Direct Bonds Activity & Flow

Fixed Income is continuing to gather increased attention from investors due to uncertainty in equity markets and bond yields reaching their highest levels in the last 10+ years. Some parts of the market have performed better than others in terms of marking to market, but higher running yields are on offer for investors anywhere from 5% to 11%.

Names in the tables below represent inventory we see of the banks and other Fixed Income brokers. Sector coverage spans financials, corporates and RMBS. Areas of interest across the broader Mason Stevens platform have been in mezzanine AUD RMBS/ABS, AUD Major Bank Tier 2 and AT1s (listed hybrids to a lesser extent), USD Corporate Hybrids and USD Treasuries.

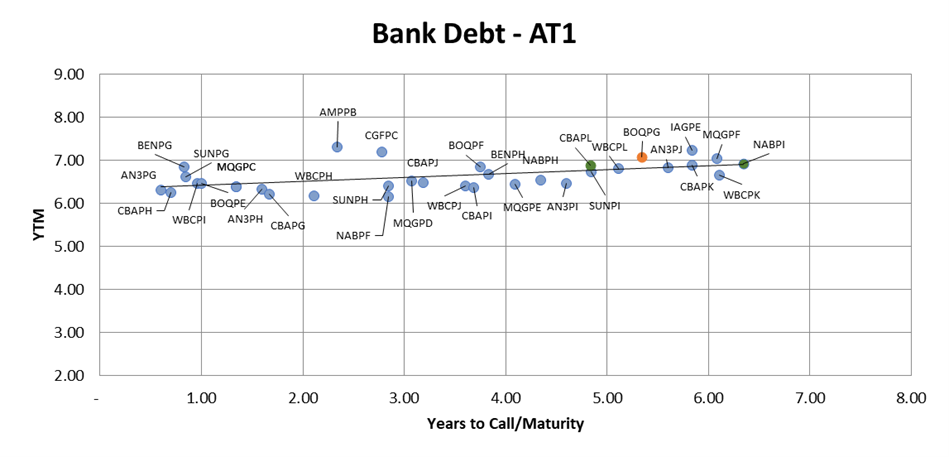

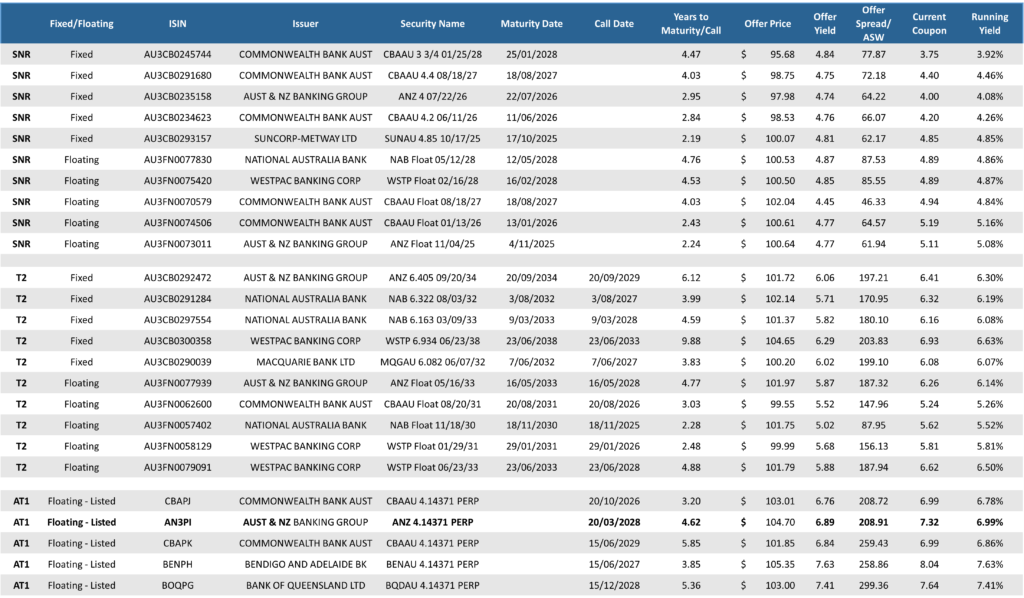

Listed AT1s (hybrids) have seen varied interest over the past year, and they are one of the most accessible forms of fixed income securities for retail investors. Many of these securities look rather expensive compared to their counterparts higher up the capital stack. For example, AN3PG is trading at a spread of +189 versus ANZ T2 (ANZ Float 05/16/33) with a similar call date is trading at a spread of +183. In this example hybrids are not compensating the investor for the extra risk (given hybrids rank below T2 in the capital stack).

