Direct Bonds Activity & Flow

As yields have increased, investors are looking more at Fixed Income to provide income and diversify their portfolio. With the many risks challenging the outlook for equities, higher yielding securities are proving attractive ways to generate consistent income without the risk of loss of capital. However, the Australian bond market does not always tick the box for those wanting even higher yields across a more diverse set of industries and issuers.

Similar to the Australian equity market which is a drop in the ocean compared to the aggregate global market (~2% in terms of global market cap), the local bond market is no different. Further there are better opportunities for Australian names that issue in USD or EUR.

One challenge with accessing the non-AUD markets is currency risk, however there are ways around that using repackaging vehicles. Some clients use forwards as an overall portfolio hedge, although is not perfect, does do the job depending on the objective.

Other clients have cash on hand or are expecting cash inflows in other currencies, most frequently in USD but also in EUR or GBP. Further reasons for looking at other currency bonds, include expats that have built up cash whilst working overseas, or those that are looking to move to Australia in the future and want to establish investment relationships that can handle flows on both sides of the border.

Often there is confusion around what are international markets as we have many offshore domiciled companies that issue into the AUD market. Any bond issued in AUD whether local or offshore is considered the Kangaroo market. Each currency is effectively its own market. The USD market (aka Yankee market) similarly has Australian companies issuing into it, they are often referred to as Aussie Yankees.

The Yankee market is the largest most liquid market in the world, given the enormous amount of US Treasuries and corporates that see the USD market as the go-to across both Investment Grade and High Yield issuers globally. The USD (and EUR) markets often have the best relative value opportunities, more so than what is available in the local Kangaroo (AUD) market. The main reason is that there are a lot more participants in the bigger markets in general with different viewpoints about which direction prices should be moving. In comparison the AUD market tends to be more concentrated with large buy and hold style investors. Timing is more important in the Yankee and Euro markets, but the opportunity to outperform is much greater.

One example where we saw this was during the banking crisis and in particular after Credit Suisse defaulted on their AT1s. The local hybrid market (for the major banks) hardly moved with only -1 to -2 price points versus the same risk (i.e. major bank hybrids) with the same features (including conversion to equity on some non-call events) in USD which moved -6 price points at the lows (i.e. from $98 to $92). Two weeks later they rebounded back to 97-98 area and are currently trading at 98. The best time to get involved with offshore markets is when there is a volatility event, that goes for short term and hold to maturity investors. Given we have a few macro risks around currently opportunities do present themselves more broadly.

Recently we have seen a broad sell off in rates due to a number of reasons and the higher for longer narrative is still in play. On a fixed rate basis there are great opportunities to lock in decent yields through the cycle. The opportunity is there to obtain yields relatively higher than at any other time over the last decade.

The chart of the US 10yr Treasuries (white line) below highlights that base yields are at their highest level since 2007. Euro 10yr Bunds (blue line) are also up significantly from negative territory in 2021 to be at the highest levels in over twelve years.

US 10yr Treasuries and European 10yr Bunds

Source: Bloomberg

Four hundred and fifty-one of the equities listed in the SP500 have a rating from one of the three big agencies (i.e. S&P, Moody’s or Fitch), all of which have USD listed bonds (some of them convertibles). Their ratings range from B up to AAA. The US IG market is full of household names across the Big 7 including Microsoft, Apple, Meta, Amazon, NVDIA, Tesla and Google. We would encourage investors to think about the bond side of the equation when looking at listed equities as there may be a better way to get exposure to the name. A way to think about that would be if a dividend stock is not yielding at least north of 6-7% and potentially same if not higher yield in a bond format.

