Objective

The Mason Stevens Dynamic ETF Managed Portfolios are a low-cost, all-in-one multi-asset investment solution designed to deliver a diversified portfolio aligned to a specific risk profile. The portfolios are constructed using a passive blend of cost-effective ETFs traded on the ASX and other global exchanges.

Key Features

| Benchmark | RBA Cash Rate |

| Inception date | 21 April 2021 |

| Investment universe | Domestic and international passive ETFs |

| Number of investments | 5 – 20 (subject to Manager discretion & market conditions) |

| Max individual security weighting | 30% |

| Rebalancing | Investment Manager discretion |

| Management fee | 0.22% p.a. |

| Currency | AUD |

| Minimum initial investment | A$25,000 |

| Suggested investment timeframe | 2-7 years + (portfolios vary) |

| Availability | Mason Stevens Global Investment Service |

As at CY2022

A solution for investors seeking:

An actively managed basket of passive exposures

A low cost solution

All-in-one investment solution

Diversification

-

Fundamentally and thematically driven using forward-looking fundamentals and house views to take an active position on the market.

Fundamentally and thematically driven using forward-looking fundamentals and house views to take an active position on the market. -

A combination of passive index tracking, complemented by an active view with sector, factor and geographical tilts to provide a low-cost, diversified solution.

A combination of passive index tracking, complemented by an active view with sector, factor and geographical tilts to provide a low-cost, diversified solution. -

Unconstrained access to the entire ETF universe.

Unconstrained access to the entire ETF universe.

-

Before you make an investment decision, it is important that you understand the risks that can affect your investment being able to meet its objective or retain value.

-

The risks that may impact the Managed Portfolio include, but are not limited to factors such as market risk, company or security specific risk, and currency risk.

-

Please refer to the Investment Mandate for a full list of potential risks linked to the portfolio.

