Happy New Year and welcome to our first daily morning note of calendar year 2021!

We hope that you all had a lovely holiday period and are rejuvenated for the year ahead.

Our last morning note was published on 18 December, and there have been several significant global events that have occurred since our last missive.

To bring everyone up to speed, we’ve written the below recount of events that have occurred in the interim period, providing more detail where necessary.

In advance, tomorrow’s note (2 February) will be more Australia-centric, discussing the current state of our domestic economy and COVID-19 vaccine rollout that begins this week.

December 2020

14th The US electoral college confirmed Joe Biden’s victory.

20th London and parts of England were placed on Tier 4 lockdown restrictions.

21st A new strain of COVID was identified in the UK and was soon identified in Denmark, the Netherlands and other European countries.

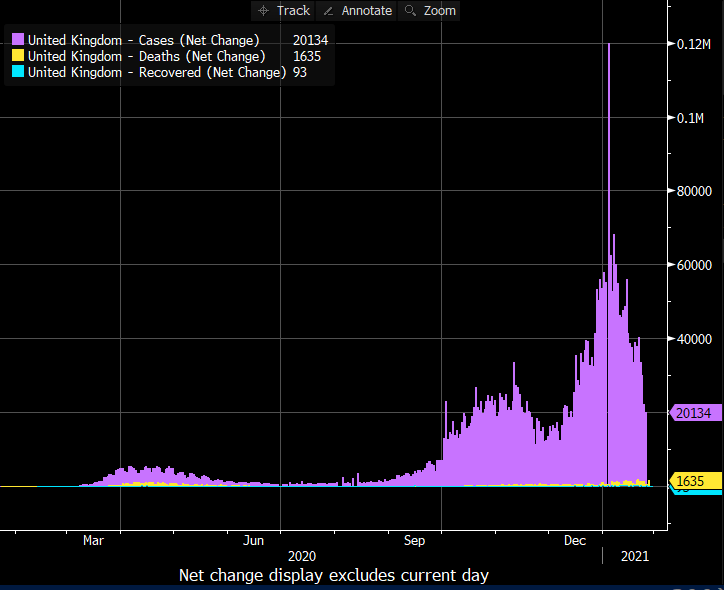

Mutations in viruses across geographies are common, and this is part of the reason why influenza shots need to be taken annually – to keep immunity to new variants of a virus. Preliminary information suggests the new strain is more contagious, as it correlated with surges in case numbers in those areas where it was identified. The chart below (purple line) shows the UK spike in cases in December preceding the increased severity of lockdowns.

22nd US congress passed a 900bio USD stimulus deal plus approved a “debt ceiling” extension until Sep 2021.

24th UK and EU agreed on a trade deal preventing a ‘hard’ Brexit.

30th EU and China agree on an investment deal, and Brexit was ratified by the UK Parliament.

31st UK’s transition period with the EU ended, meaning Brexit has happened.

January 2021

3rd Marks the 1-year anniversary of assassination of Iranian Revolutionary Guard Corps, General Qasem Soleimani. Markets had expected there could be some market volatility due to some reciprocal threats from Iran on this day, with nothing eventuating.

4th US Democrat Party successful in Georgia State election run-offs, winning both the state’s senate seats and taking US Senate to 50-50 split, with the Vice President (Democrat) casting the tie-breaking vote if required.

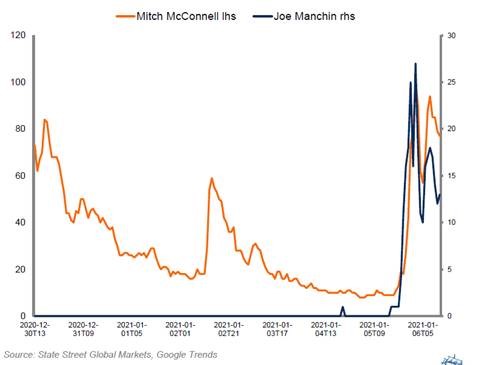

However, we note that several centrist Democrats have already come out saying they vote against their party if required. Joe Manchin (West Virginia) came into the spotlight, increasingly known as the key centrist Democrat to be placated for legislation to pass.

The below chart utilises Google Trends data to show the name recognition spike in Joe Manchin compared to leading Republican figure Mitch McConnell.

