“Just a small-town girl,

Livin’ in a lonely world,

She took the midnight train goin’ anywhere”

Journey (1981)

A question we increasingly receive at Mason Stevens is if bonds are still a benefit to portfolios.

The latest academic research from MIT in Boston, USA – in joint venture with State Street Bank and Trust, suggests that based upon the fair-value pricing of stocks and bonds, current bond yields are fair and that bonds can offer strong diversification for multi-asset portfolios.

Also, the current correlation between stock and bond markets project that bonds will remain a valuable diversifier over the next 5 years.

Sounds like a great topic to start your Monday morning.

Grab that coffee and strap in, as today, we provide a summary of the research and what this means for investors and financial advisers.

Asset Allocation

In general, asset allocation can be viewed as the choice between investing in stocks, bonds and holding cash.

Stocks offer ownership in a company and growth potential.

Cash offers a store of value and optionality to invest in stocks or bonds if prices move lower.

Bonds are loans to governments or corporates that provide fixed interest (re)payments. However, their overall role is less clear when the interest repayments (yields) are lower.

In the 1970’s and 80’s, bonds offered higher yields and behaved like stocks because of the inflationary economic environment.

In the 1960’s and 2000’s, bonds had much lower yields but provided valuable diversification by tending to rise when stocks fell – in a disinflationary environment.

Bonds as an asset class

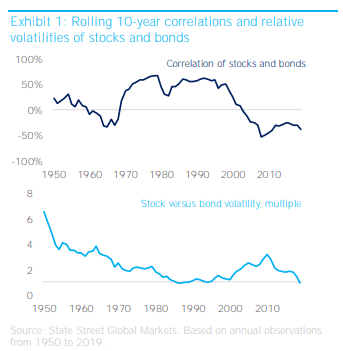

The extent that bonds diversify or correlate with stocks depends upon the economic conditions of the time.

An increase in inflation affects stocks and bonds similarly by eroding the value of their cash flows, so stocks tend to be a positive contributor to their correlation.

Conversely, a drop in economic growth that we’re currently experiencing is generally bad for stocks but positive for bonds, because central banks cut cash rates to stimulate economies, and the lower growth environment lowers the perceived upside benefit to stocks. This sees asset rotation based on the perceived benefit of less risky assets (bonds or cash).

Stock/Bond correlation

The current stock/bond correlation for the next five years until 2025 based on a very large negative correlation between stocks and bonds.

This means that for every negative move in stock prices, there should be a positive move in bond prices.

This implies that bonds will provide diversification benefits in the coming years.

Diversification at what price?

The more appealing an asset class is, the higher its price should be, and the lower its expected future return. This is the key tenant of asset pricing theory.

As stocks are generally riskier than bonds, they should a higher long-run premium in terms of expected return.

A negative correlation (as currently predicted) makes BOTH more attractive, because they hedge each other’s risks when combined in a multi-asset portfolio, though differing in proportion or weights allocated.

Are bonds expensive?

When we’re asked if bonds are beneficial to portfolios, we’re being asked because the overall yields are at historic lows, and because bonds typically offer a lower expected return than stocks, but higher than cash. Hence, the difference in expected returns is deemed an opportunity cost, i.e. how much return is perceived to be given up investing in bonds rather than stocks?

This premium is measured by measuring the return of stocks minus the performance of bonds.

As at June 2020, this stock/bond premium is 2.6% per year, per unit allocation to bonds. E.g. if your perceived bond return is 1% for the coming 12 months, and your equity return is 3.6%, you should have exposure to bonds. If your perceived equity return is less than 3.6%, you should be adding more weighting to bonds to achieve the same risk adjusted return.

Is this justified?

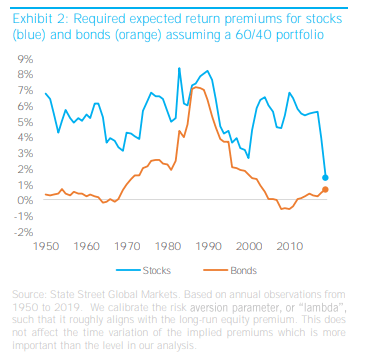

To gauge the pricing, we must measure the correlations and volatilities in pricing of a model portfolio.

In the two papers referenced earlier, Czasonis and Turkington use 60% stocks, 40% bond, 0% cash portfolio as their model portfolio.

We note that a 60/40 portfolio is the most commonly used cookie-cutter portfolio globally – coming into vogue after Harry Markowitz published his theory of “Portfolio Selection” in 1952 and later won a Nobel Prize for it.

Using Czasonis and Turkington’s variant of Capital Asset Pricing Model (CAPM) of the model portfolio shows that if equity risks increase to 1.3x bond risk (measured by price volatility), then a 2.6% yield sacrifice is perfectly justified in the name of diversification. I.e. if stocks are proportionally riskier, then an increase bond allocation is better suited, even at low yields.

In short:

- Bonds become more valuable as equity risk rises

- Bonds become more valuable as the stock/bond correlation gets more negative

Can bonds continue to diversify?

Diversification requires that when stock prices fall, bond prices rise, which means that yields must fall further.

Given rates are already so low, can they still fall further?

The short answer is yes, and we’ve seen this in Japan and Europe for years already.

It should be noted that long-term bonds always receive a basic level of demand as insurance companies, bank treasuries, annuity providers, pension/super funds and sovereign wealth funds seek assets that are (a) risk-free, and (b) in-line with their multi-decade objectives.