Source: Mason Stevens, Bloomberg

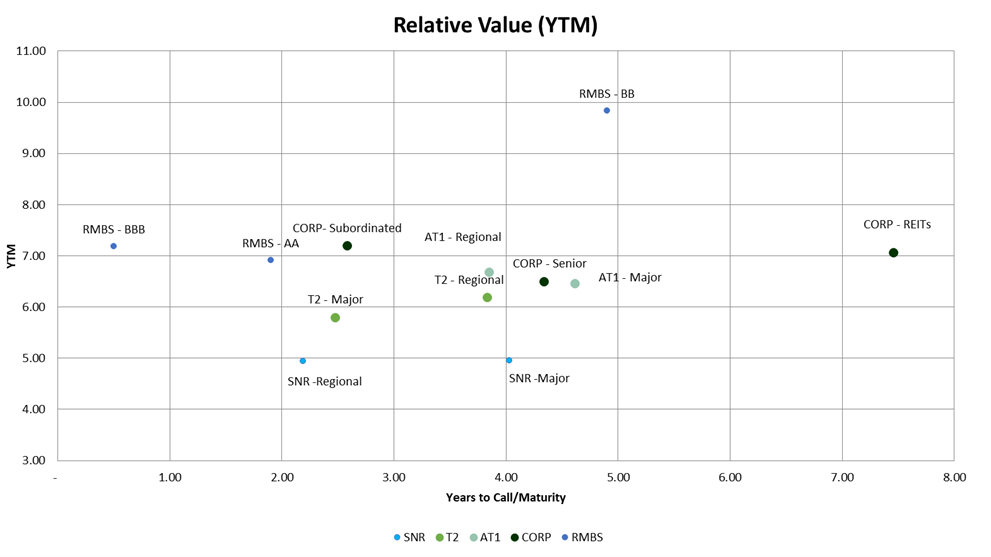

The chart above illustrates the relative value of each sector through the comparative yields that can be achieved from Senior, Tier 2 and AT1 bank debt, along with corporates and RMBS(Residential Mortgage-Backed Securities). This provides a visual comparison on the yields that can be achieved across the different sectors and payment ranks.

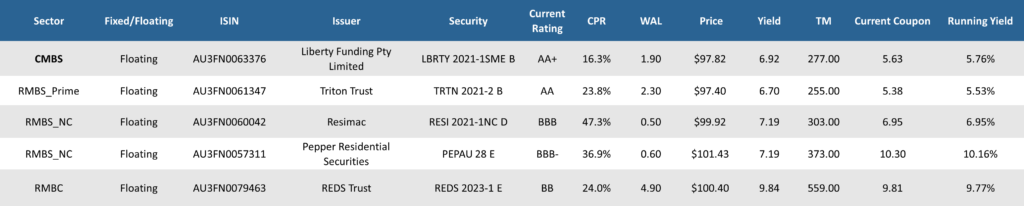

The highest yields can be achieved with RMBS, given double digit returns on offer. RMBS can provide one of the most attractive relative value plays when looking for yield vs credit rating. For example, REDS 2023-1B is a recent issue from Bank of Queensland (an Australian ADI) and is rated AA by S&P, however issued at a margin of BBSW1M +290. This is versus +60 for major bank senior of the same rating.

Source: Mason Stevens, Bloomberg

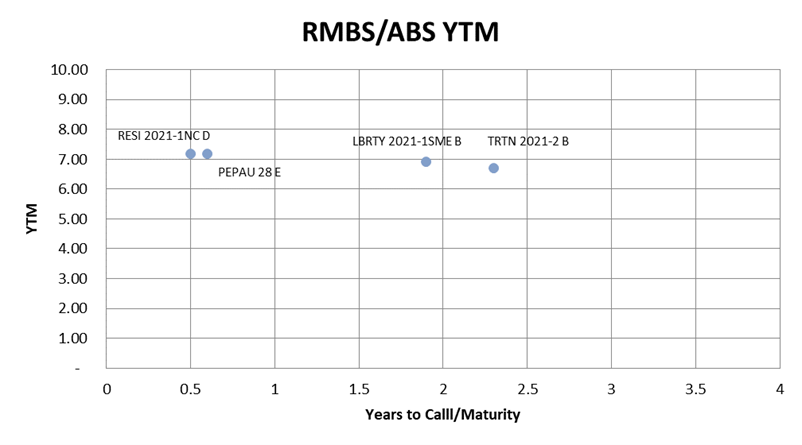

For those that are willing to gain a deeper understanding, yields of 10-11% can still be achieved for E and F notes rated BB and B consecutively. Secondary market has limited availability of Es and Fs at current time, as offshore investors have come back into the Australian market. However these very attractive opportunities can be obtained via Primary market issuance. Secondary flow in AAs to BBBs is still attainable.