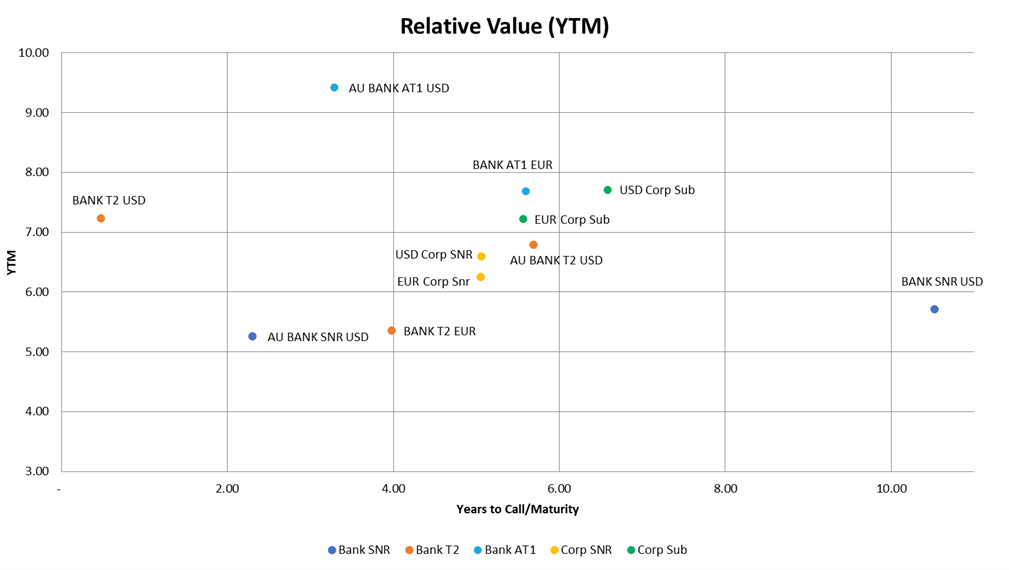

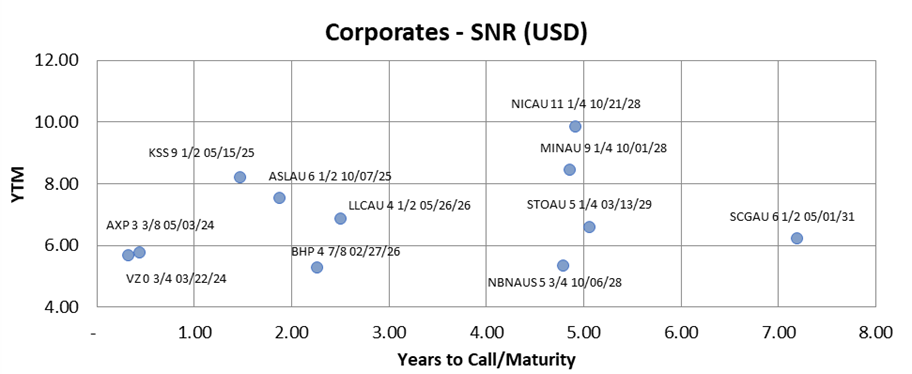

The names below broadly represent the more liquid names we see available. Sector coverage spans financials and corporates in both USD and EUR. Areas of interest across the broader Mason Stevens platform have been in EUR and USD bank debt, US corporate and Aussie Yankees. The most popular Aussie Yankees are Mineral Resources, Nickel Mines, Scentre, Perenti (old Ausdrill), major Bank AT1 hybrids (including Macquarie Perps).

Source: Mason Stevens, Bloomberg

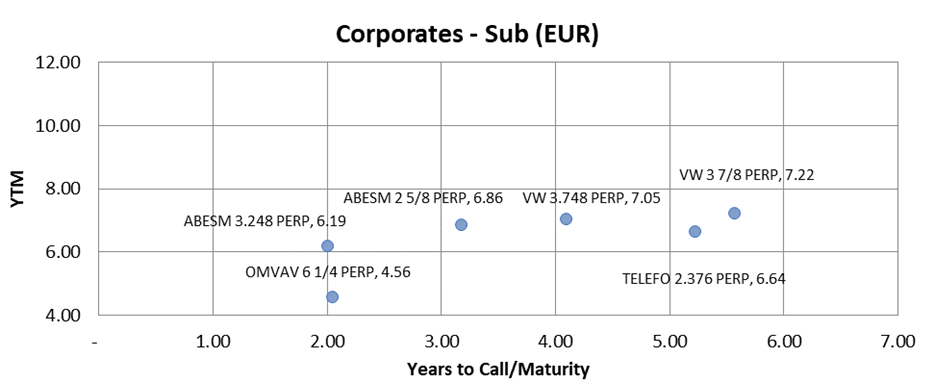

The chart above illustrates the relative value of each sector through the comparative yields that can be achieved from Senior, Tier 2 and AT1 bank debt, along with Senior and Subordinated Corporates. This provides a visual comparison on the yields that can be achieved across the different sectors and payment ranks.

