“To be an investor is to live constantly at the intersection of story and uncertainty. We build our mental models, frameworks, and processes to try to accurately price securities and overlay them with a story about the economic, geopolitical, and psychological factors that frame the backdrop to value them. We create data-driven stories to explain our differentiated view of a security that is out of balance within its sector or asset class to justify a variant perception that we think will generate alpha. Sometimes, however, investors might create a framework that seems sound only to discover that the method is actually no better than a system to “win” at Russian Roulette. The key, of course, is to change your framework when the environment changes – – Since I started Third Point 27 years ago, I have seen many investors (including myself) stumble after years of success because they did not adapt their models and frameworks quickly enough as conditions shifted. I have said before that they don’t ring a bell when the rules of the game are changing, but if you listen closely, you can hear a dog whistle. This seems to be such a time to listen for that high-pitched sound.” – ThirdPoint CEO Daniel S. Loeb

I read the quote above this week, and I thought it was worth sharing. It is easy to look at those sectors of the market that have fallen the most and automatically assume that when the market corrects, they will mean revert. In several conversations I am having of late, I have been asked about investing in the Growth/Nasdaq/ARKK/Crypto et al complex.

Whilst I dislike using the words “it is different this time” the fact is that we need to adjust our “mental models” when thinking about where to invest next. I choose the word ‘invest’ purposefully as I am not really one for short term ‘trades’. Some of these proposed ‘trades’ may not provide the short-term outsized returns expected as in my mind it is not as simple as just putting money to work in the sectors that have fallen the most.

Anchoring is a cognitive bias described by behavioural finance when an individual makes new decisions based on the old, anchor number. I believe that there has been a paradigm shift and the portfolio structures, sectors and stocks of the last decade (or so) will not be those that will outperform during the next decade (or so). Hence, I caution an assumption of mean reversion.

It is safe to say at this point that inflation is not transitory. However, the reality is that secular dis-inflation driven by demographics, globalisation and technology essentially just shifted the components of the economy where inflation manifested i.e. to asset values. The ‘basket’ as measured by CPI did not sufficiently reflect the true dynamics of inflation across the economy. The rich got richer, and the poor got poorer i.e. the wealth divide expanded over an extended period of time.

Additionally, this secular dis-inflation that we have ‘enjoyed’ has essentially allowed central banks to reduce volatility in the economy for an extended period of time, by retaining highly supportive monetary policy.

‘‘Stability breeds instability because stability itself is destabilizing’’

Hyman Minsky

What is unclear is whether the shift into de-globalisation or ‘slowbalisation’ as some are calling it, combined with the ‘green’ capital spend required to shift to net zero will combine to simply neutralise the secular dis-inflation (demographics and technology are still at play) or are they sufficient to shift into secular inflation.

With cyclical inflation now manifesting across the measured ‘basket’, central banks can no longer come to the rescue given the cyclical inflation unwind required which is why the Powell Put is shifting further and further out of the money. It’s also clear that within GDP the share going to profits is very high relative to that going to labour. Consequently, we also see this pendulum to shift back toward labour over time via wage inflation.

Importantly the rolling back of years of poor monetary policy and years of capital under-spend is not going to be an overnight event. These shifts are here to stay and the realisation will come slowly to many; investors, central bankers and politicians.

In the long-run nominal bond yields tend to equate to nominal GDP. Thus, in my opinion, we are still some way off equilibrium with global government bond yields at 2-3.5% and nominal GDP much higher, thanks to inflation. For these two dynamics to normalise we need either more interest rate increases and/or a decline in nominal GDP.

The Gordon Growth Model, otherwise described as the dividend discount model is a valuation method that can be utilised to value an individual stock or an index for that matter. It is used to determine the relationship between growth rates, discount rates and valuation.

The formula is simple; d/k-g where ‘d’ is dividends, ‘k’ is the required rate of return (cost of equity) and ‘g’ is the expected dividend growth. I like to think about dividends and earnings as interchangeable in this context.

If growth slows the higher the denominator becomes and the lower the valuation. If the required rate of return is going up as well, then the denominator in the current environment continues to increase which is not conducive to investing in long-duration assets. Especially those that were not supported by fundamental valuation in the first instance.

In my opinion, one needs to be careful automatically shifting into high growth names on the basis of an automatic assumption of mean reversion. In an inflationary environment, real assets and commodities prevail but one of the sectors that we have not focussed on until now are dividend compounders.

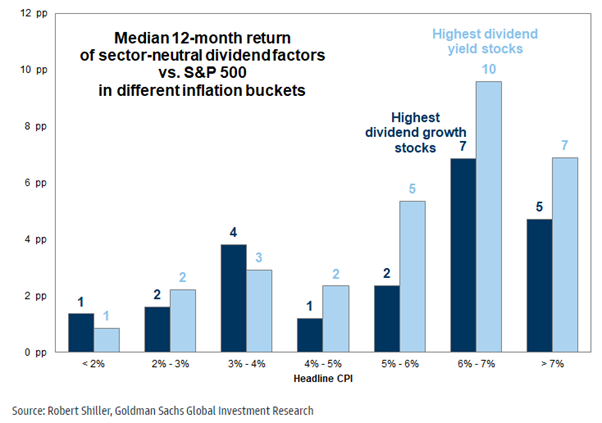

High dividend yield and high dividend growth stocks typically outperform during periods of high inflation and currently trade at attractive valuations as shown in a chart from Goldman Sachs below:

Chart 1: Stocks with high dividend yields or dividend growth both outperform the market during periods of high inflation

We also believe that we are transitioning from a decade of focusing on top-line growth to a cycle where investors will focus increasingly on margins. In the deflationary dominated cycle post the financial crisis, weak aggregate demand and lower inflation pushed nominal GDP and average earnings growth down.

The scarcity of top-line growth made it more valuable and this was further enhanced as interest rates fell, pushing up the relative value of longer-duration assets. In the current environment, with higher inflation, nominal GDP is higher and top-line growth is less scarce. Instead, the higher inflation puts greater value on margins and lower volatility of margins.

Investors should focus on companies irrespective of sector or region that can secure margins and generate good compound returns in an environment of lower index returns. Quality, sustainable dividend growth will become more valued as investors increasingly focus on compounded returns over time. Strong balance sheets and relatively low payout ratios also make this a more attractive strategy than in the cycle post the financial crisis.

Interestingly the ETF which best replicates this thinking the Vanguard High DVD Yield ETF (VYM US) has indeed done its job this year, in fact, its performance aligns somewhat to the ASX200 in that year to date it has fallen less than 5%. Its largest sector allocations are Banks, Pharma and Energy with its geographic exposure largely the USA. Even more surprising this ETF has outperformed Vanguard’s Value ETF (VOOV) year to date as well as shown in the chart below.

Chart 2: Relative performance of VYM to VOOV

Source: Bloomberg

Over the medium-term investment horizon, we would argue that dividend compounders should be considered as a key plank within an investors International Equities sleeve of their portfolio. It is not the only exposure we would suggest but could be considered a part of a well-constructed portfolio.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.