Over the past 100 years, financial markets have developed into the beast we now know – offering exposure to anything and everything, ranging from a simple share of Apple to complex derivatives on the Laotian Kip (currency).

As our product offering has expanded, so have our priorities, with investors no longer solely concerned about monetary returns, but also by the societal and environmental impacts of their investments.

In the share market, those companies which promote Environmental and Social responsibility, and good corporate Governance have prospered (ESG).

In the bond market, investment philosophies towards ethical investing have not shifted as rapidly, however, the green bond market has been growing, with fixed income investors increasingly allocating their assets towards those issuers which promote positive environmental outcomes.

Today, we will take a look at what makes a “green” bond, their performance to date, and the dynamics driving their future.

Green bonds

Green bonds are part of a broader subset of “sustainable” bonds, which are those which provide either environmental or societal benefits. They provide a means to which investors can impose their ethical beliefs on corporations, enabling more than just monetary returns.

Green bonds are any type of bond instrument, where the proceeds will be used exclusively for new, and/or existing eligible green projects (as per the Green Bond principles).

These green projects are primarily centred around the decarbonisation of our economy, and include renewable energy, energy efficient infrastructure, clean transportation, green buildings and waste management.

Whilst green bonds may sound great in principle, how do we judge if a bond is green or not?

Moreover, how do we ensure that the capital is dedicated purely towards activities which provide environmental benefit?

The International Capital Market Association’s (ICMA) Green Bond Principles (GBP) serve as a voluntary, best practice guideline for issuing green bonds. It outlines the eligible categories for which bonds can be issued for, the process for evaluation and selection, the management of the proceeds and post issuance reporting.

Once an issuer determines what environmentally beneficial activity the bond will finance, the GBP recommends utilising an independent institution to provide a second party opinion on the bond’s eligibility, as well as a third-party audit, either before or after issuance.

To provide further assurance to investors, issuers are also encouraged to seek certification, with many leading multinational firms such as KPMG, Deloitte and PWC being qualified to issue Climate Bond Standards (CBS) certification, which is awarded on the basis of compliance with the GBP.

As you can tell, the onus largely falls on the issuer to follow best practices in ensuring that funds raised are dedicated solely towards environmentally beneficial activities. With the absence of a regulatory body, these steps are not legally required, however issuers will have to follow these principles to satisfy investors.

But what if companies don’t act in the best interests of investors post the issuance of debt?

This is where sustainability linked bonds come in.

Sustainability linked bonds (SLB)

Sustainability linked bonds are those which have investment outcomes that are inextricably linked to pre-determined KPI’s. They typically involve an increase in coupon rates, relating to pre-determined environmental KPI’s, and incentivise issuers to meet sustainability commitments outlined during issuance.

Italian energy group ENEL, whom were the first to issue an SLB, with bondholders having the potential to be compensated with a 25 basis point increase in coupon rates, should their renewable energy capacity not equal at least 55% by the end of 2021.

Cynical investors may hope that this target is missed given the coupon step up, though failure would also likely involve a decrease in the bond’s capital price given lower ESG strategy-based demand and forced selling.

Much like current structures in place for step ups in coupon rates upon credit rating downgrades, SLB’s will offer downside protection for investors concerned about sustainability-based performance.

Is green always better?

So, how have green bonds performed to date?

Green bonds around the world have typically displayed a “greenium”, with their credit spreads trading at a premium to their vanilla bond equivalents. This premium has existed given the relatively small universe to which ESG orientated fund managers are exposed to, with strong fund flows into these strategies continuing to underpin the imbalance in supply and demand.

In the chart below, the green line represents an index of investment grade green bonds, and the red line an index of investment grade corporate bonds.

This positive credit spread differential should continue to exist in the future when comparing green issuances to equivalent vanilla issuances, due to the additional environmental benefits priced into credit spreads, and the technical support offered by demand from ESG mandates.

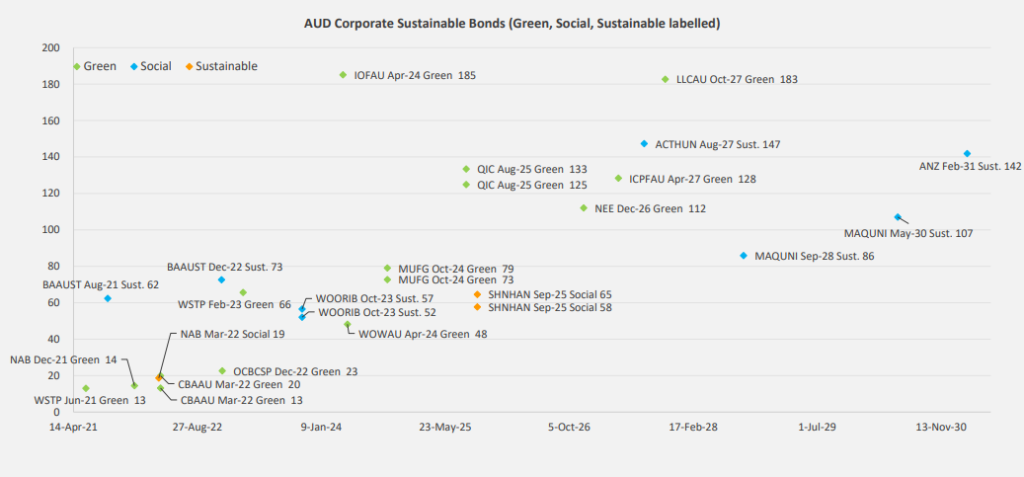

In Australia, the green bond market is relatively underdeveloped when compared to U.S and European markets, however, recent issuances from Lendlease and the 4 major banks have bolstered market supply.

ESG mandates in Australia look likely to continue growing, with 4 out of 5 Australians feeling that environmental issues are important when making investment decisions. The majority of this fund flow has, and will come from Australian superannuation funds, who have both expanded their product offering, and placed greater priority on the environmental and societal impact of their investments.

Feels like a heading should be here too “Closing Remarks”, “Investment Rationale” “Forward Momentum”

Looking forward

As these mandates continue to grow, we will likely see increased green bond issuance, with companies incentivised by relatively cheap, and ample liquidity for environmentally beneficial projects.

Regardless of whether one is incentivised by their positive environmental returns, green bonds offer a unique point of diversification in one’s investment portfolio.

They can act as a hedge against any portfolio constituents which may be negatively exposed to ESG risk, and also tend to be more stable in periods of volatility given the long-term perspective of the bondholders – superannuation funds, insurance companies and sovereign wealth funds.

As the world attempts to be increasingly more decarbonised, green bonds will continue to play a vital role in funding required projects.

Investors will continue to put their money where their mouth is and consider the implications of their investment decisions.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.