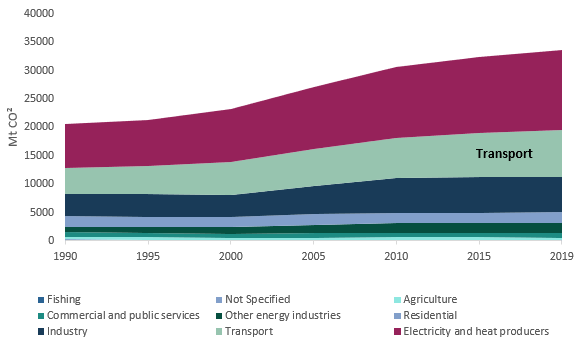

Decarbonisation has been one of the most talked about phenomenon’s over the past few years, as governments and institutions grapple with how to meaningfully reduce emissions to a point where we can avoid irreparable damage to our planet.

Central to the task at hand for policy makers has been our global energy mix, which is the single largest contributor to CO2 emissions and one of the toughest riddles to solve.

Chart 1: Global CO2 Emissions by Sector

Source: International Energy Agency

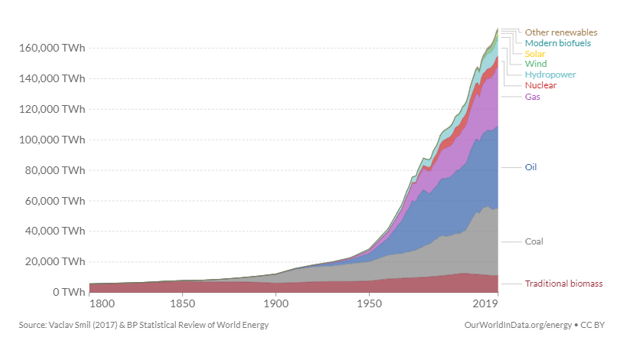

Over the next 30 years, we will have to significantly reduce our usage of fossil fuels, through deploying renewable energy technologies (some of which do not yet exist) at a scale which has never been accomplished.

Whilst carbon capture technologies can help reduce emissions, we must still significantly reduce our fossil fuel usage – which made up 79% of our global energy mix in 2019.

Chart 2: Global Primary Energy Consumption by Source

During our journey of developing renewable energy technologies, we have succeeded in the generation of energy through wind, solar and hydroelectric means.

What we have lacked is a scalable and effective manner to store this energy once it is generated – a void which lithium has begun to fill.

The size of the opportunity from the storage of this energy is immense, where it covers automobiles, homes and grid level storage.

If lithium is able to claim this mantle, our future portfolios may include lithium as a core exposure – where we might see lithium names alongside BHP and RIO in many Australian investor portfolios.

As the topic of today’s note we will cover the Lithium sector – how lithium batteries work, the factors driving investments and the available exposures on the market.

How Do Lithium Batteries Work?

Max has already covered battery technology in the past, but as a refresher we will go over the basics of lithium battery technology.

The Lithium-ion (Li-ion) batteries we know today were first invented in 1991 and have seen little change since that time.

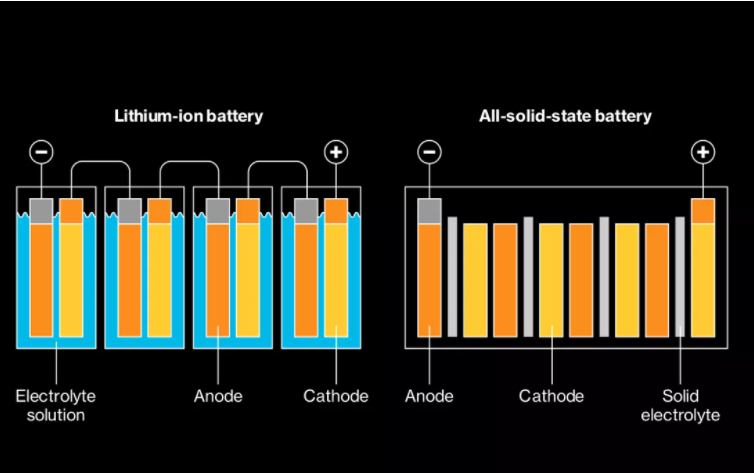

Li-ion batteries will contain four key components – a cathode (usually made out of lithium metal oxide), an anode (usually made out of graphite), a separator, and an electrolyte (lithium conductive salt and organic solvents).

Chart 3: Lithium-ion vs Solid-State Battery

Source: Toyota, Bloomberg

Through these four key components, Li-ion batteries are able to effectively receive, retain and distribute energy – with a relatively high level of energy density.

However, Li-ion batteries are not perfect and can sometimes overheat given the presence of a liquid electrolyte.

The process of overheating occurs when the liquid electrolyte expands (as a result of heating up), putting pressure on the casing of the battery and exploding if there are defects from production.

Solid state batteries could have the potential to alleviate these issues, through the removal of the liquid electrolyte, and replacing this with a solid electrolyte.

