A hot topic of debate over the past few years has been the outsized controls which social media networks have on the dissemination of information, where the concept of “free speech” has been debated time and time again against the perils of misinformation.

Such debate is critical to the fabric of democracy given the growing role which social media networks have in shaping the perspectives of society.

In the past, flows of information were controlled largely by television and newspaper networks, though in the last decade, the spread of social media has passed the buck of influence to individuals and smaller groups of people.

Whilst this has arguably led to more diversified opinions and promoted greater conversation within society, it has also created an environment where fringe groups have been able to spread misinformation and promote hate speech.

Events such as the Capitol Hill riots have galvanised social media networks to begin controlling the conversation in the last two years, starting with the ban of Donald Trump from most major social media networks, and spreading to a more widespread culture of censorship surrounding issues which social media networks have elected to intervene upon.

Adding onto this, social media networks have built their businesses around the sale of user data for advertising purposes, creating systems where corporates and political parties have been able to profile users with frightening precision – culminating in ugly episodes of targeted political advertisements (often in a manipulative fashion) within important democratic elections unearthed through the Cambridge Analytica scandal.

Elon Musk’s recent disclosure as the largest shareholder in Twitter through his 9.2% stake has stoked discussions of what could be the next step for social media networks – where free speech and open protocols could dictate how we converse in the digital age.

Such a transition would carry significant implications for existing social media networks, and marks yet another part of society trending towards the concept of decentralisation.

Therefore, as the topic of today’s note, we will discuss social media censorship, privacy concerns, regulation, and the way forward for social media in the years to come.

Damned If They Do, Damned If They Don’t

Over the past few years, social media networks have been pushed towards implementing greater levels of censorship within political and social issues.

Whilst many could argue that the ban of Donald Trump from Facebook, Twitter and other major social media platforms was for the greater good, it raises a series of ethical questions as to the right of these companies to determine what is right, and what is wrong.

Should the onus of determining the discourse of individuals in democratically free societies fall to a select group of individuals within Silicon Valley, who are driven by their own self interests, and that of their investors?

Now, more than ever, social media companies have an important responsibility in maintaining platforms which foster free speech – a tenant of democratically free societies.

If these companies enhance their levels of censorship, we could enter an era of Orwellian levels of control, where discourse is limited only to that of mainstream opinion.

Though at the same time, social media networks must ensure that they do not become breeding grounds for social unrest and destructive conversation.

Thus social media networks as they currently stand are stuck in a difficult situation when faced with the decision to censor – damned if they do, and damned if they don’t.

They Know Everything

The business models of social media networks have been predicated upon the harvesting of user data, which has been richly successful in an age where we elect to share more and more of our lives in the digital sphere.

Whilst often harmless, it has led to the reduced levels of privacy, where many of the largest technology companies like Meta and Google have been able to collect thousands of data points on individuals, creating more accurate profiles to then be sold to the highest bidder.

The infamous Cambridge Analytica scandal brought to light the dangers of personal data collection, where it enabled political parties to shift the results of democratic elections through implementing frighteningly precise, and targeted social media advertising campaigns.

The implementation of new initiatives which “depersonalise” data collection will likely continue to act as a point of compromise for these companies, where developments such as Google FLoC (Federated Learning of Cohorts) will continue to grow, attempting to masquerade the true power of these companies.

Regulation has and will continue to hound the industry as practices like third party cookies are outlawed, though it is likely that the power of large technology companies will constrain the impact on bottom lines.

What we likely see is a dramatic shift in the ways in which regulators view concepts such as free speech. The ground rules laid down centuries ago within the constitutions of many global governments were certainly not made in an environment where a handful of social media networks could provide unfettered access to information, but also have the ability to control the conversations of society.

Elon To the Rescue

Elon Musk’s recent disclosure of his 9.2% shareholding and appointment on the board of Twitter (and his subsequent reversal of this offer) has raised new hopes for more equitable and free social media networks.