The highest yields can be achieved within the AT1 and subordinated Corporate bonds sectors, with up to double digit returns on offer. One thing to note in AT1s are that there are key difference to AU bank AT1s particularly in relation to calls and conversion to equity options, which is not as much the standard convention for banks in other countries.

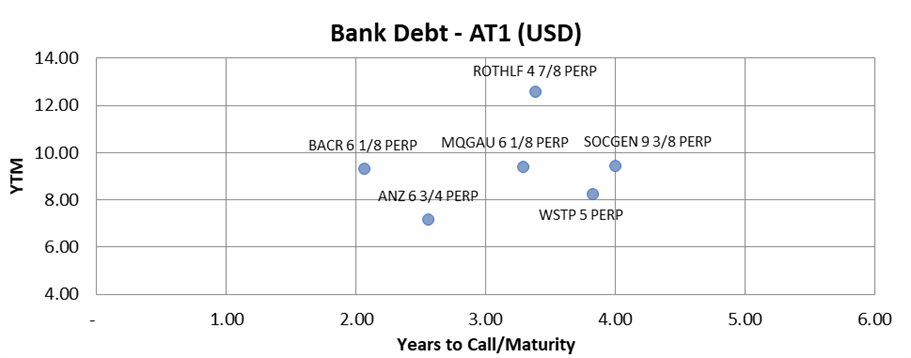

Source: Mason Stevens, Bloomberg

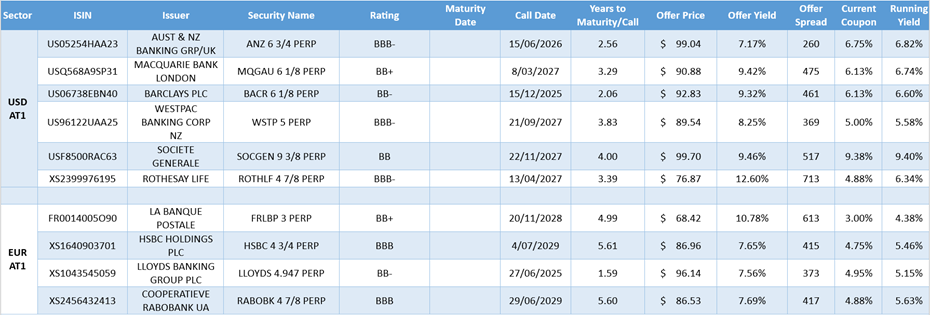

In the USD AT1 space there are many options that now have yields going up to double-digits in some names. Starting with Aussie Majors, the Westpac 5% perp is rated BBB- and has a yield of 8.25% but for investors willing to look at lower rated AT1s, Barclays and Societe Generale are yielding 9.32% and 9.46% yields respectively. Outside of the banks life insurers such as Rothesay life, has a Restricted Tier 1 hybrid with a current yield of 12.60%.

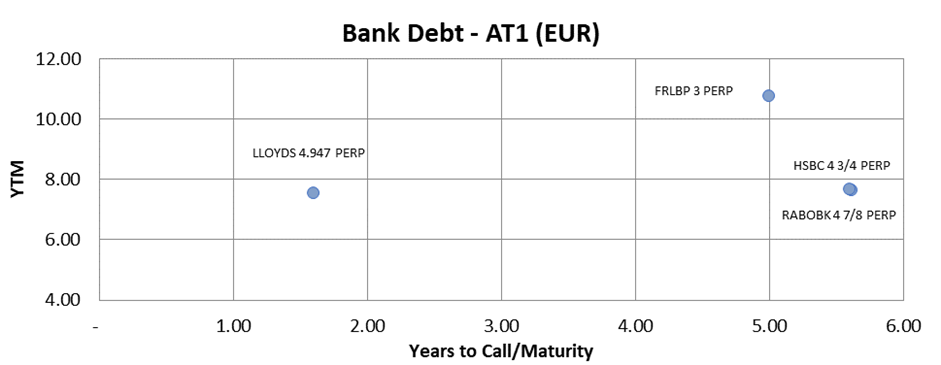

Source: Mason Stevens, Bloomberg

The best value EUR AT1s include well known franchises, such as HSBC and Lloyds currently trading at a yield of 7.65% (Jul-29 call) and 7.56% (Jun-25 call). For comparison purposes, NABPI which also has a call date of 2029 has an implied yield of 7.34%.

