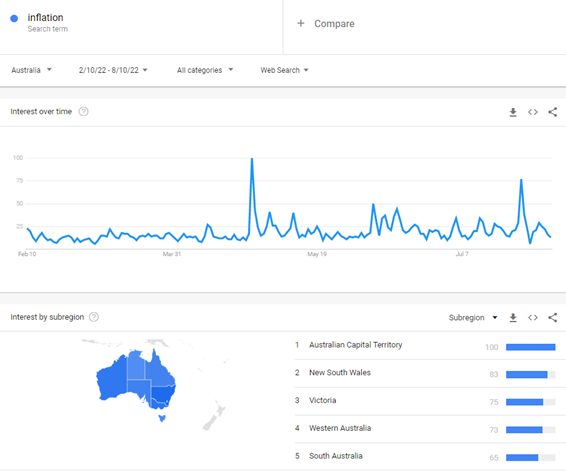

Google Trends is a highly unscientific tool to see what is important to people. Looking at the chart below it seems only a few of us were checking for the latest inflationary developments before the Russian invasion of Ukraine started sending shockwaves in late April. Inflation has been just a concept for younger generations, here it had suddenly come to life and we were keen to find out more.

Interest had another upsurge when Australian inflation hit 40-year highs last month but it looks like the story of higher prices is now boring for most.

So what is the so what? Do wage demands rise because workers are now comfortable with the higher costs being inevitable? Do they react stoically and accept they need to work harder or longer to keep the same living standards? Do asset prices need to adjust further because inflation is baked in?

Although boring for many of us the lack of clear answers to these questions has been driving markets into their current state of “directionless volatility”

US CPI was released overnight on 10 August and was slightly below market expectations at 8.5% (8.7% expected). Although a better result than expected, this has been interpreted by markets as a sign that the crisis has passed (equity markets staged a rally and bond yield were a little higher). This reaction to a better than expected but still much higher than acceptable CPI is a sign that the focus is firmly on the future not the present and potentially not the near future.

Fed officials had to speak to the markets to urge them to not lose focus on the fact the battle against this inflationary pulse is not over. Bond yields had pushed lower with an expectation that the need to keep raising rates has lessened. Post sobering comments, those lower yields retraced.

Minneapolis Fed President Kashkari said the CPI release may be a “first hint” that inflation was moderating, but that he was still firmly of the view that the target rate for Fed funds would 3.75-4.00% at then of 2022 and 4.25-4.50% at the end of 2023 (currently 2.50%). Kashkari also said expectations of the Fed cutting next year are “not realistic.” Chicago Fed President Evans, speaking separately, said that rates will continue increasing as inflation is still “unacceptably high.”

As we have noted in the past, the Fed and other central banks have one main tool, the blunt instrument of the overnight cash rate. Although they have added QE to their armoury, there is little expectation that another round of that activity would occur in anything but the most dire circumstances. Influencing the market’s perception of the likely path of rates becomes their focus when they are between policy-setting meetings.

Keeping the market focused on what now appears the boring old story of inflation is proving difficult and contributing to the “directionless volatility”. We have no Fed meeting until late September so officials are facing an uphill battle to keep the message that inflation must be tamed at the forefront of decision-making.

The key downward influence on headline CPI was a reduction of gasoline prices by 7.7%. Excluding the volatile Food and Energy components, the monthly CPI was actually slightly negative (but rounded up to 0.0%.) Food prices rocketed to more than offset the reduced price of “gas” gaining more than any time since 1979. Rents continued to be a key component that has not yet finished its upward swing. The pattern of price rises for each component remains very uneven.

As costs weave their way through the supply chain the Fed wants to make sure expectations remain modest. An exuberant consumer could enable more pricing power and endorse higher consumer inflation.

The impact for Australia of the seemingly milder US CPI permeates through most markets. There has been a substantial reduction in petrol prices here, a parallel to the US. Food pricing is still on an upward arc here, like the US. The complicating element is that Australian CPI is only released on a quarterly basis and the next release is not until October. Markets will draw parallels to the US and rates, equities and the currency all reflected in parallel to the US post the release.

Keeping Australian consumers and markets focused on inflationary concerns will not be straightforward for the RBA. Fatigue with that old story and a lack of hard data for the next 2 months will contribute to the battle they have to keep the message fresh. As boring as CPI feels, its influence over market pricing will not dilute for some time yet.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.