With the new year came a new US administration in the White House, where President Joe Biden has since divulged foreign policy priorities, amid the backdrop of rising tensions between the US and China centred around flashpoint issues such as Taiwan, Hong Kong and Xianjiang.

From the US perspective, it’s about supporting nations which prioritise democracy and human rights, which China perceives as a strengthening of the hegemonic power structures that stand as a threat to their future expansion.

To date, retaliation has been primarily facilitated by the imposition of economic sanctions between China and the U.S. and its allies.

Australia is wrapped up in the middle of this through its position as a key strategic ally to the US and has been subject to a plethora of trade sanctions from its largest trading partner, China, because of this.

However, the possibility of armed conflict has increased as China continues to ramp up its threats to invade Taiwan, with some predicting the likelihood of Indo-Pacific conflict at up to 50%.

Whilst any significant conflict is unlikely, consideration of geopolitical factors has become increasingly more important in asset allocation discussions, where geographical exposure and industry level sanctions have begun to hold greater influence over corporate profitability.

In today’s note, we will review the current geopolitical situation in the Asia-Pacific region and the implications which this holds for asset allocation.

Taiwan

Taiwan, officially known as the Republic of China (ROC), was formed in 1949 by the nationalist Kuomintang party as they fled from mainland China (now referred to as the Peoples Republic of China) after losing the Chinese civil war.

From here, they intended to control mainland China, being widely recognised as the legitimate Chinese government, holding China’s seat in the United Nations until 1972.

Currently, Taiwan maintains a fully functional, democratically elected government, whilst the Peoples Republic of China views Taiwan as a breakaway province in the “One China Principle”.

As a result of these conflicted perspectives, no country has ever maintained formal diplomatic ties with both China and Taiwan, with many favouring China in an official capacity given their economic growth in recent decades.

Many nations like the US and Australia hold functional relations with Taiwan, however, this remains unofficial in a diplomatic capacity.

For years, the PRC has sought to reunify Taiwan with the mainland, even proposing a “One Country Two Systems” approach similar to that used with Hong Kong.

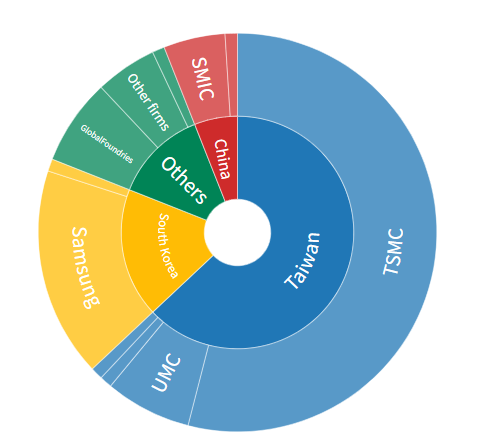

As Taiwan has prospered economically, its strategic importance to China has grown, serving as a vital hub for the production of electrical equipment – primarily as the leading global producer of semi-conductors.

Semiconductor manufacturers by market share:

In recent times, China has increasingly indicated its desire to re-unify Taiwan – which could involve an invasion should Taiwan not co-operate with the CCP.

“Taiwan is clearly one of their ambitions…. And I think the threat is manifest during this decade, in fact, in the next six years”

– Admiral Phillip Davidson, Commander of the U.S. Indo-Pacific Command

What Does This Mean for US-China Relations?

The US and China hold the world’s largest trading relationship, and as such, conflict between the two must be viewed with great significance when considering the health of the global economy.

Taiwan has become a considerable point of contention between the two countries, with the US continuing to offer support to Taiwan in the form of trade and investment talks and weapons supply in the face of the Chinese led diplomatic and economic coercion.

Existing relations are already frosty, with former president Donald Trump’s “trade war” still in place, in the form of significant tariffs placed on Chinese exports to the US.

From a Chinese perspective, a lack of support from other major nations means that the prospect of armed conflict is unlikely, however, further economic sanctions remain the likely method of retaliation.

Its Not Just Taiwan

Other areas of contention within the Indo-Pacific will also influence the geopolitical stability of the region.