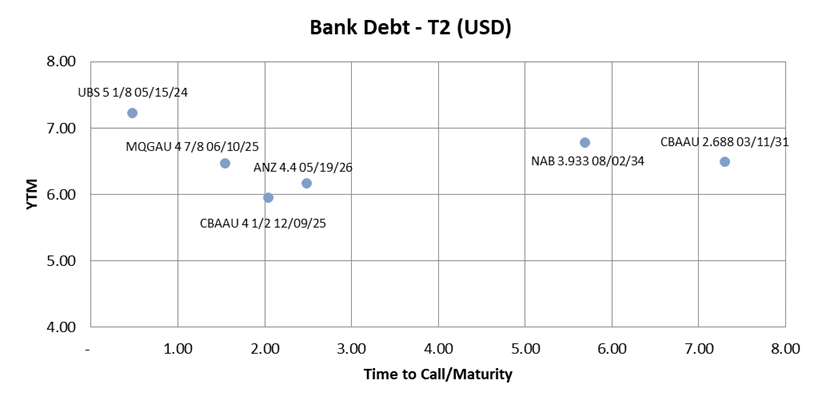

Source: Mason Stevens, Bloomberg

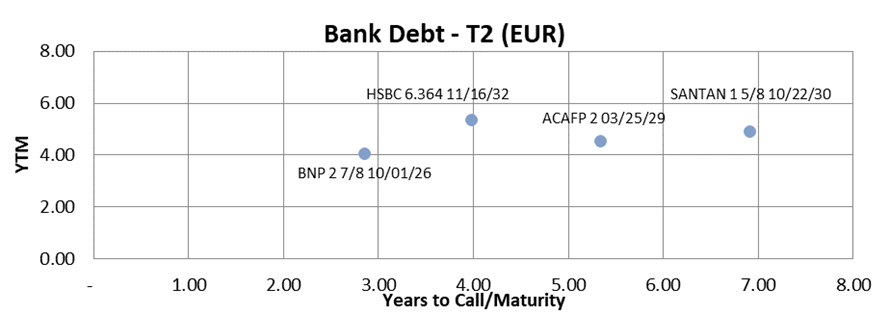

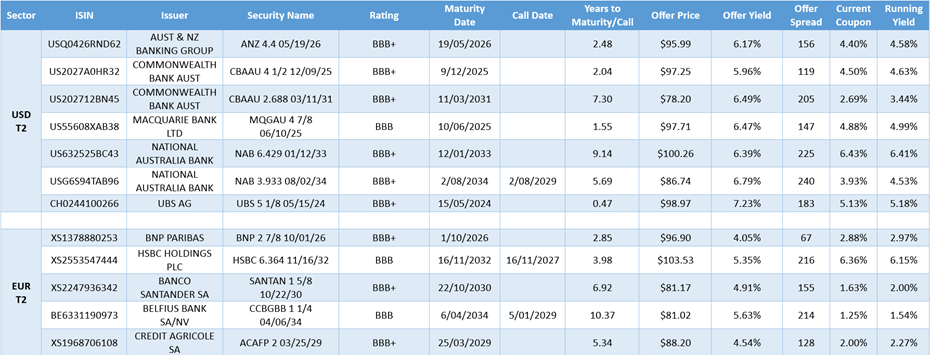

For investors looking one rung up at T2 there are several USD securities with yields in the 6.00-7.00% range. CBA and NAB have T2 offerings yielding 6.49% and 6.79% respectively. In comparison, the EU names included in the table have yields closer to 6.00%.

