Since our last relative value note, spreads have continued to compress in Australian listed bank hybrids. This is largely due to a lack of supply and increase of investors allocating to fixed income. Whilst spreads are compressing, many investors are happy to pay this due to the sufficient total yields that they are receiving.

With markets now starting to price in more rate cuts from the Fed, the rates curve has decreased in a significant way and bets are on that Australia will have to follow suit at some stage. Whilst this isn’t affecting hybrid coupons yet, it has reduced the yield to call of many hybrids.

The chart below shows the 5yr swap rate which is at its lowest levels since May 2023. The yield to call for a 5yr hybrid is broadly calculated by adding the trading margin to the 5yr swap rate, this highlights the decrease in yield investors have experienced compared to the same time last year. However, in the meantime, running yields are still supportive of demand in the space.

Source: Bloomberg, Mason Stevens

Regulatory Update

This week APRA provided an update on their investigation into the use of hybrids (AT1 securities) that proposed banks phase out the use of these instruments. Their aim for this move is to simplify and improve the effectiveness of bank capital in a crisis.

This investigation was spurred on from the default of Credit Suisse’s AT1s last year. APRA’s concern arose from the large proportion of AT1 securities held by retail investors and the purpose of AT1s being the first debt securities to default in the event of a crisis. The political sensitivity around writing off Mums and Dads has clearly weighed on APRA’s decision. As has the case of Credit Suisse where its terms and conditions did not play out as intended.

Summary of the proposed changes are:

- Large, internationally active banks would be able to replace 1.5 per cent AT1 with 1.25 per cent Tier 2 and 0.25 per cent Common Equity Tier 1 (CET1) capital.

- Smaller banks would be able to fully replace AT1 with Tier 2, with a reduction in Tier 1 requirements overall.

APRA has proposed commencing the transition to the simpler capital framework from 1 January 2027, with all current AT1 on issue expected to be replaced by 2032. For existing investors, APRA does not envision an immediate impact with AT1 capital instruments continuing to be eligible as regulatory capital until their first call.

It is not clear yet whether there will be any further hybrid issuance. APRA has proposed a 2-month feedback period and further clarity may be provided through this process. However we have been told by one major bank that they will no longer issue listed hybrids. Either way, liquidity in listed hybrids is likely to deteriorate. Especially in times of weaker markets where gap risk to the downside could elevate.

Investors in listed hybrids need to decide soon whether they are happy to stay in for the long term (to the first call date) or whether they could need liquidity at some stage before the call dates of the hybrids they hold. Those that may need liquidity prior to call date, should potentially start looking at alternatives.

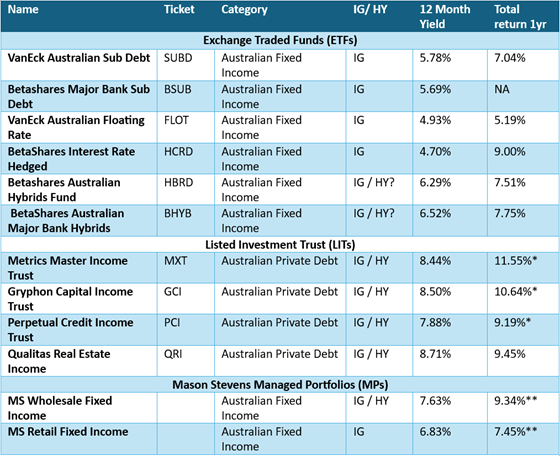

The most likely option in a listed format would be floating rate fixed income ETFs or LITs in the below table. Although not listed, the Mason Stevens Australian Fixed Income managed portfolios are another option available in an IG only or IG/HY combination with 1 year performance numbers to Jul-24, ranging between 7.5% to 9.3%.

A few options across a range of yields have been provided below bearing in mind that hybrids currently yield between 5.0% and 7.0% on a yield to call basis. Higher on a running yield basis (up to 8%) however that assumes the RBA cash rate will be 4.35% for up to 8 years, a somewhat unlikely scenario.

