For investors, risk and return go hand in hand where for a potentially higher return on capital, there is a corresponding increase in risk.

This is known as the risk-return trade-off.

It is important to be aware that investing is not risk-free, and there’s a chance you can lose money or receive a return on investment that is less than expected.

The latter is what we’ll focus on today – not making as much money as you expected or taking risk that was not commensurate with realised returns on investment.

The Risk Report

Northern Trust recently published “The Risk Report” that details their findings from four-years of analysis of institutional investor portfolios covering:

- Over 1000 different strategies

- $200bln USD of equity portfolios by value

- And 64 different institutional investors

In short summary, the report found six common drivers of unexpected results in investors’ portfolio performance, uncovering uncompensated risks.

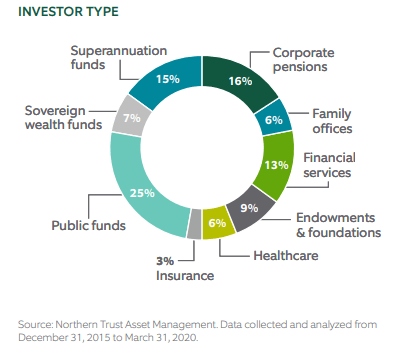

The below are the types of investors participating in the study.

Key Discoveries

- Institutions had nearly 2x more uncompensated risk versus compensated risk

- Underlying portfolio holdings that were supposed to be uncorrelated to the other components of their portfolio were not, which hurt performance

- Hidden portfolio risks caused unintended outcomes

- Investors adopting “conventional style” approaches had index-like performance but with higher fees than ETF products

- Over-diversification diluted performance – often where managers held too many assets in an attempt to diversify than was necessary

- Attempts to “time” markets led to underperformance due to poor timing or missed returns from sitting on cash

Uncompensated Risk

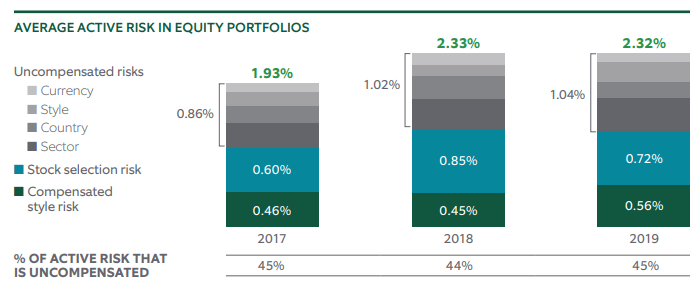

Investors and fund managers need to be aware what risks are inherent to their portfolios and that not all risks are created equally.

With knowledge of the risk-return trade-off, we must be aware of what active risks we are taking and impacts of what risks we’re being compensated for and those we are not.

Historically, uncompensated risks have been a result of:

- Foreign currency – exposure to foreign currencies that weren’t hedged

- Style/Strategy of investment – high volatility, low dividend, value vs growth, momentum, large cap etc.

- Country – exposures to foreign countries and regions

- Sector – exposure to different industry sectors

- Asset selection – For those that buy individual assets (rather than managed funds or ETFs), idiosyncratic risks from individual securities that were not due to the overall market risks

Source: Northern Trust

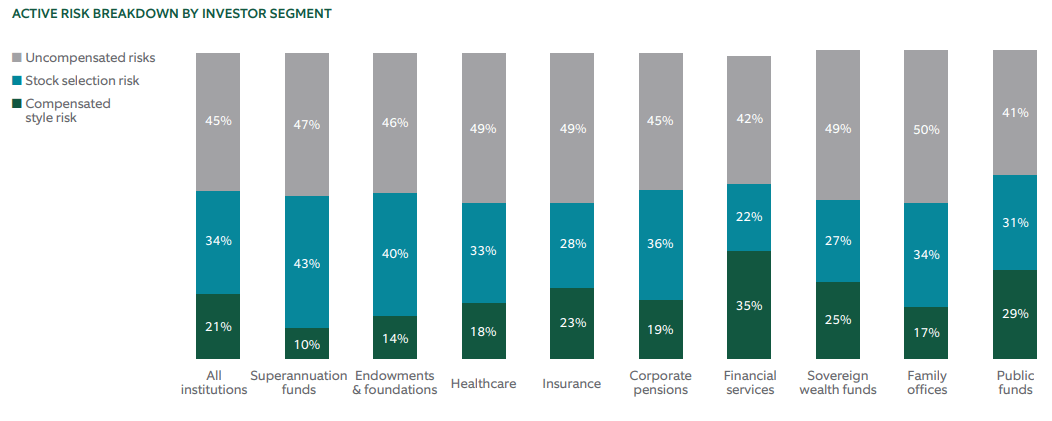

All investors had uncompensated risk

What I found most interesting was that all investors exhibited uncompensated risks in portfolios – remembering that all these investors were considered “institutional” and manage several billion or more USD each.