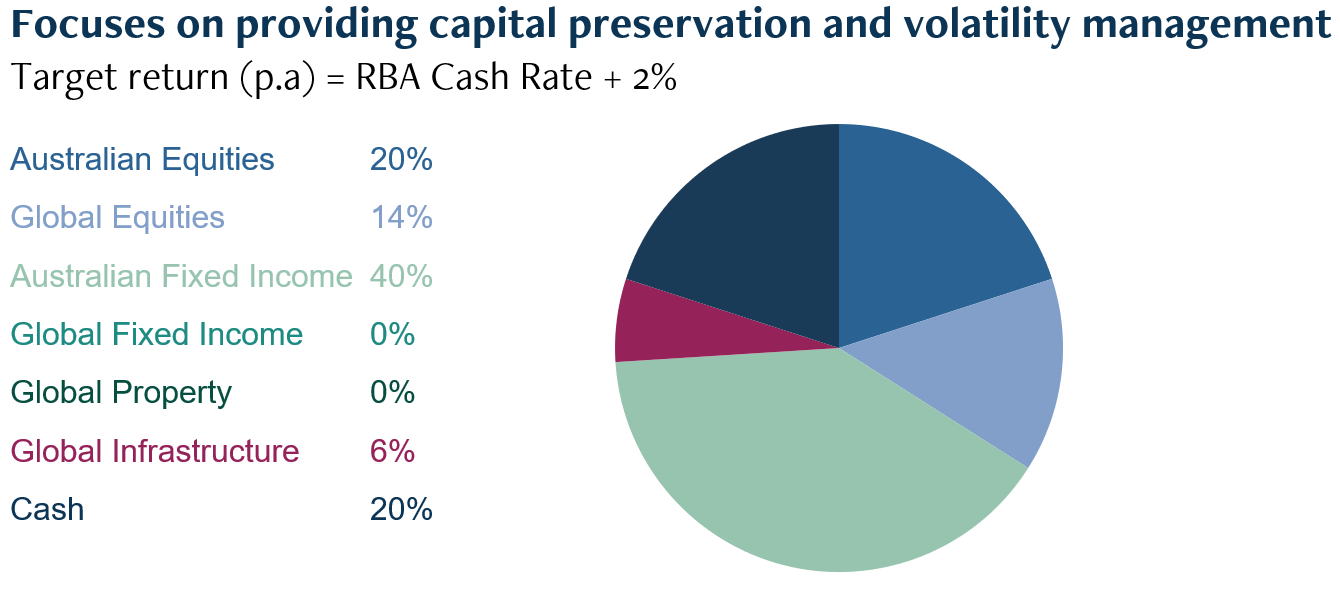

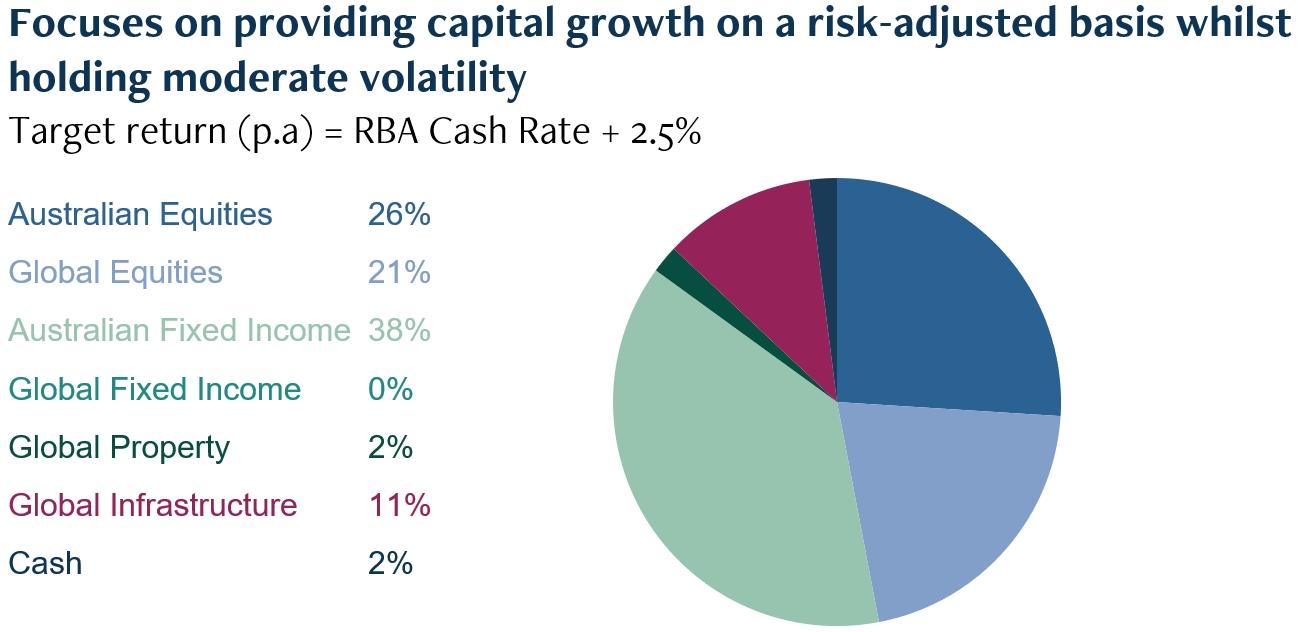

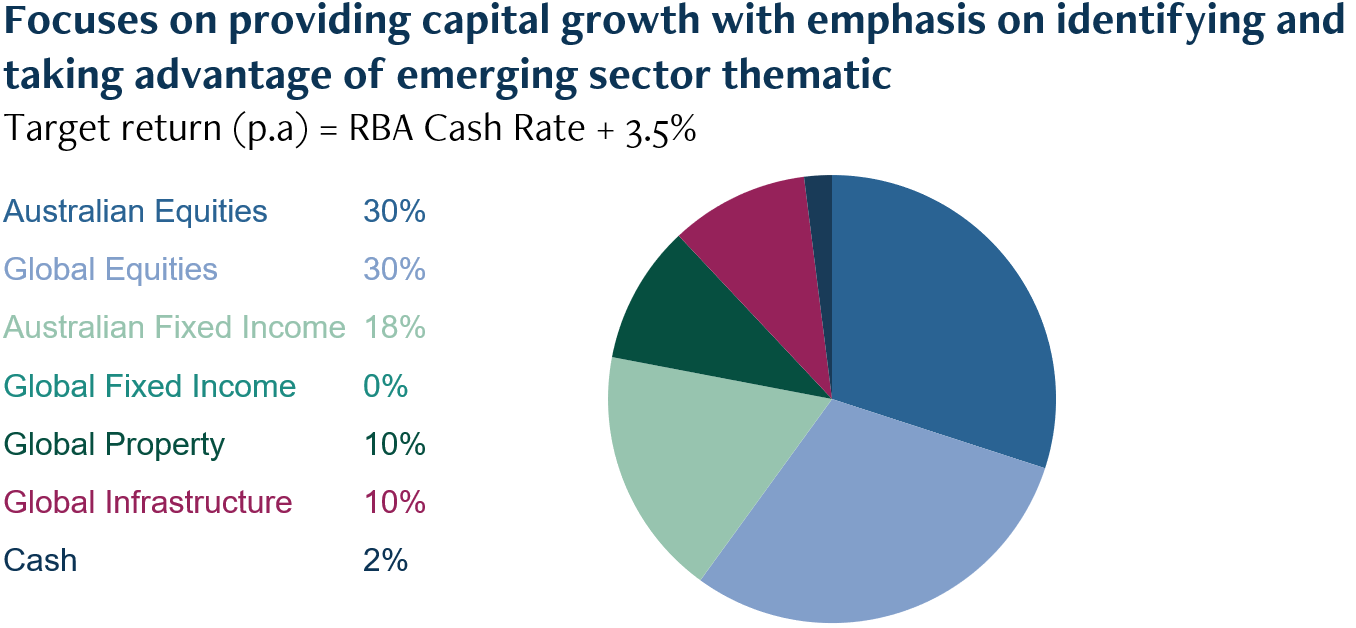

Hypothetical Managed Portfolio Allocations

The Model Portfolio Asset Allocations displayed above are the current strategic asset allocations based on our current long-term asset class return and risk forecasts.

How are the portfolios managed?

Mason Stevens are the Investment Managers and control the asset allocation decisions

Individual ETF investment management is outsourced to ETF providers

Monthly Investment Committee to discuss economic outlook, sector views and risk management

Daily management and observation of market/portfolio exposure

Related Documents

Financial Wellness Hub

Resources to help you get the most out of your super.

Retirement Calculator

Figure out how much super you need to retire in comfort.

Support Centre

Browse our Support Portal.

Connect

Follow us on LinkedIn.

David Hewett

Managing Director, Private Investments

David joined Mason Stevens in 2011. He works with single and multi-family offices and private high net worth investors. His consultative approach enables his clients to make investment decisions based on insight, trust and intelligence. With more than 25 years’ finance experience, David has held senior executive roles within St George Private Clients, ANZ Private and ANZ Investment Bank. He holds a Masters of Business Banking and Finance and Graduate Diploma in Banking and Finance from Monash University.