effect will be small as when factoring in the flatter yield curve and lower interest rates, our AUD government bonds will still be higher yielding than other AAA-rated equivalents, most of which have negative interest rates.

Closing remarks

To conclude, the RBA continues to ease monetary policy to align our policy settings with developed market equivalents.

Because the Overnight Cash Rate is in close proximity to 0%, other tools are being utilised in order to affect the price of money, over various periods of time.

The strongest policy tool they have in their toolkit, the one they utilise often but we hardly talk about, is their ability to influence markets through spoken and written word.

While we expect the RBA to implement the above-mentioned policy framework at their November 3rd meeting, we would also expect further rhetoric in the Minutes or future speeches to mention a lower AUD being beneficial to economic growth, lower for longer interest rate policy and potential additional monetary policy stimulus if necessary.

The RBA is continually providing forward guidance for future policies that affect financial markets and credit growth, without any movement in monetary policy.

Moreover, the RBA is aware of the many bullish factors affecting our AUD and our international competitiveness for exports, a key component of our economic output, something we’ve written about here, here and here.

This is why the RBA continues to provide increased lower forward guidance – whilst maintaining their credibility – to push down the AUD/ exchange rates and assist our economic rebound post COVID-19 lows.

I wouldn’t expect any new rate cuts from banking institutions after November 3rd, the effects will be felt elsewhere in the economy.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.