Source: Mason Stevens, Bloomberg

In the AT1/hybrids space, CBAPL (CBA) and NABPI (NAB) are trading at spreads of +271 and +264 respectively. For investors wanting a greater return and happy to look at regional banks, BOQPG (Bank of Qld) is trading at +293.

Source: Mason Stevens, Bloomberg

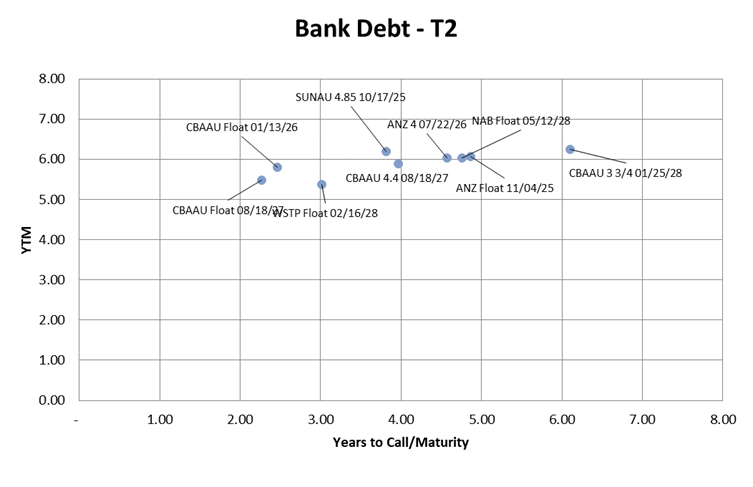

In Tier 2 we have seen more buying then selling over the past few months due to their attractive yields and minimal new issuance. For investors looking to purchase a fixed rate T2 the NAB 6.163 03/09/33 (+182) looks relatively attractive, and if you prefer floating rate, ANZ Float 05/16/33 (+185) also looks like value.

When looking at the Senior Unsecured options, these bonds trade in a much tighter range. Two of the bonds from the options below that trade at better spreads are NAB Float 05/12/28 (+87) and WSTP Float 02/16/28 (+85).