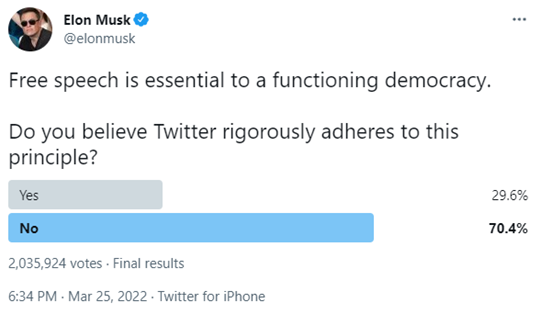

His poll released days before the disclosure of his shareholding gave some insight to Musk’s thoughts, which was answered by a staggering 2m people within days of posting.

Source: Twitter

Following his poll, Musk continued on the same tact, labouring on the point that free speech is a necessity in democracies.

“Given that Twitter serves as the de facto public town square, failing to adhere to free speech principles fundamentally undermines democracy.”

- Elon Musk

What changes Musk hopes to enforce is unknown at this junction, but it will likely involve open source algorithms and promotion of free speech.

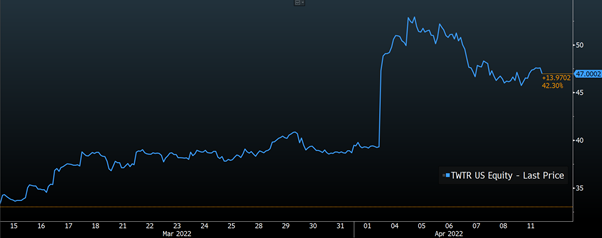

Whilst this has been positive for its stock price over the past week, it is our view that businesses will likely become more wary of allocating advertising spend to the platform, in fears that more free speech will engender hostility and negativity.

Chart 1: 1-Month Performance of Twitter

Source: Bloomberg, as at 12/4/22

The economics of such a change aren’t as profitable, however it acts as further irrefutable evidence of a transition towards more decentralised social media networks – a fact illustrated by Twitter’s moves over the past two years to create a more decentralised and open social media protocol – Bluesky.

Bluesky purports to shift the social media model from applications, to protocols where the power rests with users – enabling them to control the content they see, through transparent content algorithms and community led determinations over censorship – alleviating regulatory concerns and promoting a better user experience.

Users will be able to have greater ownership over their own data, overcoming issues with privacy which have become more and more important within the digital age.

What is yet to be revealed is how such protocols will ensure the dissemination of harmful rhetoric does not continue, where decentralised models will become increasingly more difficult to impose regulatory oversight.

An Important Societal Trend, But What Importance Does This Have for Markets?

For many, the importance of owning one’s data and having greater liberties over content creation aren’t front of mind.

Whilst they may be important in theory, the stickiness of social media networks precludes the ability of most to alter their preferred mediums of social interaction within the digital sphere.

Knowing this, it is likely that we continue to interact digitally in similar avenues in the short term, though what this signals is yet another flashpoint of societies movement to a more decentralised internet.

The age of unheralded access to user data is coming to an end for large technology companies like Google and Meta, and their future prospects will likely be determined by their abilities to capture value within a more decentralised internet.

Those companies who fail to acknowledge this fact will likely see, in our view, a decline in revenues as decentralisation picks up steam and will materially shift the performance of investor portfolios.

A Decentralised Future

Markets have been focused on Musk and his activities, though what the real story should be, in our view, is the support which decentralisation has garnered within younger generations.

As time goes on, certain business models will likely continue to become more decentralised – offering more equitable consumer experiences, and significant investment opportunities.

The extent to which society decentralises is not yet clear, and it is certainly likely that the fervour surrounding the concept could underwhelm in the short to medium term.

Nonetheless, it will continue to serve as a key emerging investment thematic – growing alongside other important concepts such as the clean energy, AI, automation, resource scarcity and ageing populations.

As is the case with investing in any emerging thematic, an understanding of fundamentals is imperative.

Ambitious narratives and foggy forecasts can elevate the risk of ruin, elevating the importance of appropriate capital allocation.

Throughout our morning note series, we have covered a variety of important emerging investment trends and will continue to do so as these concepts mature.

After all, if investing is all about forecasting future cash flows, shouldn’t we pay attention to the ideas which could shape the next generations?

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.