A negative yield does not deter such asset managers from investing if they are regulated to buy such assets, or if there are no other risk-free alternatives. German Bunds and Japanese government bonds (JGBs) have maintained negative yields for several years with investor demand increasing slowly over time.

Otherwise, bonds provide a robust hedge for equity volatility during economic recessions/depression. These bad economic conditions are (usually) bad for stock prices and give way to deflation that boosts bond prices (returns).

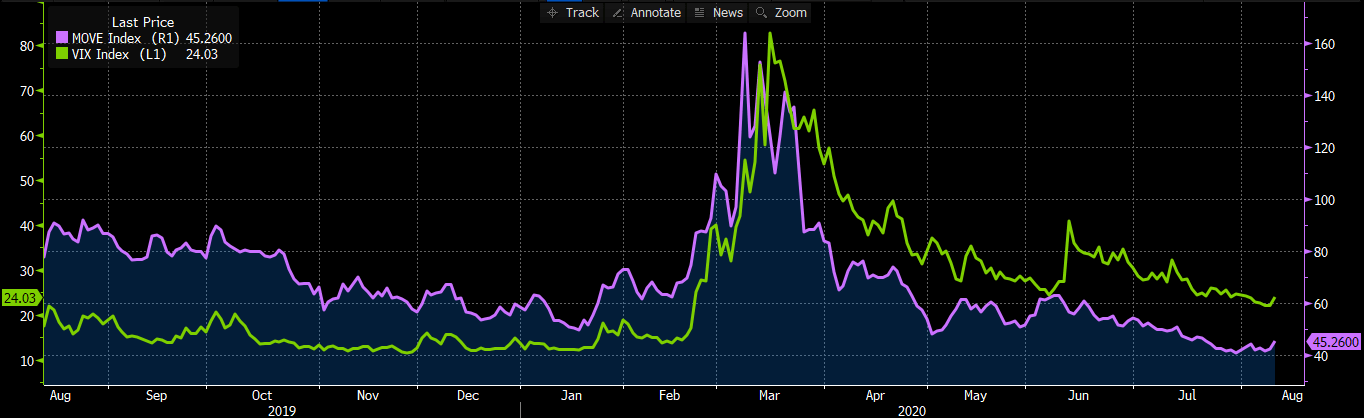

This year has been an example of bonds being a hedge for equity price fluctuations.

The MOVE Index shows that bond volatility has decreased 44% over the last 12 months, whereas the VIX index highlights that equity volatility has increased 14% over the same period.

Source: Bloomberg

Final Thoughts

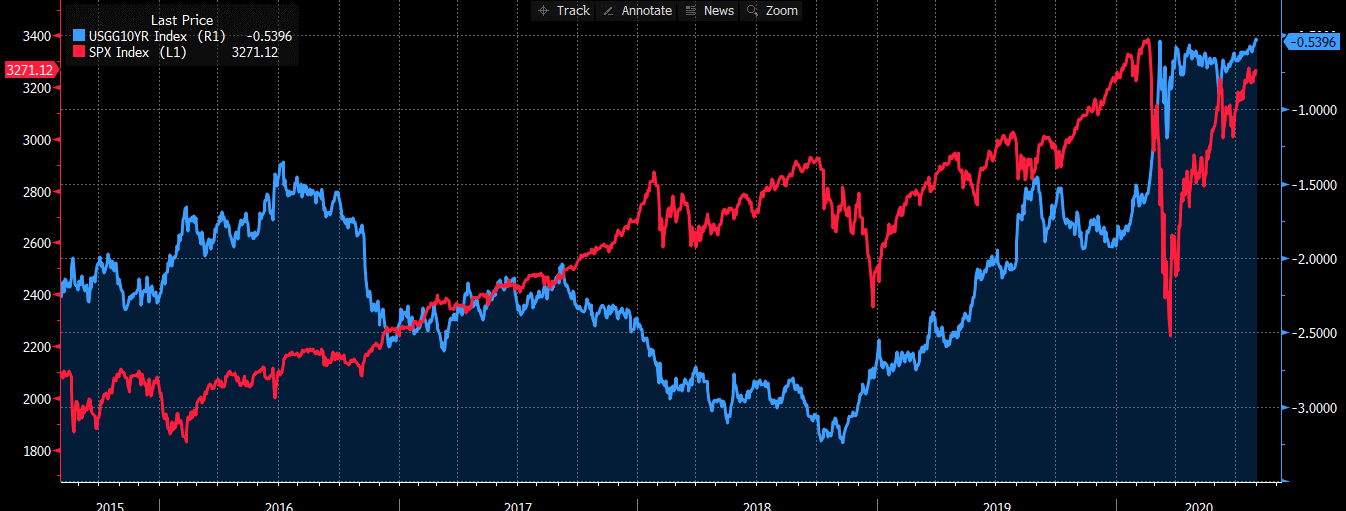

I recently wrote about the comparative performance of the S&P 500 against US Treasuries.

While the S&P 500 had returned 56.60% for the period, 5y, 10y and 30y US treasuries had all outperformed the stock index.

Source: Bloomberg

I can still foresee investor reluctance to buy bonds at low yields given the potential opportunity cost if stocks continue to rally untether from economic fundamentals.

This is an optical issue – as investor’s will be reluctant to buy bonds when their yields are low because it’s very obvious when buying bonds. You know the yield when you buy a fixed income security in advance of the purchase, whereas with stocks your future return is unknown. This provides an optical challenge due to the perceived opportunity cost IF stocks provide positive return. However, this portfolio is subject to higher implied volatility, and requires equity valuations to become more stretched, and has a lower risk-adjusted return.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.