The solid nature of the electrolyte enhances stability, making it non-flammable, and much safer than Li-ion batteries.

Moreover, by having a solid electrolyser they are able to have a greater energy density, being at times half the size of Li-ion battery, and therefore having double the energy capacity.

Right now, solid state batteries are yet to be rolled out at a commercial level, but once they are, EV’s will be able to cover twice the distance, and be much safer.

When it comes to competitors, there are no alternatives which can currently compare to Li-ion batteries in terms of scalability of commercial production.

As Max touched on last week, hydrogen battery technology could be the next best alternative, though it is yet to be produced at scale in a profitable manner.

Other battery technologies like steel flow batteries could offer more efficient long-duration commercial storage solutions, with investors in the market leading manufacturer ESS Inc (NYSE: GWH) including the likes of Softbank and Bill Gates’ Breakthrough Energy Ventures.

Similarly, Vanadium Redox Flow Batteries (VRFB) could be an effective means for long-term grid storage, however its physical footprint would prevent it from being used in more mobile use cases – like EV’s.

What’s Driving Lithium Investment?

On the demand side, forecasts for EV production will see consistent growth in demand for lithium over the next few decades, with Deloitte predicting that EV’ will make up approximately 32% of new car sales by 2030.

Considering the size of the total global car market, this will involve the sale of over 100 million EVs by that point in time, with JP Morgan forecasting lithium demand to increase 10-fold over that period.

On the supply side, a production lead time of 3-7 years means that current market imbalances are likely to remain for the short-medium term, where rising lithium prices may not even slow demand given consumers have proven to be quite price insensitive.

Nevertheless, shocks to lithium prices could come should major developments in hydrogen fuel cell technology eventuate, or if any other alternatives to lithium batteries are commercially developed.

Investing into Lithium

Investments into lithium can come along multiple points in the supply chain, with each sector carrying different market dynamics.

Miners

The obvious choice for investing into the lithium supply chain is the miners.

Australia makes up around 20% of the world’s lithium deposits, second only to Chile.

Yet when it comes to production, Australia currently leads the world, with political issues largely stifling the establishment of a strong lithium industry in Chile.

Some exposures listed on the ASX include Mineral Resources (ASX: MIN), IGO (ASX: IGO) and Orocobre (ASX: ORE).

Abroad, the two largest players in the space are Albemarle (NYSE: ALB) and SQM (NYSE: SQM), who both conduct the majority of their mining operations within Chile.

All of these miners have business operations outside of lithium mining, where some are involved in the mining of other resources or are involved further up in the lithium supply chain.

Chart 4: Lithium Miners (1-year performance) – MIN (red), IGO (yellow), ORE (blue), ALB (green), SQM (purple)

Source: Bloomberg

Battery Producers

For the sake of brevity, we will skip over the chemical converters and the producers of cathodes and anodes within the supply chain and get straight into the battery producers.

The production of lithium batteries is largely centred around a few companies – being Samsung SDI (KRX: 006400), LG Chem (KRX: 051910), Panasonic (TYO: 6752) and Contemporary Amperex Technology Limited (CATL) (SHE: 300750).

All 4 companies have been involved in the production of EV batteries, and will likely continue to be heavily involved given the scale they have been able to build.

Chart 5: Battery Producers (1-year performance) – Samsung SDI (red), CATL (blue), LG Chem (yellow), Panasonic (green)

Source: Bloomberg

Original Equipment Manufacturer (OEM)

There has been a trillion-dollar company who hasn’t been mentioned yet, which has been synonymous with the expansion of the industry – Tesla (NASDAQ: TSLA).

Along with its EV business, Tesla is also involved in the production of batteries for its Powerwall and Powerpack product lines.

Beyond its obvious business in selling EV’s, Tesla could play an equally large role within the industry through providing lithium batteries for home and grid energy storage.

Chart 6: 1-year Tesla Performance

Source: Bloomberg

Whilst Tesla’s lithium batteries may not be as suitable for these largescale means of energy storage when compared to the aforementioned steel flow or VRFB batteries, the key point is that the technology is tried and tested, and ready to be rolled out immediately.

Lithium to the Rescue

The task ahead to reach net zero emissions by 2050 is extremely difficult and will require a reorganisation of our entire energy mix over the next 30 years.

Luckily for investors, this will result in one of the largest reallocations of capital in history, where we will see significant investment from institutions and governments all with the common goal of decarbonising our economy.

When we look at the energy supply chain – battery storage stands as the bridge between renewable energy and consumer use, and subsequently carries significant importance.

As the only scalable battery storage option in the market, the lithium industry is set to continue growing at a rapid pace for at least the next few years, as our demand for EV’s and home/grid battery storage expands.

Whilst it may be supplanted by more efficient hydrogen technology in the future, decarbonising activities are of critical urgency, and must be rolled out immediately and quickly to avoid irreparable damage to our climate.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.