For the everyday Australian, their superannuation account will be one of the most important investments of their lives, serving as a stable base to support their retirement.

We are blessed with having one of the best superannuation systems in the world, ranking third in terms of superannuation assets to GDP at 175%.

Central to our success has been the requirements of mandatory superannuation contributions, where employers must contribute 10% of an employee’s wage into their superannuation, with this rate set to rise to 12% by 1 July 2025.

However, systemic flaws exist through how superannuation funds are mandated to control our assets – both through performance evaluations introduced through the recent Your Future, Your Super reform, and the large proportion of assets held in unlisted securities.

Given its importance to our lives, we should spend time dwelling on how we can improve our retirement outcomes, instead of trusting in our superannuation funds to act with our best interests in mind.

Your Sub-Par Future, Your Super

The Australian government implemented the Your Future, Your Super reforms within the 2020-21 Federal budget, to ensure underperforming superannuation funds were kept accountable through conducting yearly performance evaluations.

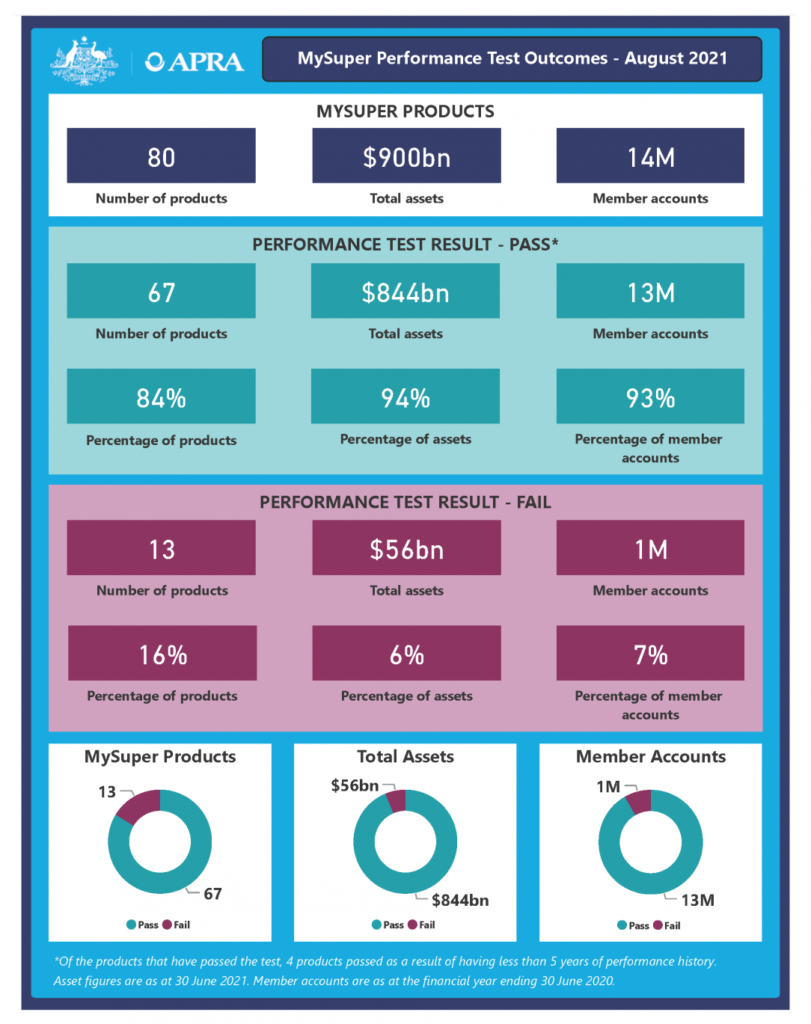

In August of this year, APRA released its findings, where 13 MySuper products were deemed to have failed the test, totalling AUD$56bn in assets and spanning 1 million accounts.

Those superannuation providers which failed the test were required to contact their members, advising of their underperformance and recommending the re-evaluation of their investment.

Source: APRA 2021

Whilst this yearly evaluation will lead to greater transparency and accountability, it has also created a culture which prioritises risk taking, where we have essentially penalised any funds which may have adopted more conservative positioning over the past year, which may have been prudent to their objectives during the middle of a recession.

Furthermore, these reforms encourage conformity, where funds which may seek to adopt more contrarian positioning will be disincentivised by the fear of failing their performance review.

This will mean that funds will not focus solely on the greatest interests of their clients, where some funds may have higher proportions of older members, who preference capital preservation to a greater extent, but instead will be driven by the positioning of their peers.

This is all a worrying development, as greater conformity will also see enhanced levels of volatility in domestic equity markets, as super funds will be incentivised to allocate capital in alignment with their peers.

Illiquid Assets in Liquid Portfolio’s

Unlisted assets form a key component within many superannuation accounts and serve as one of the largest points of differentiation between superannuation providers, where many are able to outperform through their superior levels of access within the illiquid asset universe.

Whilst the exposure they offer is often a valuable and stable source of diversification, the manner in which we value these assets is inherently flawed.

For liquid assets, valuation methodologies are clearly defined and identical for all.

For illiquid (unlisted) assets, valuation methodologies are subjective, where forecasting of future cash flows and the rate at which these cash flows are discounted are all a matter of opinion, not fact.

If illiquid assets are valued too highly, then incoming investors are disadvantaged to the benefit of existing/outgoing investors.

If illiquid assets are valued below their true value, then vice versa – it is a zero-sum game where one party will always be disadvantaged.

The impact of this inequality is driven by the relative level of cash flows, and as the majority of the Baby Boomers are now within their retirement years and withdrawing from their super balances, the impact will only grow in size.

Moreover, recent reforms have pushed greater cash flows, where AUD$36bn was withdrawn during 2020 in response to the COVID-19 pandemic, as well as the elevated level of movements between funds caused by the performance evaluation from Your Future, Your Super.

Transparency is Not the Answer

Whilst this is a positive step forward in enhancing transparency and accountability for the asset allocation practices of super funds, it is a misguided step which will expose the valuation of unlisted securities.

This will enable prospective buyers of these unlisted securities to place their bids at the exact levels where the super fund values it – capping any upside for investors and potentially leaving billions on the table.

With the sale of larger infrastructure assets, these disclosure requirements are particularly disadvantageous, as there are often only a limited number of bidders – and sometimes only one, where they can easily just bid according to the super fund’s valuation.

Not So Super

As the old adage goes,

“It’s now how much money you make, but how you much money you keep”

We do have one of the largest superannuation sectors in the world, but this also means that the implications of mismanagement are much higher.

Recent regulatory reforms have not been made in the best interests of superannuation members, where risk taking and conformity have been encouraged, and capital preservation and contrarianism have been punished.

The valuation of illiquid assets has always generated inequality in outcomes, however, enhanced disclosure to investors will also lead to sub-optimal outcomes in the event of a sale.

These issues will impact almost all of us reading this note – and should be well publicised to ensure that our superannuation sector continues to work in our best interests.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.