The biggest impact inflation has had is not the higher cost of gas for the American commuter or that steak is a once a fortnight not once a week family meal, but a quick unwinding of the “extraordinary” financial measures put in place since not long after the GFC to “protect” the world from disinflation. Markets had settled into a cosy understanding that rates were being engineered low and even weak income streams were valuable in comparison to what else was available.

Inflation expectations are the “trigger” for central banks to hike rates, and Russia’s invasion of Ukraine changed those expectations globally. Inflation from that point to now has largely been a function of supply issues.

Lithuania for example has suffered annualised 21% inflation in June 2022 seeing food & non-alcoholic beverage prices jumping 28.5 percent alongside transport housing and utilities. These are not discretionary items, consumers having to buy these necessary items in scarce and expensive supply. Taming that level of inflation is beyond any central bank and the population can only hang on until the horror show is over.

Vladimir Putin has explicitly said that generating inflation in the West was a key tactic once NATO countries began to support Ukraine’s resistance efforts “Further use of sanctions may lead to even more severe – without exaggeration, even catastrophic – consequences on the global energy market,”

The inflation report for the US released on Wednesday night is the next signpost for whether the US Federal Reserve has lost control like the Lithuanians.

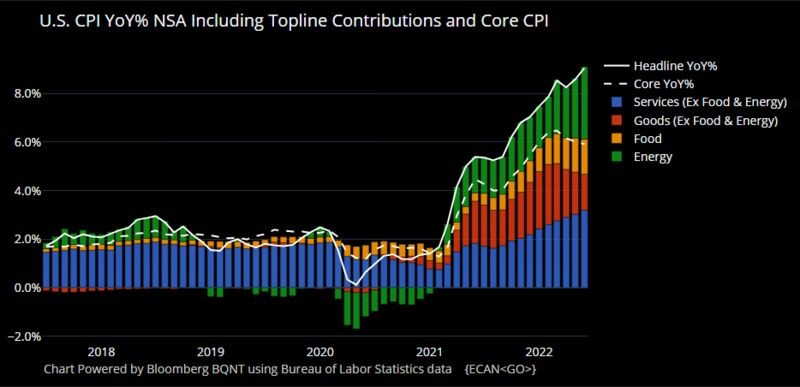

Market economists have pored over the numbers looking not just at the headline rates (1.3% for the month, 9.1% for the year) but also how each component contributed and whether their contribution will be persistent or reaching the end of its upward pulse. There were hopes that the worst of the rises would be contained in the Food, Shelter and Energy segments, but pressures there are permeating into the economy more broadly as cost bases rise so even the core measure was +5.9%.

This year’s core inflation is the highest for 40 years.

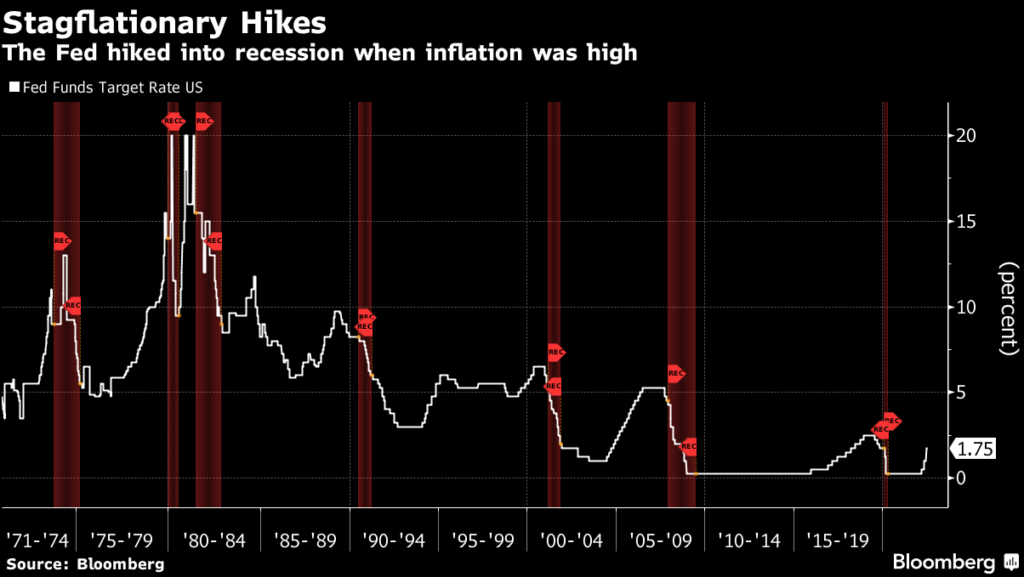

Markets were already expecting the Fed to respond with significant rate hikes but this hotter than expected CPI falls just before a summer shutdown in August for the Fed. Even more of the inevitable hiking will be front loaded with a 100 basis point rise now beginning to be priced in at the July meeting.

