“And we’re falling all over again,

Like a flashback to way back when,

Back when we were us.”

Luke Combs (2019)

It is becoming a consensus view that an Australian economic recovery, as well as a global recovery, hinges upon people:

- Being able to return to work

- Returning to work

- and businesses becoming comfortable in their outlooks to deploy funds into consumption, investment and business operations.

In Australia, both our national jobs and employment data and consumer confidence data were released last week.

Consumer Confidence

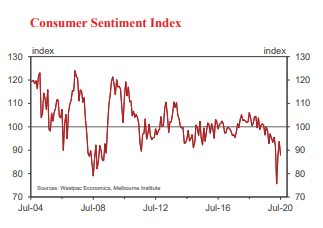

The Westpac-Melbourne Institute Index of Consumer Sentiment – try saying that three times quickly – fell 6.1% to 87.9 from 93.7 in June.

The survey was conducted in the first week of July – across the nation – and covers the period after Victorian Premier Andrews announced Melbourne lockdowns – but reports before the latest Sydney clusters were reported.

The result in confidence reverses all June’s gains, taking the Index back to the weak levels seen in May, though above the extreme low of 75 seen in March.

Source: Westpac-Melbourne Institute

It may seem simple, but I think it is worth mentioning that sentiment has been rocked by the resurgence of Coronavirus cases over the last few weeks.

After averaging about ~10 cases a day over the last month, new cases have lifted significantly to ~200 per day during the July survey period.

State-level readings of confidence underscore the importance of virus-related developments to consumer behaviour:

- Victoria’s sentiment index dropped 10.4% in July;

- Whereas other States and Territories dropped 4.5% on an average basis

- Non-VIC results were likely weaker because of the linked likelihood that VIC resurgence could lead to further lockdowns in other States and Territories.

Outlook for Confidence

Westpac economists highlight that while previously surveyed respondents were confident the damage from the virus would be short-lived, this set-back over the last month raises significant doubts over our ability to contain the virus permanently, limiting the extent to which the economy can return to business as usual.

The renewed outbreak points to a slower and more difficult path ahead for foreign education, hospitality and tourism sectors, all of which may see longer lasting restrictions even if the latest outbreak is successfully contained.

Employment data

Last Thursday, the Australian Bureau of Statistics (ABS) published the all-important monthly employment data, detailing employment figures, the unemployment rate, labour utility and underemployment figures to name but a few.

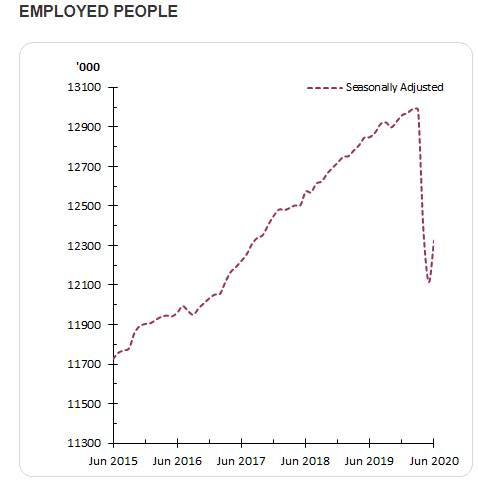

The headline figure looked promising, with employment rising by 211k persons and hours worked increasing by 4% in June from May’s figures.

On face-value, this would show a clear turn-around since the 870k jobs that were lost in March-May period, and hours worked having fallen by 10%.

Where I seem to be contrarian

I wrote my summary of these results – what you’re reading below – before reading any other economist or journalists’ interpretation of the results. Having read several views before writing this missive, I’ve noticed that I seem more negative than average.

This is unusual, as I’m usually more optimistic.

Total employment increased by 210,800 to 12,328,500 persons.

Full-time employment decreased 38.1k jobs to 8.489m.

Part-time employment increased by 249k jobs to 3.839m.

The part-time employment gains were largely offset in the headline unemployment rate as the “new” jobs added were people that had left the labour force in March-May as they were not employed or unemployed and looking for work. Hence, they have re-commenced work.

This saw the participation rate increase from 62.9% to 64.0%, and headline unemployment to move UP from 7.1% to 7.4% – yes, a HIGHER unemployment rate.

Where I’m negative

I see this as negative long-term for our domestic economy as seeing full-time employment drop in June when we were meant to be re-opening is indicative of protracted and possibly permanent unemployment.

This puts heavier burden on society through emotional distress to individuals and families, and longer-term requirements on government through social welfare and unemployment benefits.

Part-time jobs – which includes casual and contract workers – is a more volatile dataset and usually more volatile during economic downturns. Contract workers are usually the quickest to be let go, and the quickest to be re-hired relative to full-time employees.

To put this employment “recovery” in perspective, here’s what the bounce back looks like – with the small up-tick being June’s result.

Source: Australian Bureau of Statistics

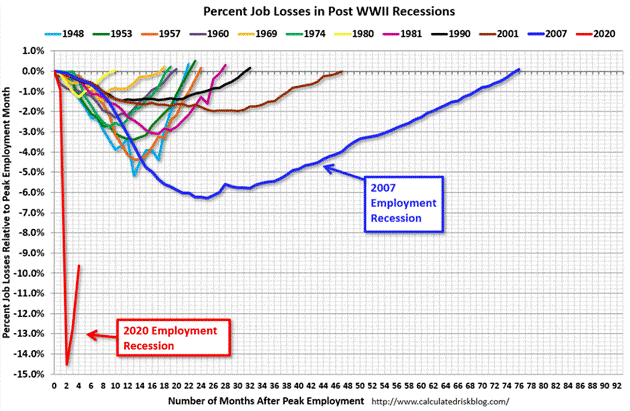

I worry over the full-time employment decrease as being indicative of a trend we mentioned last week in a discussion of US employment trends.

Employment takes longer and longer to bounce back

Since World War II, each recession sees labour markets take longer and longer to return lost jobs to the labour force.

The below graphic is of US labour market recoveries, with the magenta, black, brown, blue (the last 4 crisis) taking longer each time to recover.

Source: Calculated Risk

This is because of the evolving and increasingly changing nature of global consumers.

Markets are able to morph quite rapidly in response to technological innovations and changing consumer demands, even now more than ever through the near-immediate awareness via news and social media platforms.

We note how quickly certain drug/vaccine producers have become household names during this crisis, similarly, programs such as Zoom that have become overnight sensations for business use.

Tying the two together

Both consumer confidence and employment data are highlighting that a return to “normal” or pre-COVID levels of activity and employment are some time away.

Both datasets will remain key in forecasting our future economic welfare and prosperity – as:

- people need to return to work and earn wages in order to consume or invest

- households and business need to have confidence in their futures to spend these wages/earnings.

As uncertainty remains, financial markets could continue to trade with more volatility than historical averages – as outlooks should change more rapidly in response to forthcoming data – be it economic or health specific.

As always – we remain nimble and mentally flexible to adapt our views to the ever-changing world.

Jesse Imer – Fixed Income Strategist and Chief Worrier

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.