On Tuesday 19th the minutes of the July RBA Board meeting that decided to raise the Cash Rate by 50 basis points was released. The Board said that it was absolutely determined to “withdraw some of the substantial policy stimulus that had been in place and had highlighted their willingness to raise policy rates more quickly and above neutral levels if inflation remained high.” Rates are going higher and the Board is telling us that they may continue to go up beyond levels that the market economists like Bill Evans of Westpac had expected. Westpac’s call is currently a pause at 2.60%, but only a day before these minutes were released ANZ revised their “terminal rate” expectation to above 3% by year’s end. These Board minutes and speeches by other senior RBA staff may see further revisions – to the upside.

Besides obviously needing to unwind the monetary conditions we found ourselves in at the height of the pandemic, the setting for interest rates now must overcorrect and at least attempt to soften demand as inflation reached heights not seen since the early 70s. The Board said at least three times that the economy was “resilient”.

People with mortgages who buy food, go shopping and own shares (in other words most of us) are indicating they don’t feel as resilient as the RBA suggests. The Westpac Melbourne Institute Index of Consumer Sentiment fell 3.0% to 83.8 in July, from 86.4 in June.

Not long after the minutes were released Deputy Governor Michelle Bullock delivered a speech with the title How Are Households Placed for Interest Rate Increases?

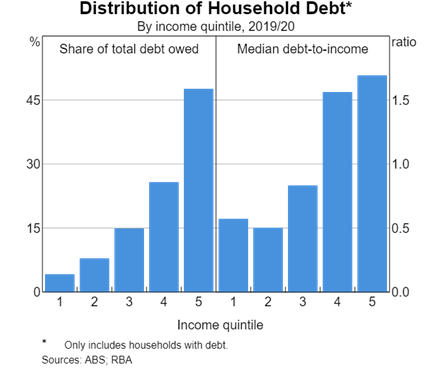

DG Bullock noted that borrowers with high debt to income (“DTI”) ratios are the most problematic for both lenders and regulators. This was followed by “broadly, investors with high-DTI loans are more likely than other borrowers to have high liquidity buffers; they also tend to be wealthier and have higher incomes. This group of high-DTI borrowers has historically been less likely to experience mortgage stress than other borrowers.” So these high leverage loans are not concerning the RBA even in the event rates rise and house prices fall.

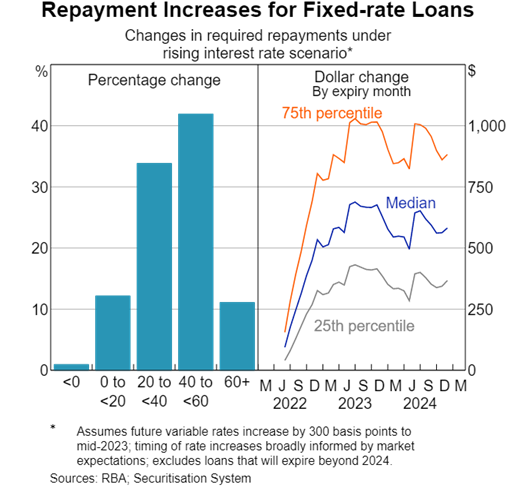

Not every mortgage in Australia is floating rate and some borrowers are facing quite high increases in their servicing costs once their fixed period ends (the vast majority by the end of next year.) The graph below shows how much more those borrowers would be paying and there was a little nugget of a clue as to how high the RBA thinks rates might rise in the notes at the bottom. The graphs were drawn with an assumption rates will rise a further 300 basis points from their levels today, which is in fact much more than market expectations.

Notwithstanding the modelling of another 300 basis points of hikes, recognition of the vulnerability of high debt to income borrowers (meaning some homeowners may have to sell in a weak market) there seems no current concern about the economy-wide effect of significantly lower house prices. The wealth affect of much lower house prices was not mentioned at all.

This very sanguine view of the ability of borrowers (even the most high risk) to withstand interest rate rises and house value drops has many commentators branding the talk as “Hawkish” and heralding an even more aggressive stance on monetary policy. There was little to point at in the speech that suggested the RBA is concerned that higher interest rates were going to cause a house price crisis. There was also little recognition of the fact that the RBA had provided very enticing interest rate forward guidance (“no rate rises until 2024”) which many of the vulnerable homeowners might have taken into account.

According to DG Bullock, “While in aggregate it seems unlikely that there will be substantial financial stability risks arising from the household sector, risks are a little elevated.” Not elevated enough to take a further 3% of rate hikes off the table. Homeowners who are worried by that prospect could well head for the exits sooner rather than later.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.