Early in the morning of 2 February Australian time the Fed raised the target Fed Funds rate by an expected 25 basis points to 4.50/4.75%. Chair Powell noted there was no reason for the Fed to differ from its guidance that rates were still only mildly restrictive and that inflation needs to be lower before the Fed will change its course and begin to ease. In response to a question in the press conference Powell noted that he didn’t see a cut in 2023 if the economy performs broadly as expected. He did note that other people had forecasts of inflation coming down much faster and if that were to happen then it would be incorporated into FOMC thinking.

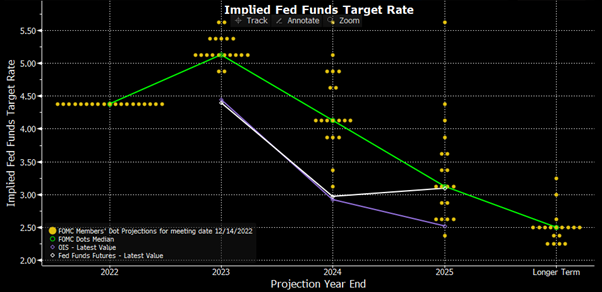

The second half of that message reinforced market views that the Fed has got it wrong and that not only will rates not need to get to 5.00%, but there would be at least one rate cut by the end of 2023. The chart below shows the divergence between market rates and the expected Fed Funds rate as predicted by the people who actually set those rates…the FOMC.

Figure 1: Fed projections – FOMC members v Market Pricing – Source Bloomberg

The current US yield curve expects rates to be 50 basis points lower than the Fed by the end of 2023 and an even more contrary 1.15% by the end of 2024. To put this in context, the Fed has a history of assuming its policy will have the desired effect meaning it overestimated the two year forward rate for most of the 2010s and could not have predicted the need for a COVID response in 2020.

On the other hand, the market was convinced well before the Fed that rates would have to move into the 4.5-5% region as early as March 2022. At the time the Fed thought the supply side issues causing price shocks was transitory, but following the Russian invasion of the Ukraine the sticky nature of the inflation problem became apparent to all.

Interestingly the market implied Fed Funds rate for end 2024 has remain solidly anchored at 3% since that time despite the Fed wildly changing their expectations for both the terminal rate for this hiking cycle and the length of time before it is “safe” too ease. The market pricing has been anchored largely on a view that either inflation moderates and rates can normalise or a slowdown will be significant causing a quick reduction in rates to take the choke hold off the economy. The fact the market is decoupled from the Fed is not unusual, but the fact the expectation for 2024 has not moved in a year is interesting.

The more pressing question is what should investors do with this information. As bond markets are already priced for significantly lower rates is there value in getting long duration now. The question of how long rates stay elevated is still open and at the end of the day it is the Fed rather than the market that gets to set the rate.

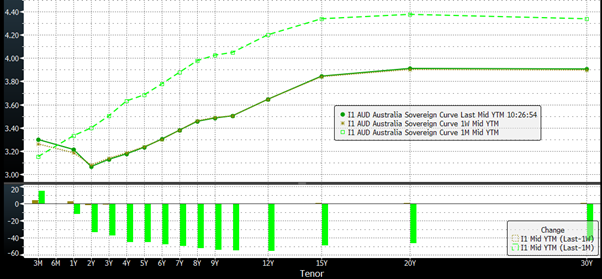

The knock on effect for Australia is also very interesting. A month ago, the market did not believe inflation was under control and that the RBA would need to stay on a rate hiking or pausing schedule for years into the future. We have a rates decision due from the RBA on Tuesday 7 February. Over the month the market has decided this will not only be either the last or second last hike, but that there will be rate cuts in early 2024 followed by hikes again by the beginning of 2025.

Figure 2: Australian Bond Curve current and 1 month ago – Source Bloomberg

The markets all tend to run on momentum and adjust slowly over time to the maths of the time value of money. At the moment the bond market momentum is heavily weighted towards a slowdown, inflation being under control and the central banks needing to cut over a relatively short timeframe. If there is a lag in the inflation recovery or a sense that the economy is remaining robust enough for any easing to be met with a rush of new consumer demand, then the maths will make a lot of the positioning look brave. We are fighting the Fed (and the RBA) and they have often been wrong, but at the end of the day they are the ones who set the maths exam.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.