The Russian/Ukraine war, strong demand recovery, inflation and weak supply growth have all combined to contribute to significantly higher oil prices to date through CY2022. Consequently, one of the best performing equity sectors globally is unsurprisingly the Energy sector.

I recently listened to a conference call hosted by Citi, with Anders Fogh Rasmussen. Mr Rasmussen has been at the centre of European and global politics for three decades as Secretary-General of NATO, PM of Denmark, Danish Minister of Economic Affairs, and a leading Danish parliamentarian. According to Mr Rasmussen, one of the key risks going forward is that of a prolonged conflict between Russia and Ukraine. Consequently, it is his opinion that additional sanctions may be waged on Russia which could include Oil and LNG.

We hosted a call with the domestic Head of Energy from Citi last week, who suggested that the market is currently trading above supply and demand levels with disrupted oil supply being largely managed by strategic reserve releases. As such Citi expect a net inventory build over the next year and therefore a loose market and consequent oil price softening. This view is predicated on a rapid de-escalation of the Russia/Ukraine conflict without significant long term structural ramifications. Consequently, Citi’s long term oil price view remains USD$55/bbl.

In stark contrast is J.P. Morgan’s supercycle view on the outlook for Energy with a long-term price forecast of USD$80/bbl. In the shorter-term J.P. Morgan see risk of oil prices reaching $125/bbl in 2022 and upside to USD$150/bbl in 2023 (JPM Commodities base case average of USD$104/bbl in 2022 and USD$98/bbl in 2023). J.P. Morgan believe strategic reserve releases are positive, as the move might mitigate recessionary risks to demand. It also supports medium to long-term prices, as inventories decline, and governments look to replenish that crude (in an environment of low spare capacity). Lower production volumes coupled with declining inventories (exacerbated by reserve releases) should result in a higher risk premium to long term oil prices over and above the marginal cost of production at USD$80/bbl. This forms the basis of their structural bullish view on energy equities, also supported by valuations close to all-time lows and implied long term oil prices of USD$65/bbl.

Differing opinions certainly is what makes a market!

In our view, given the inflation and geopolitical backdrop, an overweight exposure to commodities is warranted. Within commodities, Energy has the potential to remain well bid, but volatile.

From an ETF perspective there are a number approaches. State Street’s Energy Select Sector SPDR Fund (ticker XLE) is the oldest exchange traded fund to focus on the energy business. The fund has a focus on the large, integrated oil companies which given the tense political environment makes sense. It’s top two holdings are Exxon Mobil and Chevron and its holdings are virtually all US based.

For a global approach State Street administers the MSCI World Energy ETF (ticker WNRG). The objective of this fund is to track the performance of companies in the energy sector across the developed markets globally. Looking at the holdings your allocation is less concentrated geographically with US listed holdings just under sixty percent and you gain exposure to Shell, Conoco Phillips, TotalEnergies and BP PLC.

For more diversity Van Eck offers the Oil Services ETF (ticker OIH). Once again US focused its top three holdings are Schlumberger, Haliburton and Baker Hughes Co comprising of approximately 40% of holdings. I mention oil services as a diversification away from Russian energy exports will only happen with increased investment and commitment to new projects globally. With that said this grouping of businesses while likely beneficiaries to capital expenditure in the sector, will not see the same level of profit and loss leverage to a higher oil price.

The more direct approach is owning an energy ETF with direct commodity exposure. The United States Oil Fund (USO) aims to achieve its underlying net asset value reflect the price changes of WTI Crude oil futures contract. Futures contracts are the traditional way of gaining exposure to commodities but they trade on different exchanges to listed equities and because of the leveraged nature, timeframe of their contracts are not for individual investors. The ETF wrapper simplifies the process and replicates the exposure.

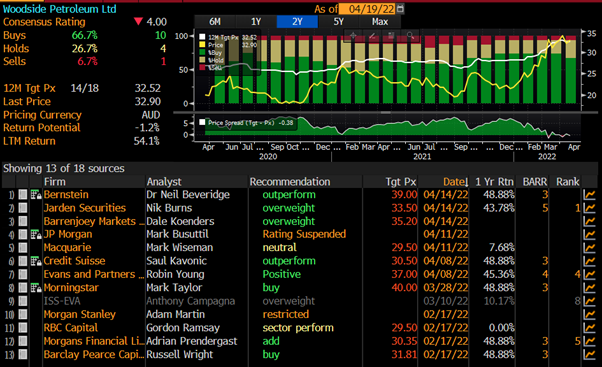

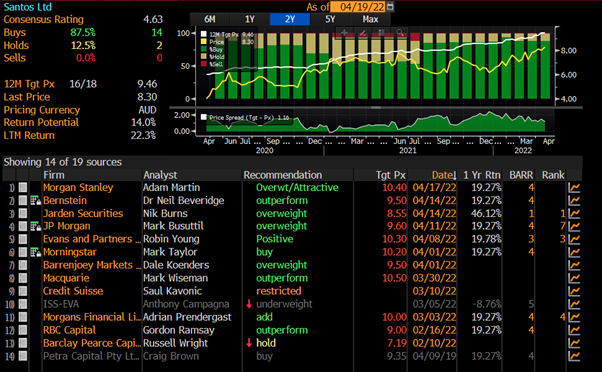

Any discussion on international energy companies should involve Saudi Aramco. It’s the world’s largest crude oil producer by production volume and one of the lowest cost producers. While a listed company it’s still 98% owned by the Kingdom of Saudi Arabia so remains outside an investment option for this forum. Common direct exposures in Australia include Woodside Petroleum and Santos Ltd. Broker forecasts are included below from Bloomberg.

Source: Bloomberg

Source: Bloomberg

In our view retaining or ensuring Energy exposure in portfolios at this stage is important given the prevailing cross currents. We have provided a myriad of ways of attaching to this theme. The irony is that only two years ago the front month oil futures contract settled at negative $37.63 as global lockdowns sparked a derivative lead market freefall on a physically delivered futures contract. Oh how times have changed.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.