As was largely expected the RBA yesterday decided to increase the cash rate to 3.35% with a 0.25% increase from their December meeting. There were a couple of key messages in the statement around inflation expectations and future rate hikes.

Underlying CPI continues to race ahead of RBA expectations, where they noted the latest data print of 6.9% ‘was higher than expected’, blaming global factors and strong domestic demand. Although the RBA stated that inflation, in their view was likely to moderate to 4.75% this year and to approximately 3.00% by mid-2025. This was pushed out from the December statement where inflation expectations were to reach a fraction over 3.00% through 2024. The market had a more benign view of inflation and reacted accordingly.

Further, the RBA pointed to a very tight labour market which continues at around 3.50%, the lowest unemployment rate since the 70s, albeit with marginal easing in labour shortages beginning to emerge. A higher unemployment level in the future is key to the bank’s expectations on a reduction in inflation, as will feed into the demand narrative. Less workers, equals less consumer demand and economic activity. In theory, this should help to bring inflation closer to their target range of 2.00-3.00%.

The bank’s forecast is for the unemployment rate to increase to 3.75% by year’s end and 4.50% by the middle of 2025. In terms of the broader economy they see slower growth of about 1.50% this year and next year with the global economy also beginning to deteriorate slowly. As with other central banks the RBA sees a ‘narrow path’ to a soft landing.

In the December meeting the RBA expressed that an increase in interest rates further over the period ahead would be required, however curiously amended the language to ‘expect further increase(s) in interest rates will be needed in future months’. A subtle but somewhat telling change to the statement. Economists from banks were quick to raise their rate expectations with CBA (increase of 0.50% to 3.85% from 3.35%) and RBC (increase of 0.25% to 3.85% from 3.60%). Others including ANZ and WBC remain with their terminal rate forecast of 3.85% (peaking in May), NAB still have 3.60% (peaking in March) and DB have a more pessimistic 4.10% (peaking in August).

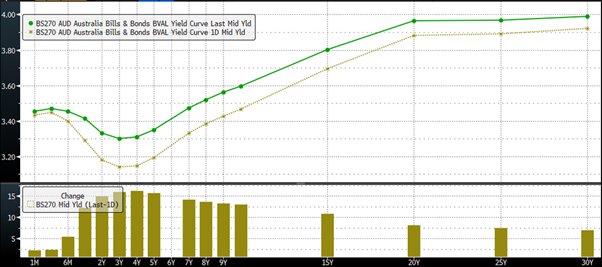

The bond market reacted by selling rates pushing Government yields higher by 0.13% to 0.15% across the curve out to 10yrs. Given further rate hikes at this stage appear to be somewhat locked in, it appears the Aussie rates curve continues to expect rate cuts out to 3yrs even though the RBA sees inflation above its target, through to at least mid-2025. The market doesn’t believe the RBA will be able to sustain their hawkish stance on inflation with deteriorating domestic and global economies.

The RBA has indicated they will be data dependent and the paths to bringing inflation down are many and uncertain. Only time will reveal who is the more accurate. In the meantime, the risk to further selloffs in rates remains, until the rate path is more certain, ways to play this would be staying in FRNs or adding Fixed on further sell offs.

Aussie Rates Curve change on RBA Decision

Source: Bloomberg

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.