Data from Bloomberg September 2024

*NAV performance used for LITs

**As at end of July

Relative Value

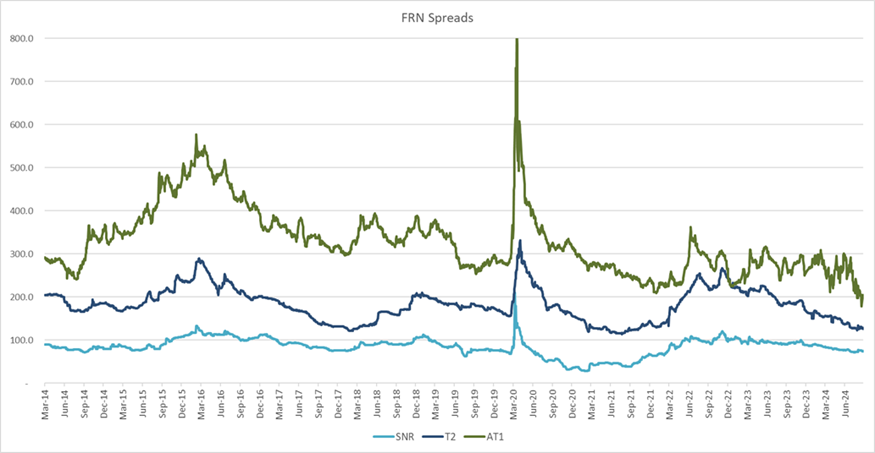

The chart below shows the historical spreads for Bank Senior, Tier 2 and AT1 securities. Whilst spreads have compressed across all three ranks, it is evident that AT1s are trading tighter to their counterparts than historical averages.

Factors that have led to this include supply and demand imbalances, investors focusing on yield rather than spread, and the ease of investing in AT1s compared to OTC traded bonds.

Source: Mason Stevens, Bloomberg, Westpac

Issuance

Recent deals have continued to be well bid. As a result we have seen most new AT1 issuance pricing at the lower end of the indicated pricing range and new money being significantly scaled.

The most recent new deal was Macquarie Capital Notes 7 in which Macquarie Group came to market to raise $1b at a margin of 2.65% to 2.85%. This had firm demand in excess of $3.5bn and the deal was upsized to $1.5b and priced at 2.65%.

To highlight how far spreads have come, Macquarie group CN6 was issued at a spread of 370 (Jul-22) and CN5 was issued at a spread of 290 (Mar-21).

Upcoming Maturities

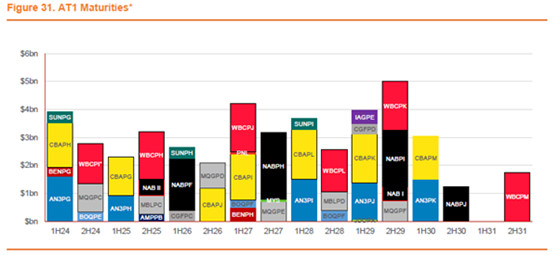

The below chart from BondAdvisor provides indications of the upcoming maturities based on first call dates.

Source: BondAdviser, *Expected maturities are based upon first call dates. WBCPI ~$820m resold/reinvested into WBCPH in Dec-23. The balance of ~$621remain on issue and are to be redeemed on 31-Jul-24

There are no maturities left for CY 2024, that have not yet been replaced. The possibility of no more primary issuance due to the APRA changes will likely worsen the supply and demand dynamics. 1H25 is also fairly light with only two bonds being called.