The sharp tightening that is the Fed’s only tool has to achieve its aim of reducing inflation expectations staying high. If not, the tightening cycle cannot finish until the economy slows so much that it becomes vulnerable to recession.

The last time the Fed was raising rates during a recession was in 1980 when the recession had begun 3 months before the last hike.

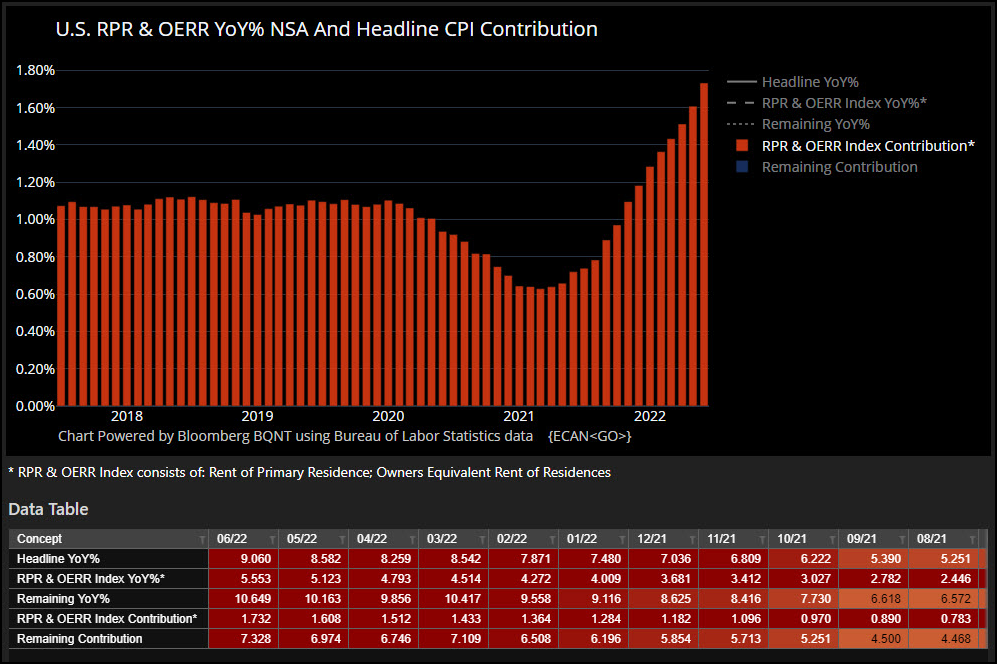

Stopping the higher prices for energy, food and shelter being distributed into the wider economy is only possible if the sellers of goods and services do not have the pricing power to pass it on due to weak demand. This inevitably pressures margins and Fed actions are being keenly watched by Earnings analysts. Interestingly the cost of shelter is rising very rapidly yet so far only recovering the ground it lost in the depths of the pandemic.

Once the shock of 9.1% CPI is digested, markets will refocus on the future path for both the Fed and inflation. There is now a widespread belief that a slowdown in the US and globally is inevitable as monetary policy seeks to limit demand. The outcome for stocks and bonds can diverge greatly here, bond traders are already positioned for rate cuts, but the path of earnings for stocks is much less clear. Historically earnings have grown in inflationary spikes, but there are few similar cases to 2022 in terms of the pressure on margins.

Unlike countries like Lithuania, the US economy has many levers to pull and many ways to substitute away from globally imported problems. The Fed themselves are relatively toothless and as Ben Bernanke (former Chair of the Federal Reserve Board) once remarked “Monetary policy is 98% talk and only two percent action.”

The wonder that is the US economy has access to more substitutable resources than almost any other country. They can be oil independent, they can be food self sufficient and they have a big enough labour pool to resist unsustainable upward pressure on salaries. Inflation expectations always remains a key focus, but poor leadership and policy can be better withstood by that economy than most.

This inflation pulse in many ways corrects the effects of many years of regulator, central bank and government intervention in markets. The process is uncomfortable, and volatility is not yet contained while the inflation beast is out of the cage. The pain being felt now is pain that these interventionist policies put off to the future but could never erase.

Economies are resilient, rates hikes will be front loaded and the removal of the market interference so quickly will bring back a normalisation of cause and effect in economies that has been missing some time.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.