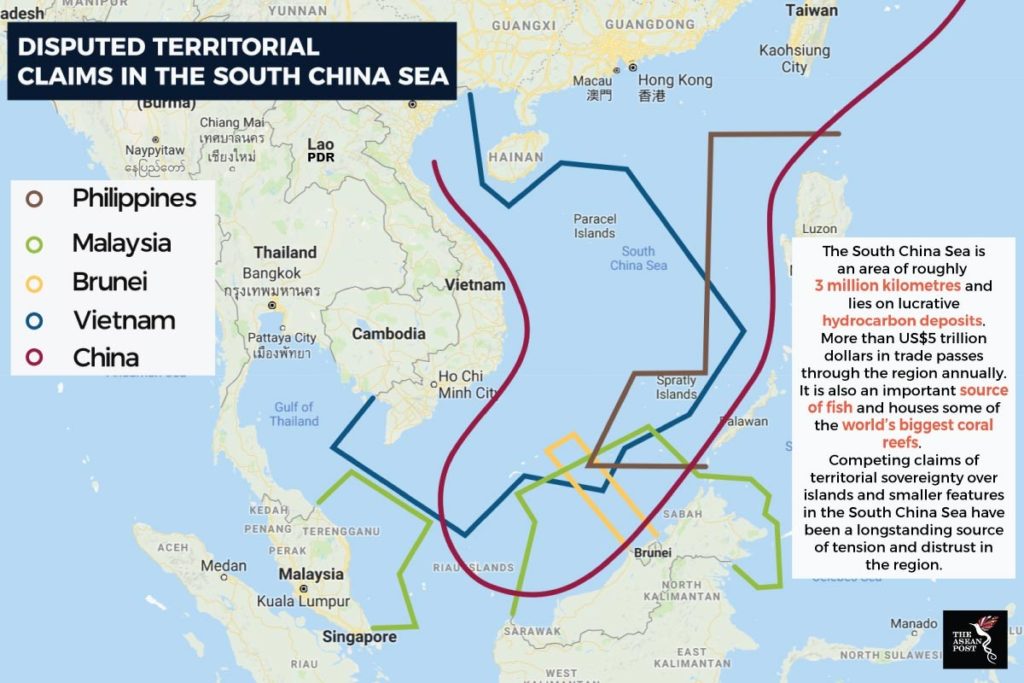

The South China sea possess an abundance of marine and natural resources, as well as serving as a vital shipping channel with up to 33% of global trade estimated to pass through the region.

As a mechanism to assert their presence into the region, China has artificially expanded the small island chains of the Paracels and the Spratleys, creating fully fledged military outposts on these islands, though they are yet unproven as militarily strategic assets.

Naval incursions are frequent within the region, and given the cultural and economic significance of shipping and fishing territories, the area is likely to be disputed territory for years to come.

What Does This Mean for Asset Allocation?

Whilst greater impositions of trade sanctions from both sides could have company specific implications, negative impacts should be minimal when it comes to broad asset allocation, if disputes remain limited to sanctions only.

Certain industries are relatively immune to trade sanctions due to scarcity of supply, with lithium and iron ore exports from Australia in particular shielded through a lack of supply from other nations.

Regions with cheap labour forces also look set to benefit from increasing supply chain diversification.

These forces have been in play since the emergence of COVID-19, which revealed the extent to which global supply chains rely on China and offer attractive growth prospects in the long term.

India in particular looks set to gain most from supply chain diversification, with exposure to India being something we’ve touched on in the past, with ASX options including the ETFS Reliance India Nifty 50 ETF (ASX: NDIA) and the Betashares Indian Quality ETF (ASX: IIND).

Apple (NASDAQ: AAPL) has led the diversification charge through its leading iPhone manufacturer, Foxconn, announcing plans to move 30% of its production of China, and to produce the iPhone 12 solely in India.

Other countries in the region like Vietnam and Cambodia also look set to benefit, with Microsoft (NASDAQ: MSFT) already pledging to move production to Vietnam.

Surveys have found that 49% of supply chains will become more diversified in 2021, with 37% intending to become less reliant on China.

Those companies with diversified supply chains will be well positioned should any conflict or further sanctions emerge and will become an increasingly more important part of company level evaluation.

For companies with supply chain exposure to the Indo-Pacific region, the old adage will hold true – you are only as strong as your weakest link.

Will We Actually See Any Conflict?

Whilst there has been much posturing from the CCP, it remains unlikely that we will see any major armed conflict in the coming years.

For China, a lack of support from major allies will mean that conflict with the US will bring forth significant trade sanctions from major trade partners around the world, and further hamper their economic growth prospects in the years to come.

It’s only real major ally in Russia would be unlikely to assist in a major conflict within the South China Sea due to its reliance on EU oil consumption, and would also be unable to offer the naval assistance China would require to win in a major conflict within the South China Sea.

Similar to the Soviet Union’s experience with the Cold War, the CCP would also place its future at risk if they were to lose, given the reduction in support it would likely experience from its citizens.

What is most likely to occur is continued pressure from China on Taiwan in the form of economic sanctions and diplomatic coercion, as well as potential minor skirmishes related to China’s efforts to gain more territory in the South China Sea.

Now more than ever, diversification in portfolio construction is key.

Centralisation within specific industries and geographical regions may expose investors to targeted economic sanctions and by products of armed conflict.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.