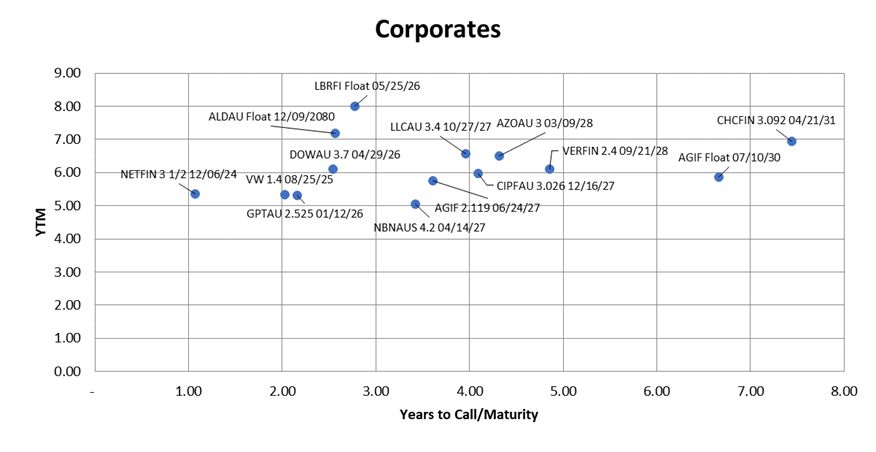

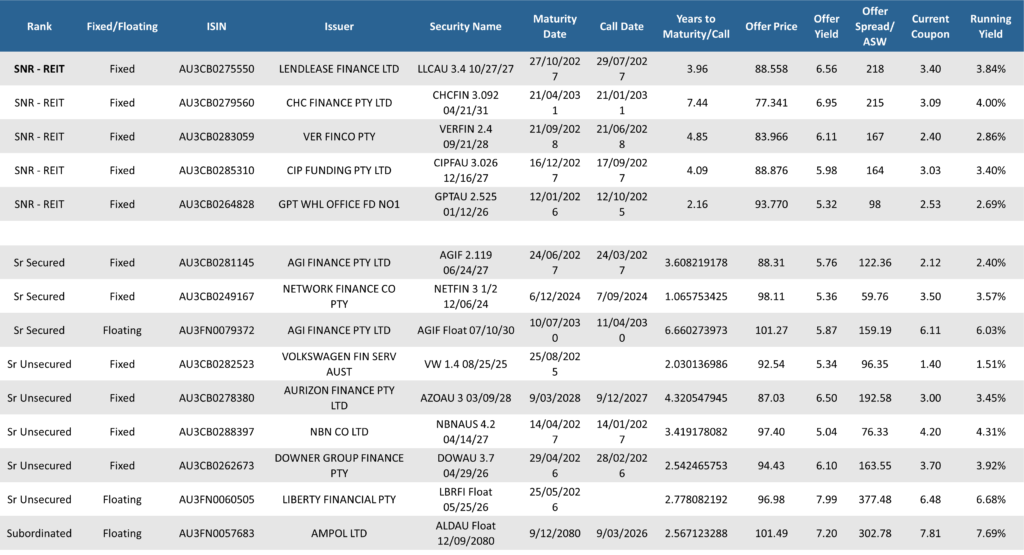

Outside of bank debt there are a number of corporates in the Australian market both from local and international issuers. These range from Government owned NBN Co (AA rated) senior unsecured notes trading at a spread of +76 to names such as Aurizon Finance and Ampol (Subordinated hybrids) that trade much wider at +193 and +303 respectively, all with 2026/7 call/maturities. Another name worth looking at is Liberty 26 which is trading at a margin of +377 and a yield just shy of 8%.

Source: Mason Stevens, Bloomberg

There are a number of REITs that sold off recently largely due to concerns around Commercial property, specifically related to risks in the Office sector. This selling has created an attractive opportunity in VERFIN (VERFIN 2.4 09/21/28). VERFIN is a REIT of 400+ service stations across Australia and leased to Viva who own the rights to use the Shell name and recently purchased the Coles Express and OTR franchises. VERFIN has been trading weaker given it is a REIT, however is not exposed to the Office REITs sector which has gained a lot of negative press. VERFIN is offered at a yield of 5.99%. Lendlease (LLACAU) is also a name that may be worth looking at as it has is yet to experience the rally that many of the other corporates have experienced recently.

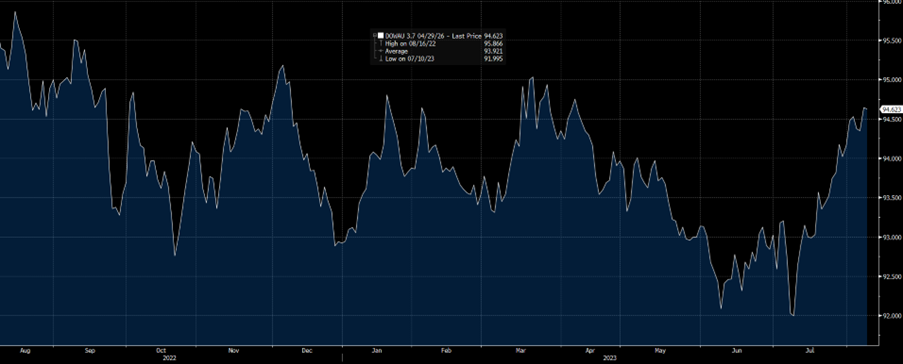

Another name that has been sold off recently is Downer. DOWAU 3.7 04/29/26 is currently offered at a yield of 5.95% but were at 6.90% one month ago. The equity and bonds saw significant selloffs off the back of a slew of negative news. These bonds were priced at $92.09 at their lows and recently traded at a mid price of $94.62. Whilst Fixed Income is largely seen as an income-based investment this is an example of the capital gains that can be made over and above income, in a relatively short period of time.

Source: Bloomberg

The bonds included in the table below and those mentioned above are a snapshot of what is available in the market to show that there are bonds to suit varying investors’ preferences.

If you have interest in any of the above bonds or would like more information about a certain segment of the Fixed Income market, please reach out to the Fixed Income desk at bondorders@masonstevens.com.au.

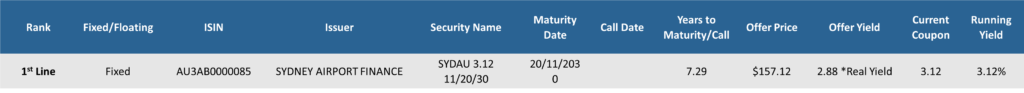

Financials

Corporate

Inflation Linker

MBS/ABS

Pricing indicative and subject to market offers/bids and based from Bloomberg data as at 16 August 2023.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.