The RBA may be rueing their decision to temper the pace of their rate hikes this month with a truly awful CPI release on 26 October. The tough news was CPI in the quarter hitting 1.8% and 7.3% annualised, both well above market economist’s expectations.

Troublingly the CPI Trimmed mean which measures the change in the price of goods and services purchased by consumers, excluding the most volatile 30% of items was at 6.1% annualised, far exceeding the expectations of 5.5%.

Bond markets appear to have shrugged off the news and are trading at only mildly higher yields than those from just before the release. In fact the bond market is at lower yields than a day earlier on the back of a more benign US Treasury market.

The biggest surprise in the release was a rise in electricity prices despite various government rebates coming online. Sydney power bills were 25% higher. These government programmes in WA Qld and the ACT will terminate in the December quarter and power bills in those states are expected to rise 16.6% in the next CPI release.

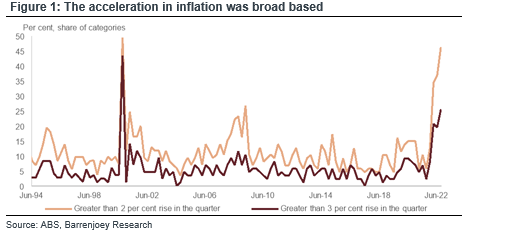

Notwithstanding the energy shock, the fact the trimmed mean had many contributors passing on big price changes will be a worry. 46 per cent of the inflation basket saw a rise of more than 2 per cent in the quarter – the largest since the 1980s if you exclude the introduction of the GST in 2000. One in four items experienced a quarterly rise of more than 3 per cent.

The RBA will have been aware this release would be disturbing and in fact their analysis from earlier in the year concluded inflation could hit 7.7% by year end. It is puzzling that they have slowed the pace of hikes with the scenario they had anticipated actually being delivered.

Some commentators have suggested this may mean there is a wait and see approach being taken now on monetary policy – the rhetoric has changed from emphasising the need to curtail excess demand into a recognition that the impact of the steep hikes from earlier in the year will manifest over the next few months. Of course that will have little effect on the price of energy but may reduce spending in more discretionary items, reducing the ability of providers to past cost increases on.

Like many financial markets, the bond market is now focused on calling the pivot from a hiking cycle to a pause or even the need to cut because the economy responds to the hoped for lower consumption with a sharp contraction. It feels early to view fixed interest with pricing upside when inflation is clearly not tamed and the hiking cycle is not yet at an end.

Perhaps most oddly the AUD has staged a rally, rising in response to the CPI and despite bond yields dropping. In the Australian budget released only the night before this data, it was clear that the phenomenally strong current account surplus and equally phenomenally weak AUD had delivered Treasurer Chalmers a welcome buffer of tax revenue from the mining and energy boom. A higher AUD actually helps the inflation outcome but is not so helpful for the budget.

As the battle against inflation seems to be left to monetary policy alone with no directed cost of living programmes announced, the RBA has released a paper saying the lower AUD has not been a major factor in boosting inflation because on a trade weighted basis our currency has remained stable relative to our major trading partners.

The RBA will be hoping that the inflation pulse from the northern hemisphere has peaked, this is key to containing flow on effects and as we have seen there is broad based pressure. If this does occur and rate hikes slow globally they will be seen to have repaired some of the ill will following the reversal of their view rates would not rise until 2024 which had been widely reported.

We are at a very delicate point with record inflation and a central bank indicating they don’t want to over tighten given the effects are not yet fully felt. We have not reached their expected high inflation level yet and it is clear energy costs will be a key contributor to the December quarter release. Accommodation costs and mortgage rates are rising, weather has exacerbated supply chain disruptions for food. It may only be a matter of time before wage pressures take over as the key factor for cost increases at which point the hoped for pause may be short lived.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.