Also, we note major legislation requires to pass a filibuster, which is a 60% majority meaning Republicans will also need to be won over.

6th Violence in Washington D.C. as rioters forced entry into the Capitol building to prevent Congress from certifying the election results. Five people, including a police officer, died. The election result certification re-commenced later that day and was affirmed.

14th US President Biden’s 1.9 trillion USD stimulus plan was announced, aimed at strengthening healthcare and support to those most affected by the pandemic. Biden suggested a second “recovery” package to come in around February during his State of the Union address (date still not specified).

Markets were initially sceptical of the Democrat Party’s ability to pass such legislation, putting “reflation” trades under scrutiny. US equities fell, also due to US retail sales and manufacturing data showing lackluster progress made in economic recovery.

One thing that I think was missed was Biden’s comments regarding large-cap equities, with listeners more focused on the stimulus details:

“Where we’re making permanent investments, recurring investments – as I said in the campaign trail, we will pay for them by making sure that everyone pays their fair share. Not punishing anybody. We can do without punishing a single person by closing tax loopholes for companies that ship jobs overseas, or allow American companies, 90 of the top Fortune 500 to pay zero federal income taxes. Asking everyone to pay their fair share at the top so we can make permanent investments to rescue and rebuild America. It’s the right thing for our economy. It’s the fair thing. It’s the decent thing to do.”

President Joe Biden

While closing tax loopholes isn’t contentious, a higher effective tax rate for large-cap corporates has the potential to change their relative Earnings Per Share (EPS).

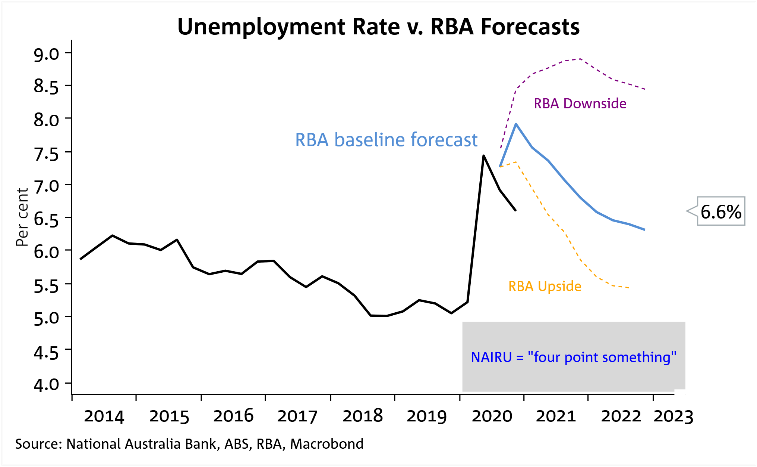

25th Australia recorded a whole week of zero locally transmitted COVID-19 infections, which set the scene for further easing of restrictions post-Australia Day public holiday. We bring this up as it also factors into monetary and fiscal policy, where Treasury and the RBA’s “upside” scenario comes back into play – where our economic and mobility data exceeds their projections, and our economy should outperform.

The best indicator for this will be watching our domestic Labour Force statistics, particularly the unemployment and underemployment rates, which the RBA uses to assess spare capacity within the economy.

28th Online retail equity brokers in the USA called Hammer Time on a number of high-flying stocks that were being squeezed higher by their retail clients, after US regulators stated they were monitoring the “volatility in options and equities markets”.

The broader equity market took this as a positive sign after a number of hedge funds were facing eye watering losses due to the extreme short squeeze.

We can’t help but notice the similarity of recent retail exuberance in US stock markets to the dot-com bubble in 1999.

The most notable this week has been GameStop (GME), which has shot up 1914% – not a typo.

Personally, I’m already committing the week to memory as I know I’ll be making references to it over the coming months, year and decades.

Looking forward

The big calendar event in February will be the impeachment trial of Donald Trump, beginning on February 8th.

While impeachment requires a two-third majority – unlikely to be obtained – the voting will be of interest to assess the Republican Party’s reaction to the fallout from the election losses of 2020.

Otherwise, markets will be digesting the “goldilocks” environment where economic data is improving, while some countries have spikes in COVID-19 infections, creating a not so hot, not so cold economic environment.

We’ll go into more detail on these factors in tomorrow’s note.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.