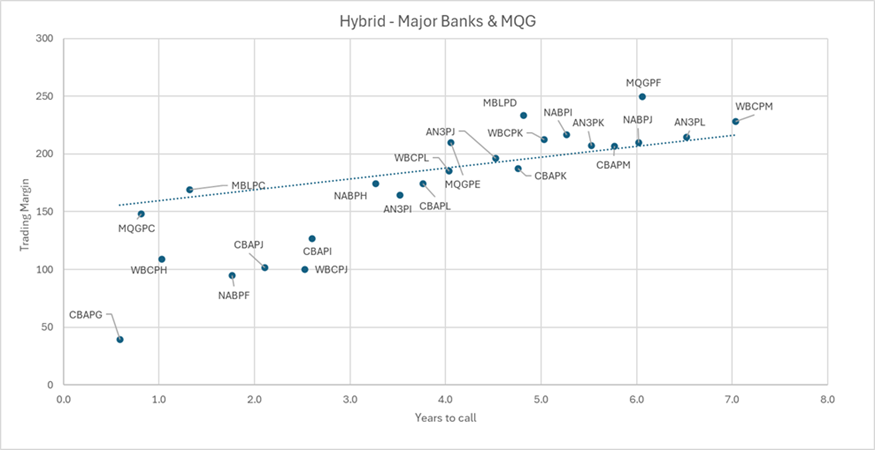

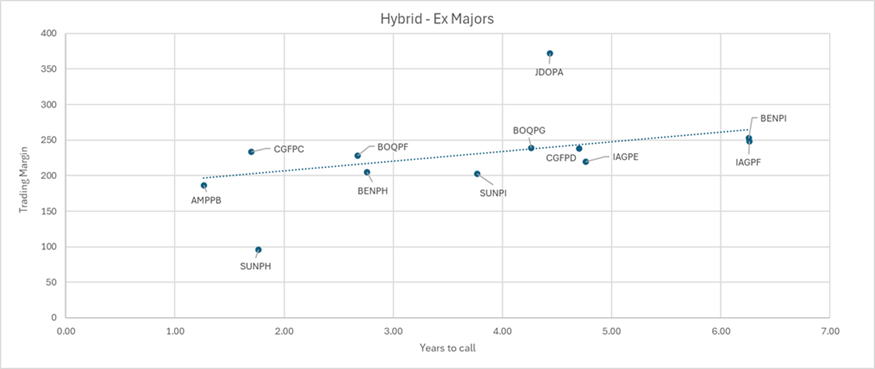

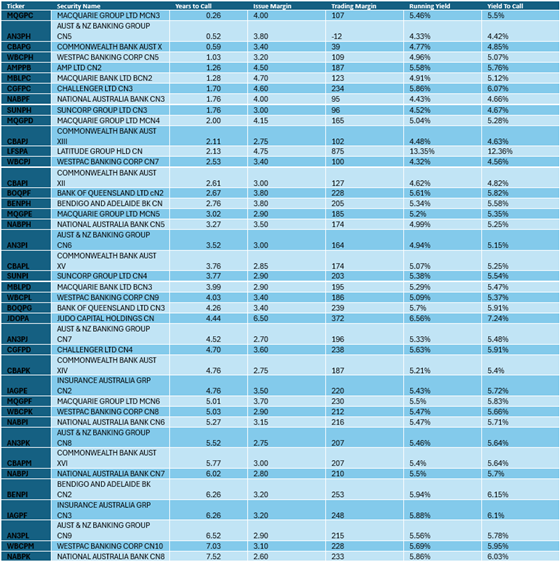

Hybrid Trading Margins

The below chart shows the trading margins of the AT1s and can be used to compare the relative value among securities. It is important to note that AT1s issued by the big 4 banks will generally trade around 15-25bps tighter than those issued by the regional banks over time.

Trading margin is calculated by the yield to call/maturity (YTM) minus the swap rate. Securities with larger trading margins are trading “cheaper” than their counterparts and imply a higher YTM. Securities with longer time to maturity will trade at larger margins than those with a shorter time to maturity as the margin will include a term premium. This is due to the additional opportunity cost and credit risk associated with the longer credit duration.

Source: Mason Stevens, Bloomberg

The chart above shows securities below the line are trading at tighter trading margins than those above the line and so look more expensive in terms of relative value across the broader complex.

Some of the shorter dated Major bank hybrids in the 2-3yr range look expensive (below the line) compared to their longer dated alternatives. AN3PJ and MBLPD are 1-2yrs longer dated that this group and are trading at a more attractive trading margin.

For call dates around the 5yr mark, CBAPK looks rich compared to WBCPK which is trading 25bps wider.

Investors can also pick up a higher trading margin through investing in the regional banks AT1s. WBCPJ and BOQPF have very similar call dates, but BOQPF is trading at a margin that is 128bps higher.

Listed Hybrids by Years to Call & Yield

Source: Mason Stevens, Bloomberg

Should you have any questions, please reach out to your relationship manager or contact the Fixed Income desk.

The views expressed in this article are the views of the stated author as at the date published and are subject to change based on markets and other conditions. Past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in providing this information. You should consider this information, along with all your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.