Source: Mason Stevens, Bloomberg

Source: Mason Stevens, Bloomberg

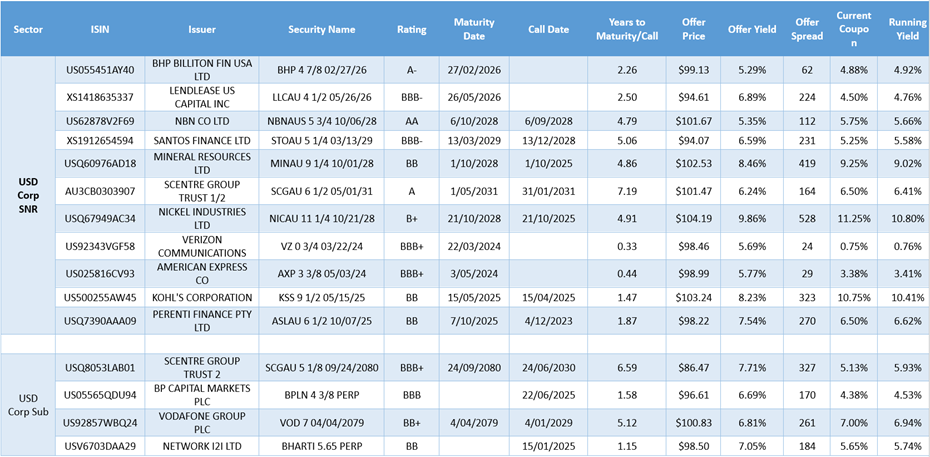

As mentioned, it is common for Australian miners to issue in the USD High Yield space. Mineral Resources has a senior unsecured bond trading at a yield of 8.46%. Nickel Mines also has a bond with a 2028 maturity that is trading at a 9.86% YTM.

Source: Mason Stevens, Bloomberg

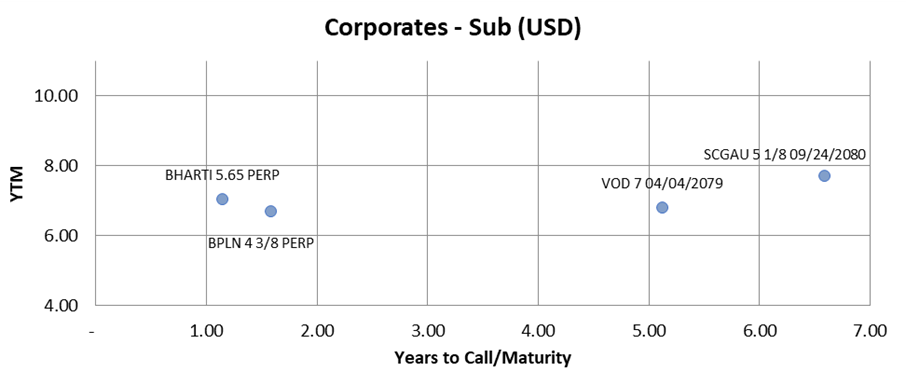

The highest yield within the USD subordinated corporate bonds below is Scentre, which is trading at a yield of 7.71%. Widely known Scentre Group operate shopping malls under the Westfield brand and rightly or wrongly have experienced a selloff with the rest of the REIT sector.

Source: Mason Stevens, Bloomberg

Source: Mason Stevens, Bloomberg

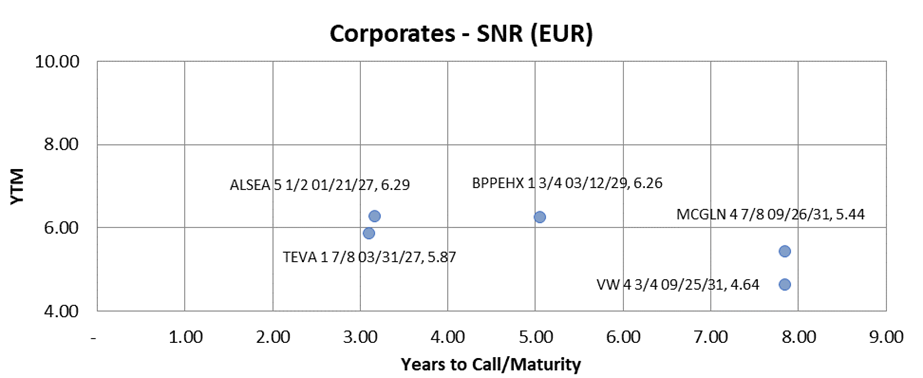

In Euro, there are household names such as Volkswagen, which has a senior line trading at 4.64% and a BBB- rated subordinated note with a call date in 2029 that is currently trading at a yield of 7.22% (provides decent relative value for an investment grade rated bond). Blackstone Property Partners has a senior line trading at a yield of 6.26%.

The bonds included in the tables mentioned above are a snapshot of what is available in the broader market.

If you have interest in any of the above bonds or would like more information (credit or relative value) about a certain segment of the Fixed Income market, please reach out to our desk.

Pricing indicative and subject to market offers/bids and based from Bloomberg data as at 24 November 2023.

Tier 2

AT1

USD Corporates

EUR Corporates

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.