Also, the uncompensated risks were ~2x the compensated risks being sought, making portfolios inherently more risky compared to their intended design.

In essence, this wouldn’t necessarily mean the portfolios would underperform, but indicates the uncompensated risks could lead to performance different to expected performance.

Source: Northern Trust

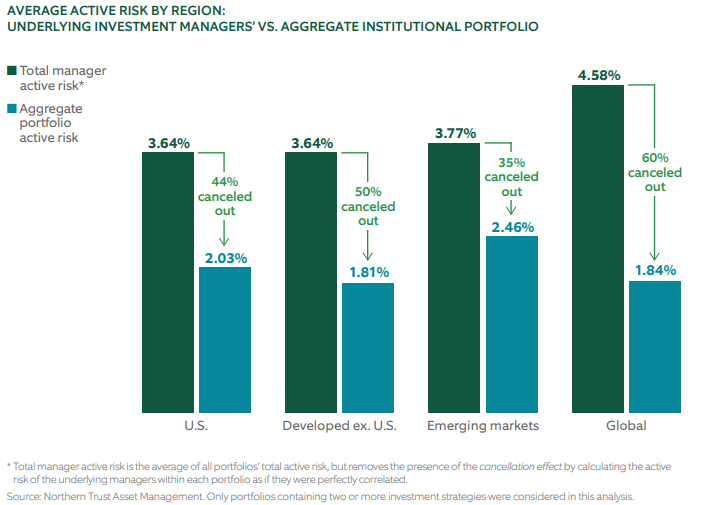

The “cancellation effect”

A cancellation effect is caused by unknown and offsetting exposures among holdings deteriorating investor ability to outperform benchmarks.

For example, a manager taking a 3% overweight position in Telstra while another manager takes a 3% underweight position in Telstra will effectively cancel each other out in a client’s overarching portfolio.

This is also seen when clients hold both growth and value style investments, which historically offset performance.

Shockingly, Northern Trust found that nearly 50% of active management exposure was lost, which translates into paying 2x more for each realised basis point of return than originally thought.

Higher fees

It’s worth remembering that if portfolios globally are underperforming because of cancellation effect, higher fees are being paid without a resulting risk exposure.

How this occurred was that portfolios were generally containing a diversified group of managers that on paper, looked to deliver a broad combination of styles, but in essence, resulted in portfolios that mimicked benchmarks and netted each other out.

For example, one investor hired two managers: one to generate exposure to the Russell 1000 Value index and another to generate exposure to the Russell 1000 Growth index.

In reality, the realised portfolio performance of both managers was that of the Russell 1000, but at a higher fee.

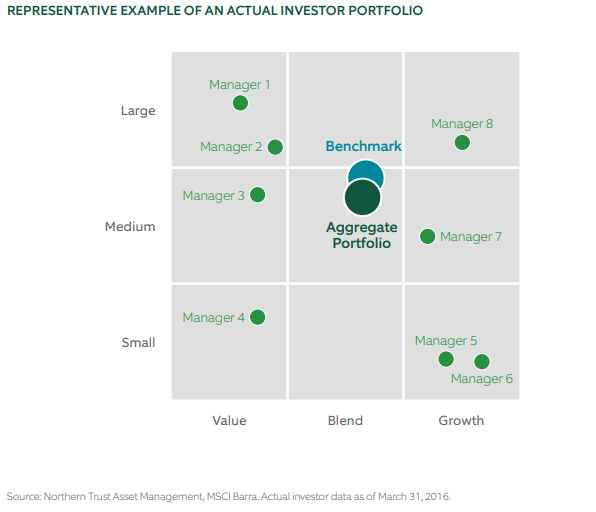

When an institutional investor outsources to several external managers across different styles (i.e. value, growth), in aggregate they return benchmark-like returns (blue dot below).

Managing risks

Overall, investors need to be active in their allocation to risk, where risk taking is appropriate.

To do this, we need to be informed of the risks inherent in a portfolio of assets and be aware of how the different components combine.

Northern Trust’s analysis found that categorically, global institutional asset managers underperformed benchmarks and achieved outcomes different from intended results because they were creating portfolios that mimicked various benchmarks, but overpaid fees because of the cancellation effects of different managers and investments.

The continued underperformance of the broader global active management community has seen multi-year outflows from active strategies to passive, at a generally lower cost.

This doesn’t mean that active management is inferior to passive management or passive investment strategies. However, it does mean that active management needs to re-think portfolio allocation to align objectives with results.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.