Australian CPI is released monthly, and the annualised rate released on Wednesday 25 January was a truly shocking 8.4%. This series is very new and the ABS has decided that it will not be as comprehensive as the quarterly release which covers a wider range of items.

The quarterly result of +1.9% for an annualised 7.8% was well above market expectations but perhaps not as frightening as the monthly print. The bond market had traded as if inflation was no longer an issue in the lead up to the release with “traders” pushing pricing up on very low volume. Since the release of the data the 3 year bonds are nearly 30 basis points higher in yield and the 10 years are up 20bps. Fast money was driving a bond rally, but fast inflation delivered a serious repricing.

Australia is by and large an optimistic place, but throughout the pandemic Australians saved in much higher than normal proportions. Once restrictions were relaxed the desire to make up for 2 lost years became evident. The December quarter with the most significant contributions coming from domestic holiday travel & accommodation (+13.3%), electricity (+8.6%), and international holiday travel & accommodation (+7.6%).

Electricity is not something consumers have much if any control over – although Australia does have one of the highest adoption rates for domestic solar installation. Going for a holiday is a vastly different segment and demand does not seem to have been tempered by the rate hikes already put in place by the RBA.

“Tradable” items saw lower increases than expected with food and vegetable prices lower than expected as weather and other logistics improved supply. Petrol was also lower reflecting global price movements in oil. The supply side shock is clearly beginning to normalise but that is being rapidly replaced by increases in services inflation.

Services inflation is much more likely to be affected by the hike in interest rates than pricing of commodities and energy. A surge in the cost base of inputs for any business is very difficult to control with monetary policy. In fact monetary policy actually increases those costs further by pushing up the price of financing.

The next wave of this inflation pulse is now being driven by services not the supply side issues of late 2021 and the first half of 2022. That services cost includes wage pressure as labour markets are very tight. In the US there are currently 1.7 job openings for every unemployed worker. The numbers are not as dramatic but similar in Australia. This follows many years of moderate and sometimes negative real wages. 2022 saw one of the biggest reductions in real wages that this generation of workers has ever seen. The tight labour market could well see workers recovering some of that lost wage growth and an outside chance of getting back to positive real wages in coming years.

This supply side pressure will be very unsettling for central banks globally. One of the constant themes has been that higher rates will temper the inflationary pulse and in fact will drive a recession (and rate cuts) by the end of 2023. The continued strength in GDP and inflation as well as moderate rather than disastrous leading indicators is forcing the market to re-evaluate the timing of the inevitable slowdown.

US GDP was released on 26 January and also showed little signs of a slowdown having beaten expectations. US results season has been broadly as expected and the US yield curve is now reflecting an extended hiking cycle but a return to “normal” inflation without cash rates dropping much below 3% over the next 3 years.

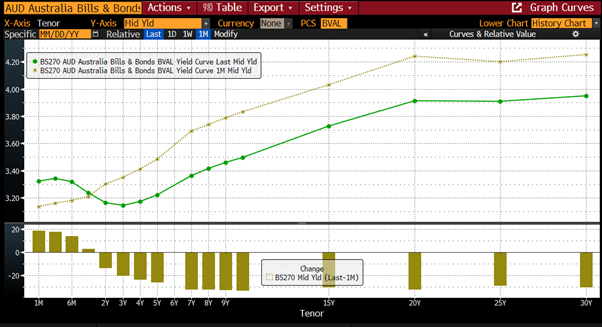

In Australia the yield curve had been positively sloped but bond market rallies over the last month has implied our terminal rate would be around 3.35% and that a slowdown by the end of 2023 will cause a rate cut before new hikes in 2026. The persistence in CPI and the switch to services as the main driver makes the consensus view that rates will be paused after the RBA board meeting on 7 February very different than the path the RBA are communicating.

The old saying “don’t fight the Fed” has been important to remember in 2022. The market seems to be pushing back against the RBA and although another rate hike is all but in the bag for 7 February, the current low yield curve will come to blows with the RBA, and in the short term the RBA always wins.

Source: Bloomberg

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.